Published: 2024-07-22T19:19:49.000Z

Preview: Due July 31 - U.S. Q2 Employment Cost Index - Still firm, if a little less so

1

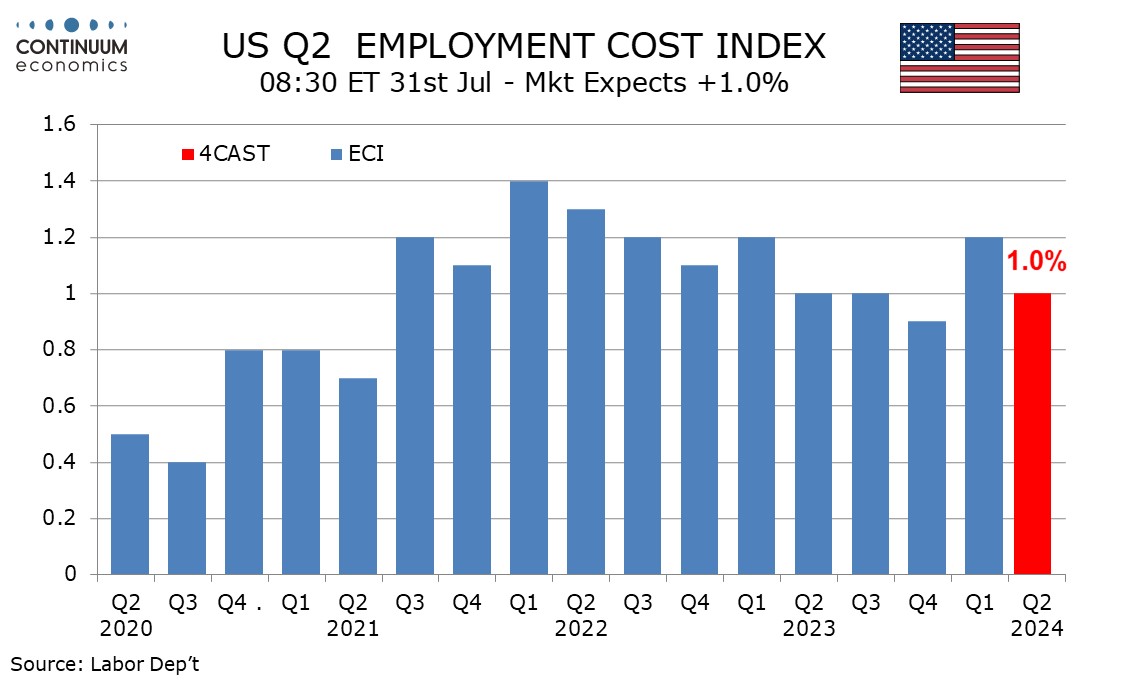

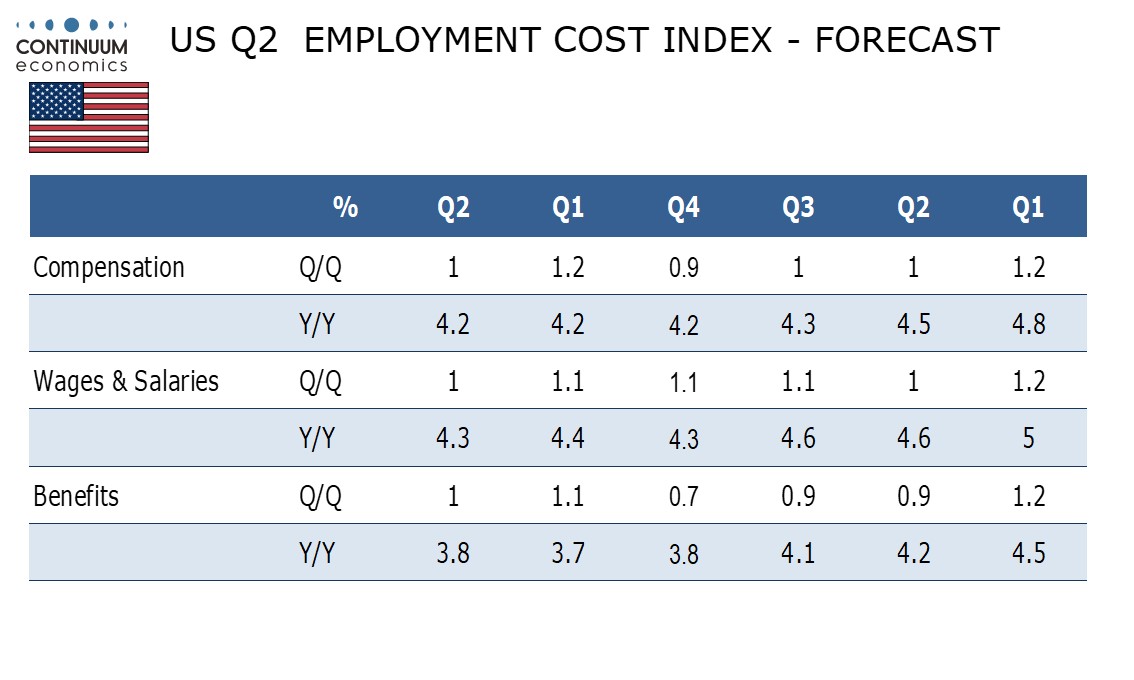

We look for the Q2 employment cost index (ECI) to increase by 1.0%, a slight slowing from Q1’s 1.2% but in line with recent trend, and keeping the picture quite strong.

We expect wages and salaries to increase by 1.0% after three straight quarters at 1.1%. Trend in average hourly earnings in the non-farm payroll detail has been slowing, but not sharply.

