U.S. April Consumer Confidence, March JOLTS Job Openings - Future weakness signalled

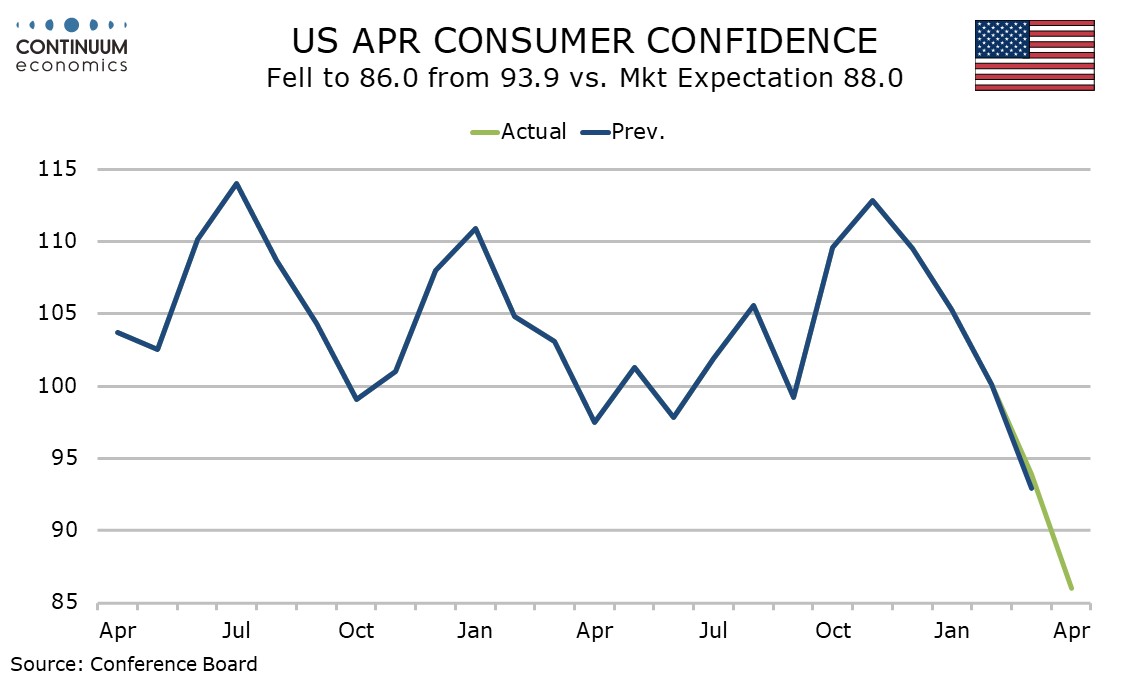

The latest data suggest upcoming weakness in the US economy. March consumer confidence at 86.0 from 93.9 continues its recent slide with the drop being led by future expectations, while March’s JOLTS report on job openings has seen a steeper than expected drop of 288k to 7192k, with February revised down by 88k for a drop of 282k.

The consumer confidence dip is only marginally steeper than expected but marks a fifth straight dip from 112.8 immediately after the election. November’s index was the highest since July 2023. April’s is the weakest since May 2020, at the height of the pandemic.

