This week's five highlights

Markets Guessing Trump Policy Priorities

U.S. Initial Claims rebound from a dip

ECB Policy Window Stays Very Open

UK Inflation Stays at Target and Services Stay Resilient

China Retail Sales Drags Q2 GDP

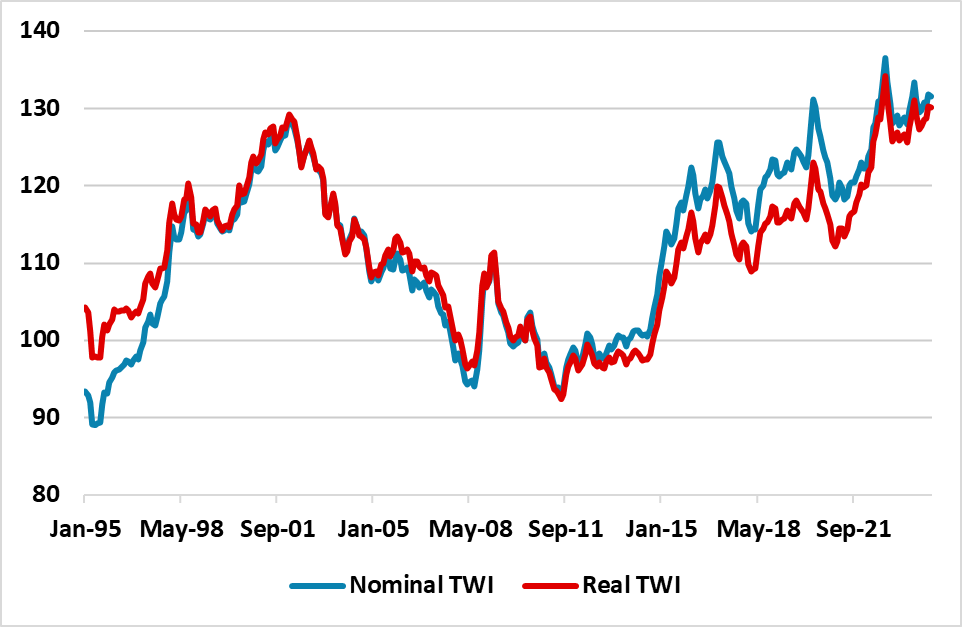

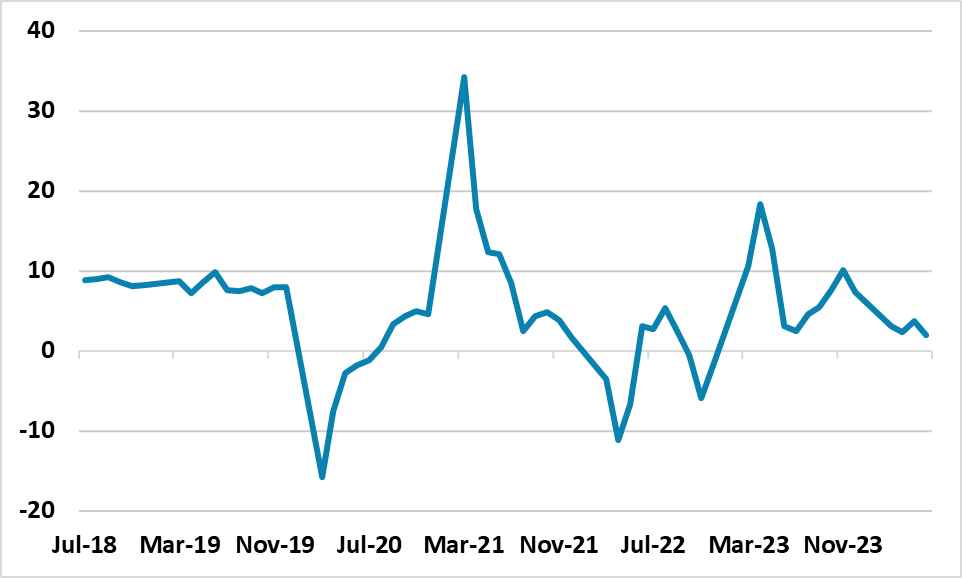

Figure: USD Higher Than Trump’s First Term (Yr/Yr %)

