Published: 2024-11-29T14:48:02.000Z

Preview: Due December 2 - U.S. November ISM Manufacturing - Slightly less weak

2

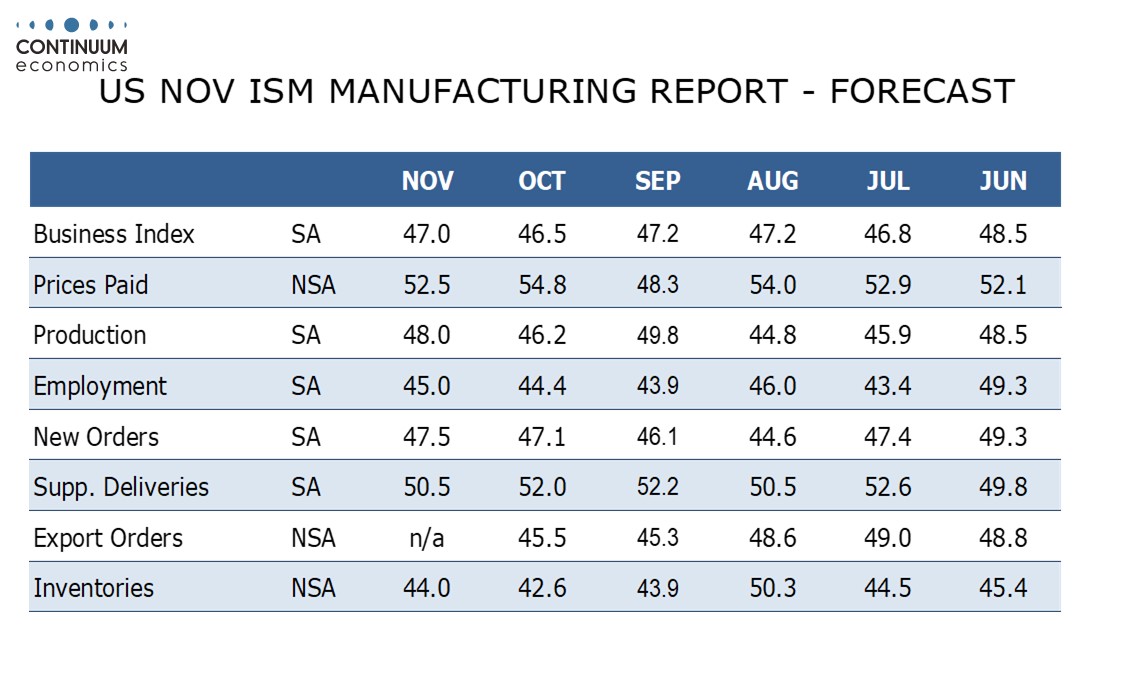

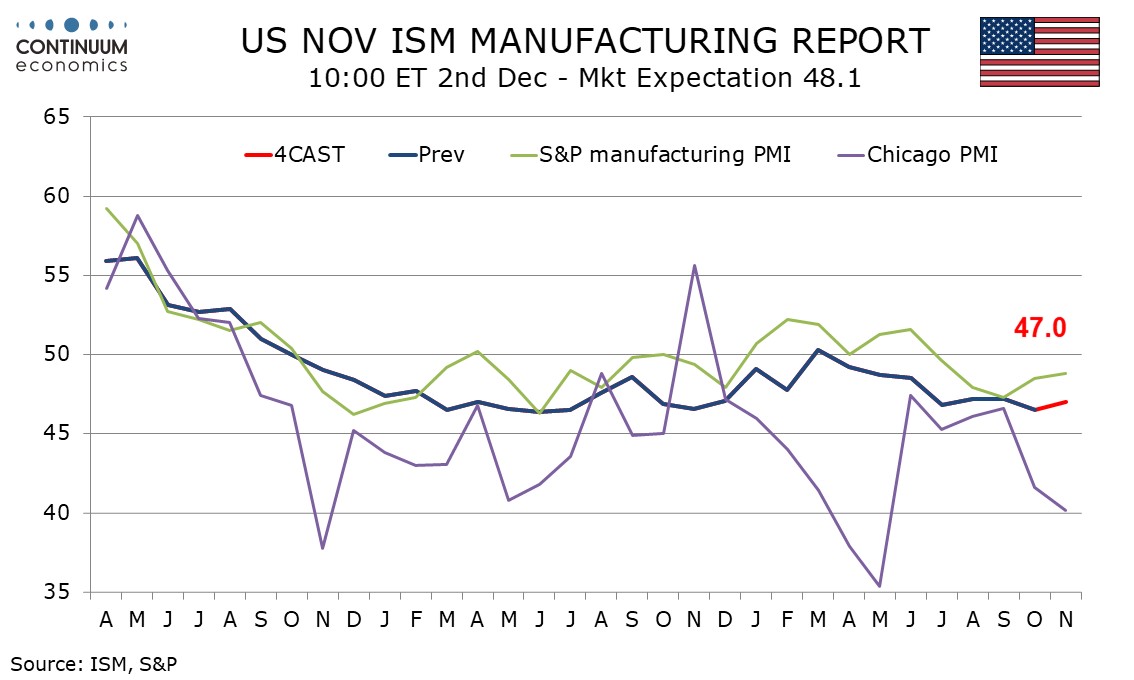

We expect a slightly firmer November ISM manufacturing index of 47.0, up from 46.5 in October but still beow the 47.2 readings seen in both August and September.

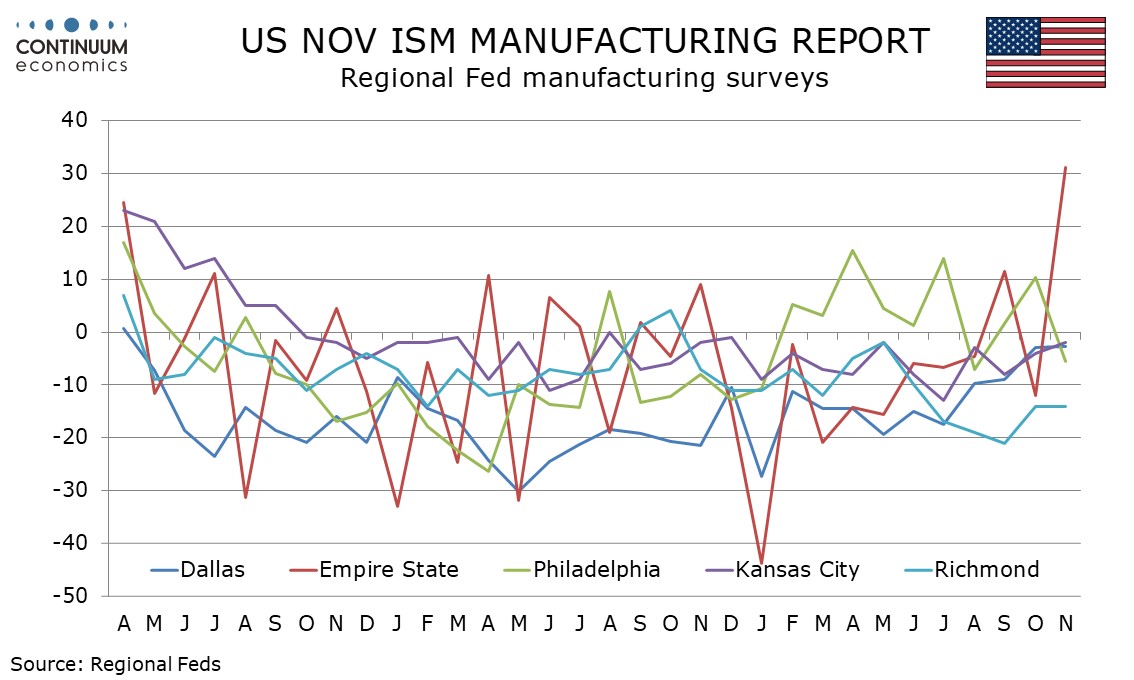

The S and P manufacturing PMI saw a second straight improvement but remains below the neutral 50, as did most regional Fed manufacturing surveys, with the exception of a sharply firmer Empire State survey that looks like an outlier.

In the ISM detail we expect less negative readings from four of the five components that make up the composite, new orders, production, employment and inventories, but this will be partially offset by a correction lower from a stronger October inventories outcome.

Prices paid do not contribute to the composite, and we expect a correction lower to 52.5 after October saw a significant bounce to 54.8 from 48.3 in September.