Published: 2023-12-21T16:31:01.000Z

Preview: Due December 22 - U.S. November New Home Sales - A second straight decline

Senior Economist , North America

-

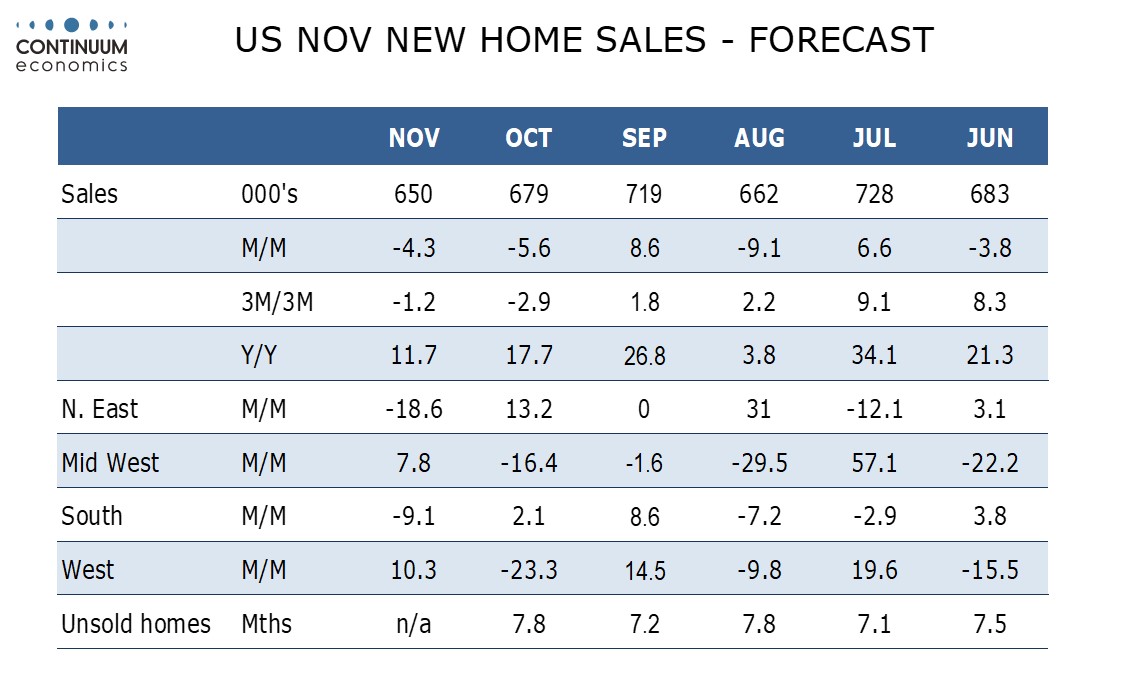

We expect a November new home sales total of 650k, which would be a 4.3% decline if October's 5.6% decline to 679k is unrevised. This would be the first example of two straight declines since July 2022, and a sign that the resilient trend is starting to weaken.

Most indicators of housing demand had been trending lower for some time in November, though there are hints that demand is getting support from recent moves in mortgage rates off their highs, with the NAHB homebuilders’ index improved in December. New home sales have been relatively resilient, probably reflecting improving supply. However the slowdown in demand generated by past gains in mortgage rates is likely to increasingly weigh.

We expect the median and average prices to correct higher by 1.0% on the month after both fell by around 7% over September and October. Yr/yr data would then correct higher to -10.6% from -17.6% for the median, and to -6.7% from -10.4% for the average.