If Trump is elected president we still feel that the top priorities for implementation will likely be reducing immigration and making permanent tax cuts that are due to lapse in 2025. Trump would likely jawbone on all issues, but actual policy changes are more important for persistent moves in markets. The key is now the close race for the House of Representatives. A divided congress would make actual policy change more difficult and would occupy Trump’s focus, while GOP control of House and Senate could speed through key policies and allow focus on other issues. Actually ending the Ukraine war could likely be a 2025 or 2026 issue, while major tariff increases are more likely a 2026 implementation issue as Trump tries to soften up countries by tempering USD strength and trying to stop currency weakness by other countries. Uncertainty is high however, both given Trump previous unpredictability and his tendency to move towards the centre in elections and drift back to the right post-election.

JD Vance has noted a strong preference for end the Ukraine war, but also for a weaker USD and tariffs against China, which has sparked debate in financial markets now that Vance is Donald Trump’s running mate. However, Trump views are ultimately the most important and Wednesday Bloomberg interview (here) is a critical read for those trying to understand policy priorities if Trump is elected president.

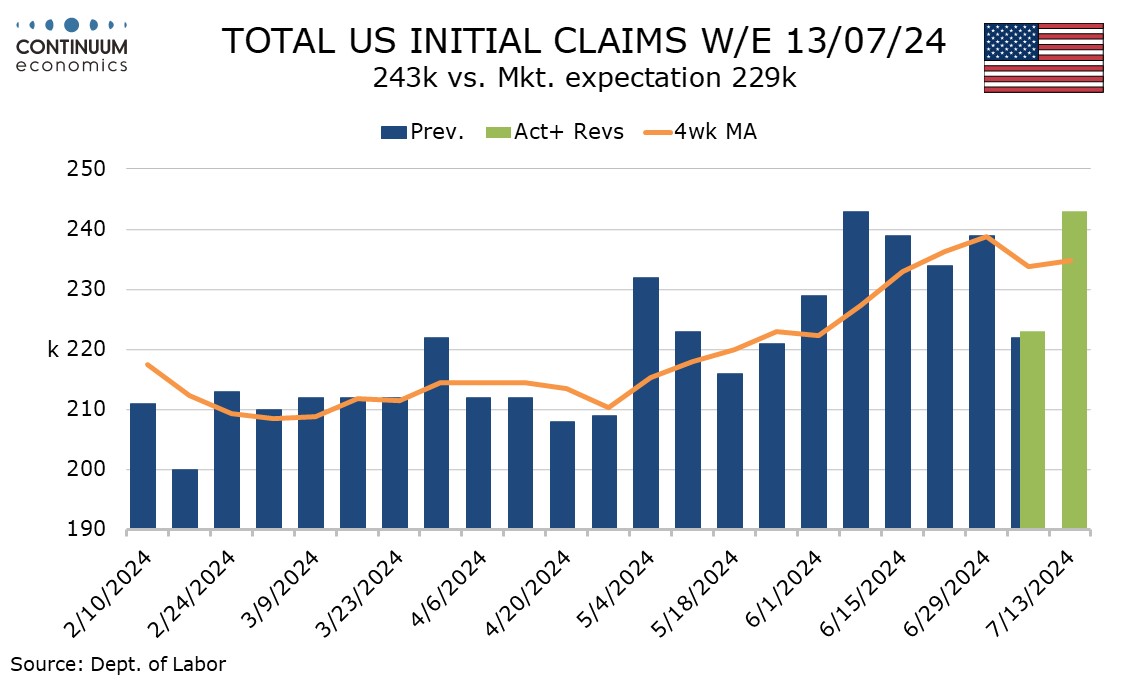

Initial claims at 243k have bounced to the highest level since a matching number five weeks ago from last week’s 223k which was a six week low, restoring signs of labor market slowing. However July’s Philly Fed manufacturing index at 13.9 versus 1.3 is stronger than expected and backs some positive recent manufacturing signals. Initial claims data needs to be treated cautiously in early July due to the first week including the 4 July holiday and the first two weeks seeing annual auto retooling shutdowns, both of which make seasonal adjustments difficult.