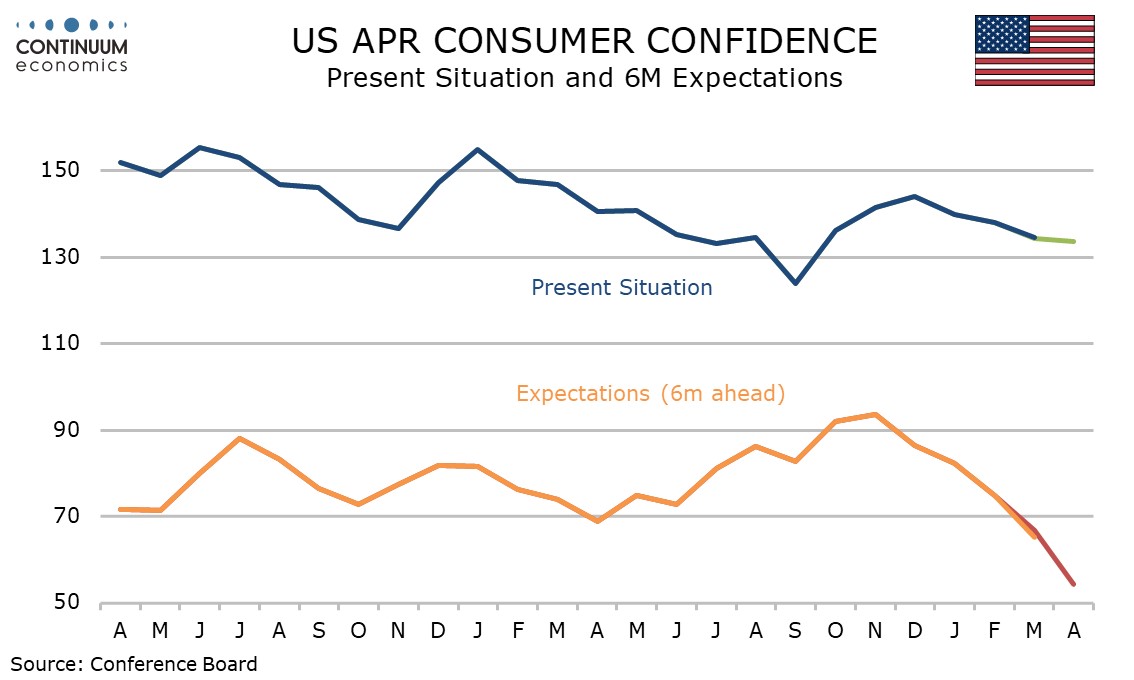

The present situation dip is modest, to 133.5 from 134.4, and the index was weaker as recently as September 2024. However 6-month expectations have plunged, the index of 54.4 from 66.9 being the weakest since October 2011.

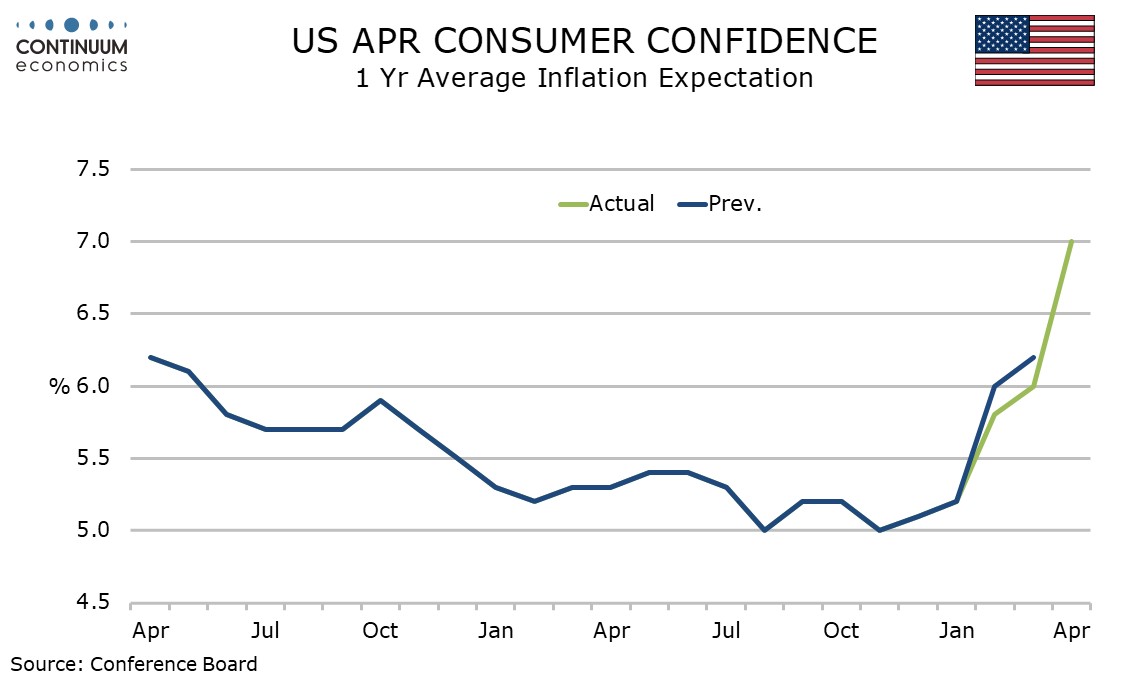

Inflation expectations are surging, the 12-month average at 7.0% from 6.0%, reaching the highest since November 2022. This is up from a low of 5.0% in November 2024. The median inflation expectation is not quite as high, though did bounce to 6.0% from 4.9%. The average is higher than the median due to extreme pessimism of some.

