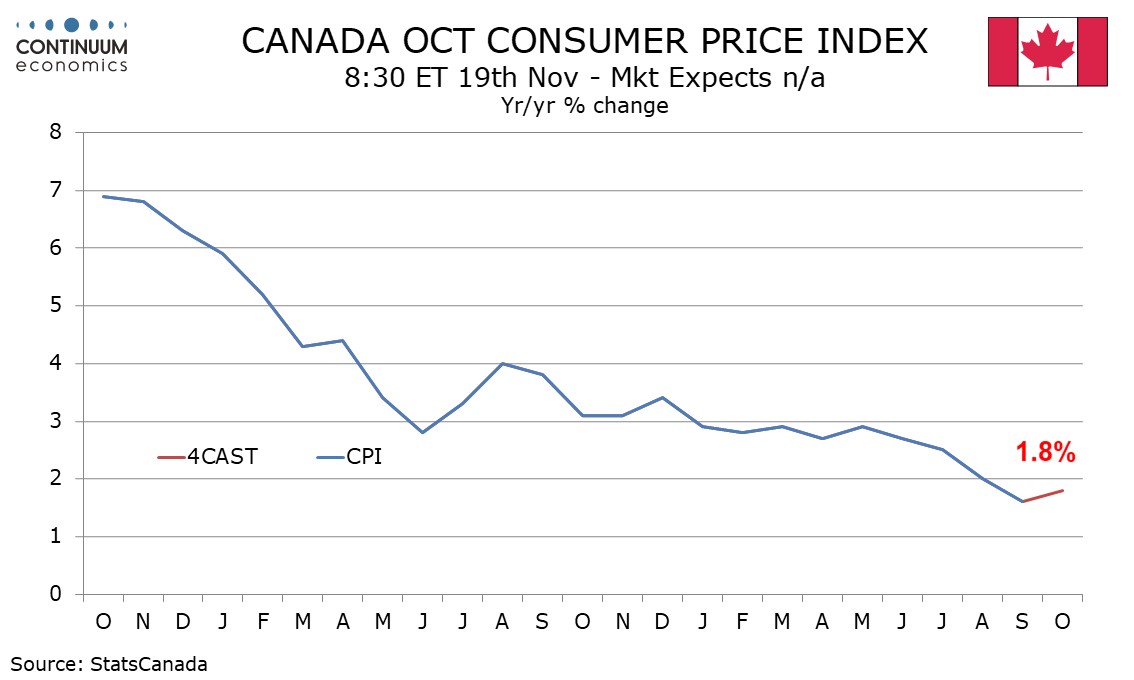

Preview: Due November 19 - Canada October CPI - A correction higher overall but with renewed slippage in the core rates