This week is the survey week for June’s non-farm payroll. The 4-week average of 234.75k has come off a high seen two weeks ago but is marginally higher than the 233k seen in May’s payroll survey week. Continued claims, which cover the week before initial claims, also renewed a rising trend, up by 20k to 1.867m after a preceding fall of 9k which was the first decline in ten weeks. The 4-week average of 1.851m is the highest since December 2021.

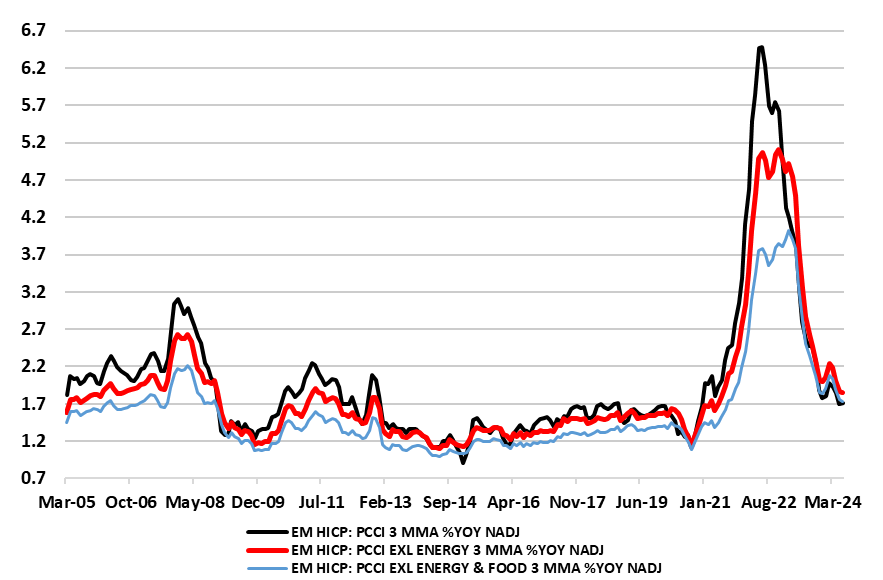

Figure: Underlying Price Pressures Back Below Target

Maybe the ECB is now thinking that it was too clear at its April Council meeting that rate cut would occur subsequently in June, basically then suggesting that something would have to occur to prevent such a move. This time, with policy rates held as very much expected, the policy window was merely left open, with nothing like any pointer to the speed and/or timing of further moves. That the easing cycle continues is clear as President Lagarde again noted that policy thinking was in a so-called third phase and made some almost-dovish hints in highlighting the softer aspects of the inflation picture. But any further moves may come with continued formal dissent and reservations. Such a possible lack of policy unanimity is not something the consensus-liking ECB Council may prefer. But with the ECB statement retaining its previous assessment of the medium-term inflation outlook (ie below target) and noting largely lower underlying inflation signs (Figure 1), it does not suggest that that hawkish minority have made any strides in affecting the rest of Council.

It is notable how the ECB stressed that most measures of underlying inflation were either stable or edged down in June, something backed up by PCCI data often cited by Chief Economist Lane as the best lead indicator of price trends (Figure 1). Indeed, these measures are all now even more clearly below the 2% target and actually only a couple of tenths above their pre-pandemic averages, possibly a result of what the ECB suggests has been a ‘buffeting’ in company profits. Admittedly, it is possible that if there are continued signs of price persistence (in services and/or wages) this may harden the hawkish reservations. But if this comes alongside formal projections still seeing headline HICP below target at the end of the forecast horizon, then the ECB may have no option but to ease (further).