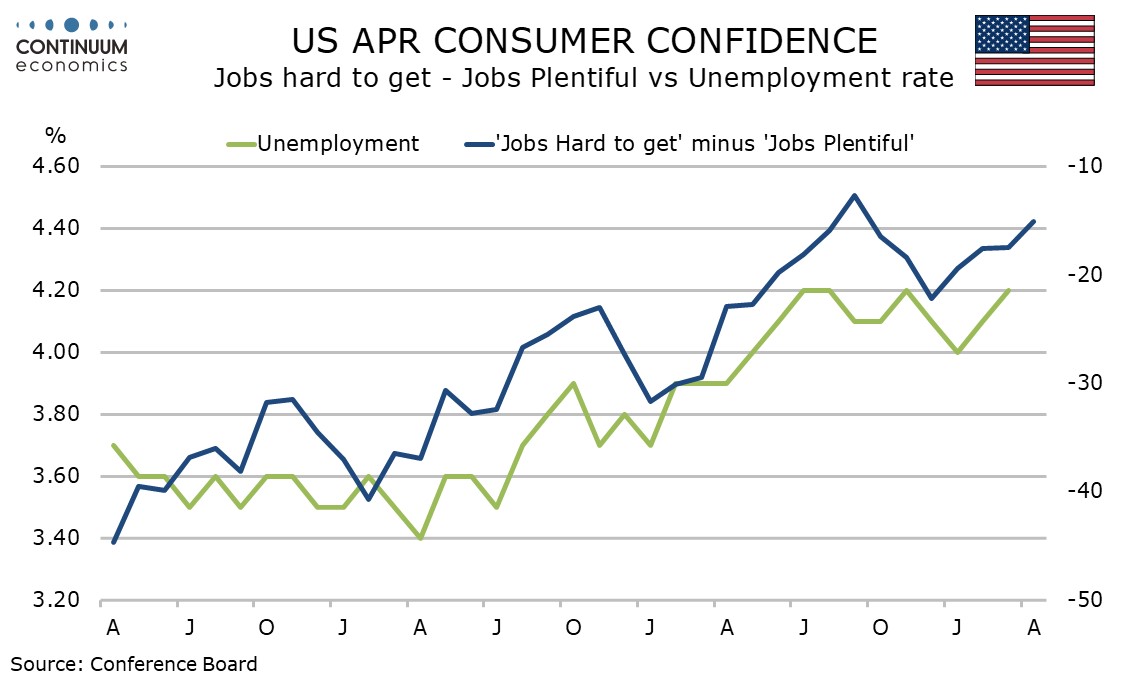

Labor perceptions have seen a modest deterioration, those seeing jobs as plentiful exceeding those seeing them as hard to get by 15.1%, down from 17.55 in March and the weakest since September 2024.

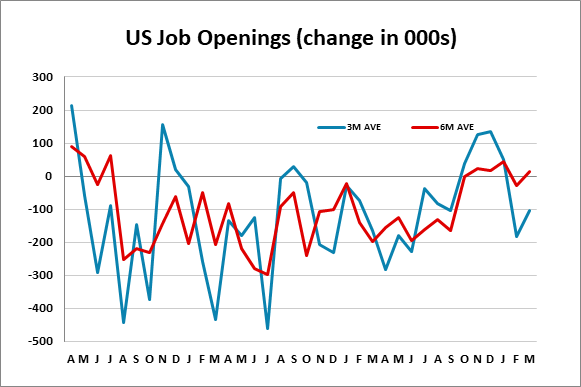

The job openings series is a volatile one and should be treated cautiously, though this month we have seen a second straight decline similar decline, and the three month average is negative, though the six month average is marginally positive.

Elsewhere is the JOLTS report we saw hirings up by 41k, and separations down by 179k, backing the stronger March payroll detail. Despite the fall ins separations quits rose by 82k which suggests optimism on the labor market persists for many despite the growing downside risks.