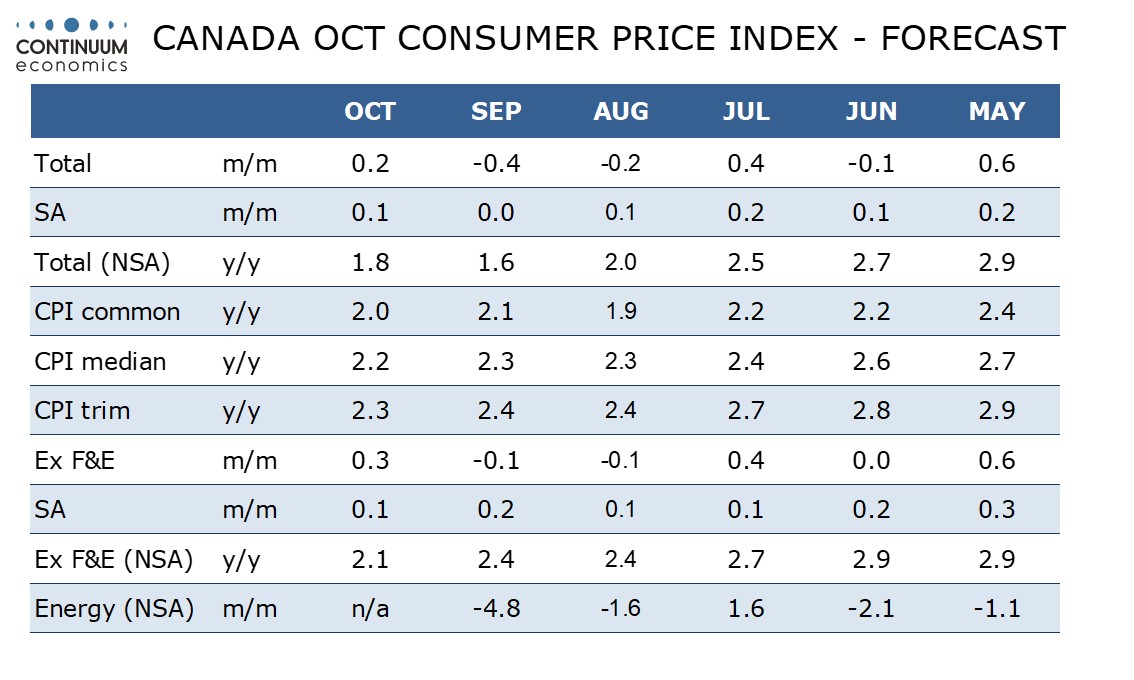

We expect October Canadian CPI to correct higher to 1.8% yr/yr after falling to 1.6% in September from 2.0% in August. This will leave overall CPI below the 2.0% Bank of Canada target. While we expect overall CPI to correct higher we expect the BoC’s core rates to show renewed downward progress after a pause in September.

On the month we expect gains of 0.2% overall and 0.3% ex food and energy before seasonal adjustment, but seasonally adjusted we expect modest gains of only 0.1% in each series. The seasonally adjusted ex food and energy pace will match those seen in July and August, which preceded a slightly stronger 0.2% gain in September. September’s data showed a loss of momentum in shelter which we expect to be sustained, but above trend gains elsewhere, which we do not expect to be repeated.

The bounce in the yr/yr rate will be due to a sharp fall in energy prices in October 2023 dropping out. Ex food and energy data however picked up in October 2023 after a below trend September, and we expect yr/yr ex food and energy CPI to slow to 2.1% from 2.4%.

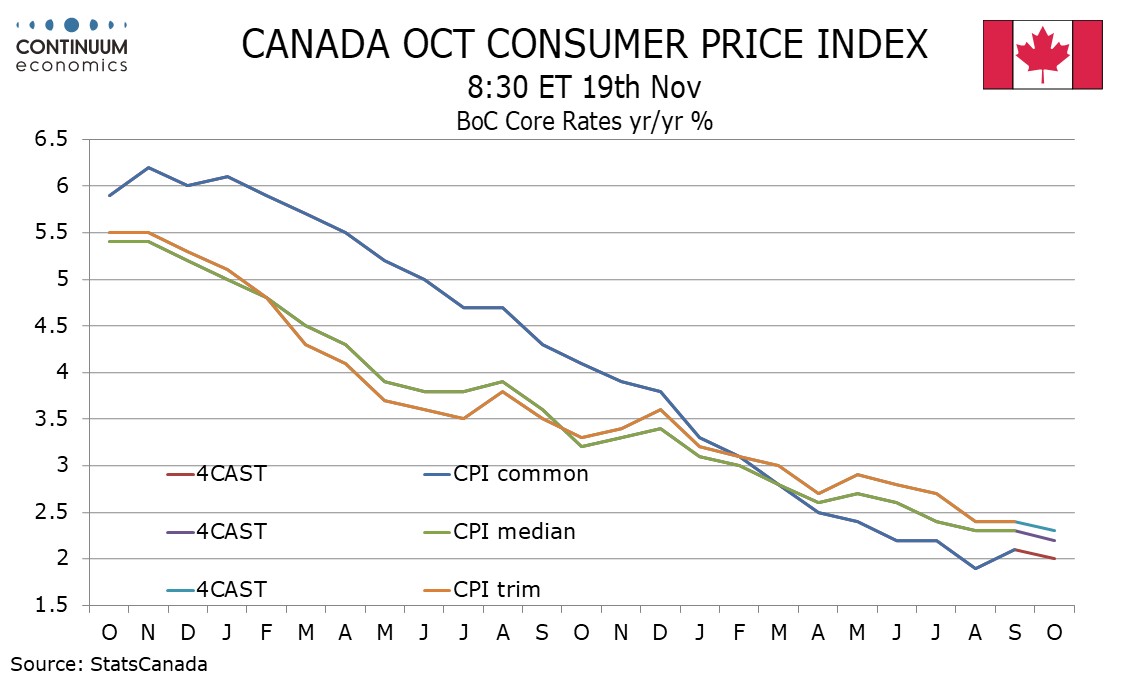

The ex food and energy rate is not one of the BoC’s three core rates, but these also look set to slow on a yr/yr basis after pausing in September. We expect CPI-Median to slow to 2.2% from 2.3%, CPI-Trim to slow to 2.3% from 2.4% and CPI-Common to slow to 2.0% from 2.1%.