We also expect a 1.0% increase in benefit costs, slightly slower than Q1’s 1.1% but stronger than the final three quarters in 2023. Despite slowing overall, medical care inflation remained quite firm in the Q2 CPI and health care is an important part of benefit costs.

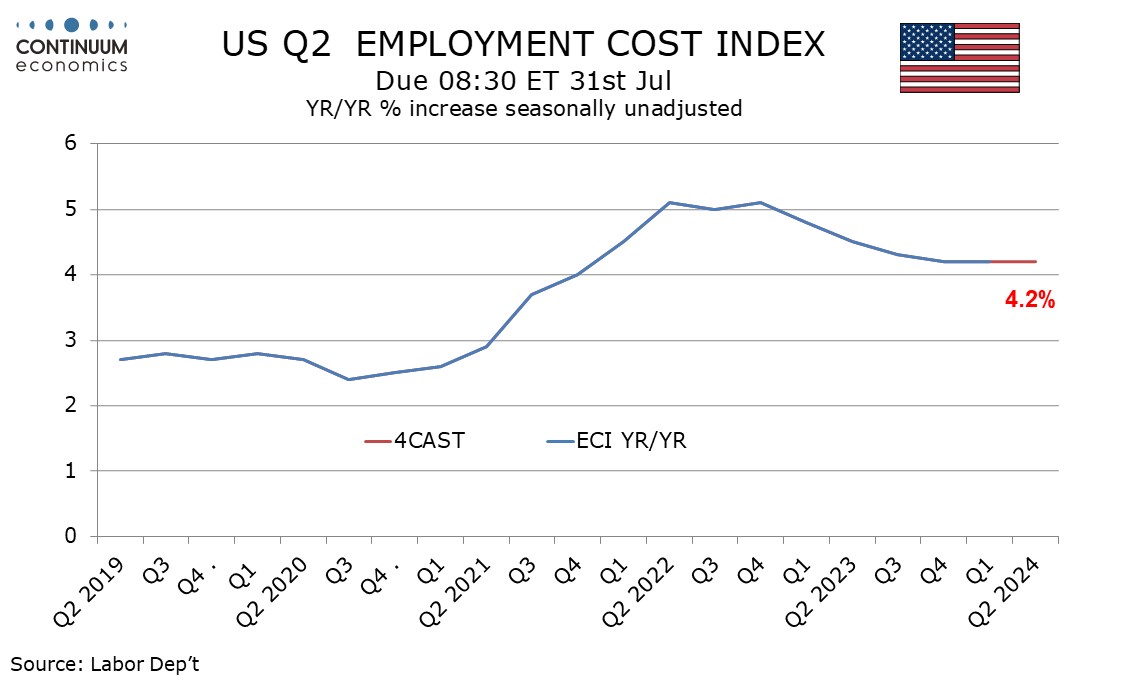

We expect yr/yr growth to remain at 4.2% for the third straight quarter with wages and salaries at 4.3% from 4.4% and benefits at 3.8% from 3.7%. This would remain well above the pre-pandemic trend which was running slightly below 3.0% yr/yr.