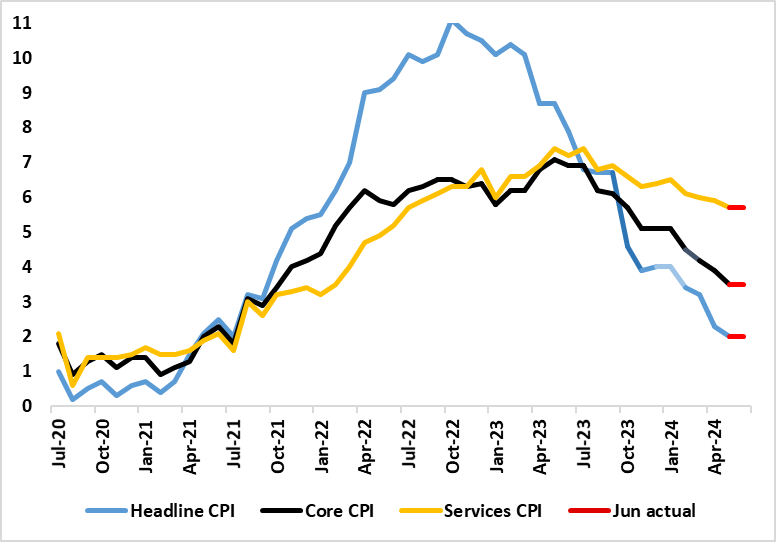

Figure: Headline and Core Inflation Steady But Services Resilient?

As has been made clear by policy-makers, labor market and particularly CPI data are crucial to BoE thinking about the timing and even the existence of any start to an easing cycle. In this regard the fact that headline CPI inflation dropped back to the 2% target in May is important but far from definitive. Indeed, largely meeting expectations, CPI headline inflation fell from 2.3% to 2.0% and thus back in line with the target for the first time in just over three years. But apparent service sector resilience is troubling the BoE (certainly the hawks) and will continue to do so. As we expected, headline CPI inflation stayed at 2.0% in the June numbers and with a stable core rate of 3.5%, but with services failing to ease by remaining at 5.7% (Figure) and thus some 0.6 ppt above BoE thinking.

Thus, the data alone is not going to give a green light to a rate cut as soon as August, especially as GDP data may suggest another solid gain in Q2 is in store. But we are still pencilling in a cut next month, at least until we see the next set of labor market numbers, given the manner in which the thrust of inflation news has evolved of late and with it therefore highly likely that the August Monetary Policy Report will continue to point to a substantial inflation undershoot ahead. Indeed, despite apparently resilient services CPI inflation that for services PPI fell further, this a solid lead indicator for the former. Indeed, services producer prices rose by 3.1% y/y in Q2 (Apr to June) 2024, down from a revised increase of 3.7% in Q1. Moreover, in spite of services price resilience (which is relatively widespread and included a fresh rise in restaurant inflation), overall CPI inflation has fallen faster that it rose, averaging a drop of 0.48% per month since its peak in Oct 22.

Figure: China Retail Sales (Yr/Yr %)

We are revising down our 2024 GDP forecast from 4.9% to 4.7%, both due to the weaker than expected Q2 GDP figure but also the weak underlying momentum of consumption. Some further targeted policy measures are likely in the coming months, but will struggle to lift economic momentum.

Q2 China GDP came in at 4.7% versus 5.1% expected Yr/Yr. Two factors look to be behind the miss. Firstly, the Yuan 1trn central government stimulus program has yet to come through forcefully, but will likely in H2 GDP. Secondly, consumption is disappointing, with June retail sales down to 2.0% Yr/Yr compared to 3.4% expected. The breakdown of the June retail sales data makes disappointing reading, with consumer goods slowing to +1.5% Yr/Yr, autos -6.2% and home appliances -7.6% Yr/Yr. The 618 shopping festival failed to boost spending. The only comfort was that restaurant spending was +5.4% Yr/Yr versus +5.0% in May. Poor consumer confidence, plus weak employment and wage growth, are hurting consumer purchases. This is beyond the well appreciated dampening effect from the ongoing residential property slump.