U.S. January ISM Manufacturing - Broad based improvement

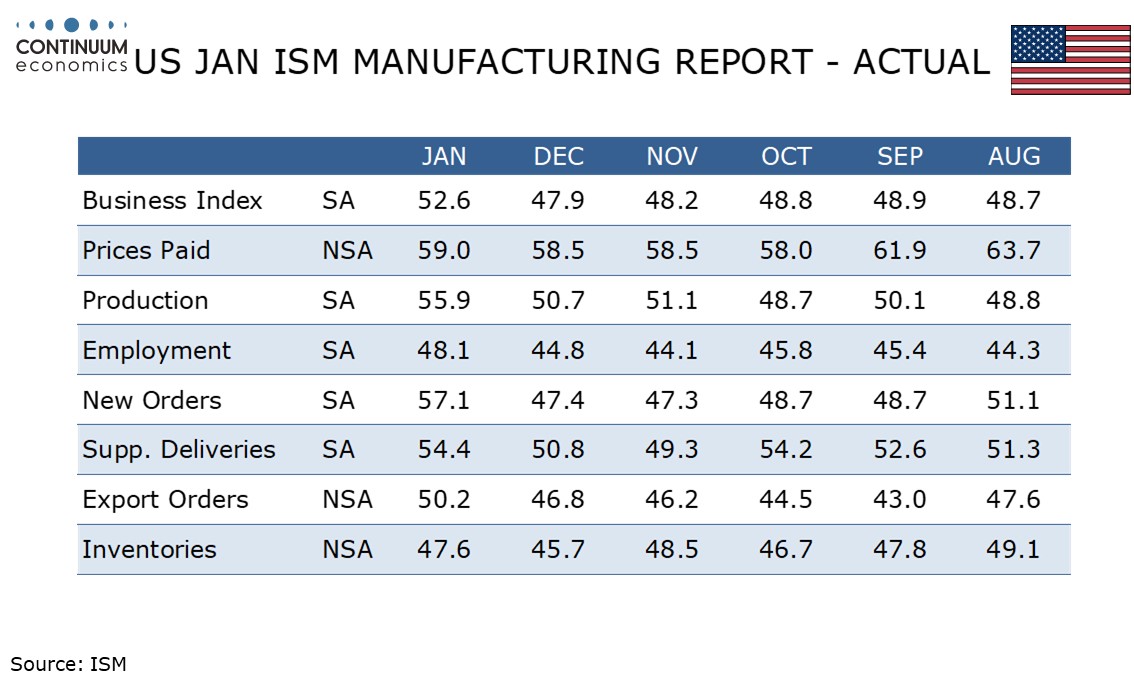

January’s ISM manufacturing index of 52.6 is up significantly from 47.9 in December and the highest since August 2022. While caution should be seen on one month’s data, the improvement is broad based and backed by several reginal surveys.

The improvement follows an upward revision to the S and P manufacturing PMI to 52.4 from 51.9, though the S and P manufacturing index was stronger as recently as October meaning the marginal outperformance of the ISM index in January is unusual.

All five components of the ISM composite are improved, most impressively new orders at 57.1 from 47.4. Production rose to 55.9 from 50.7 and deliveries to 54.4 from 50.8. Employment at 48.1 is still negative but up from 44.8. Finally inventories rose to 47.6 from 45.7.

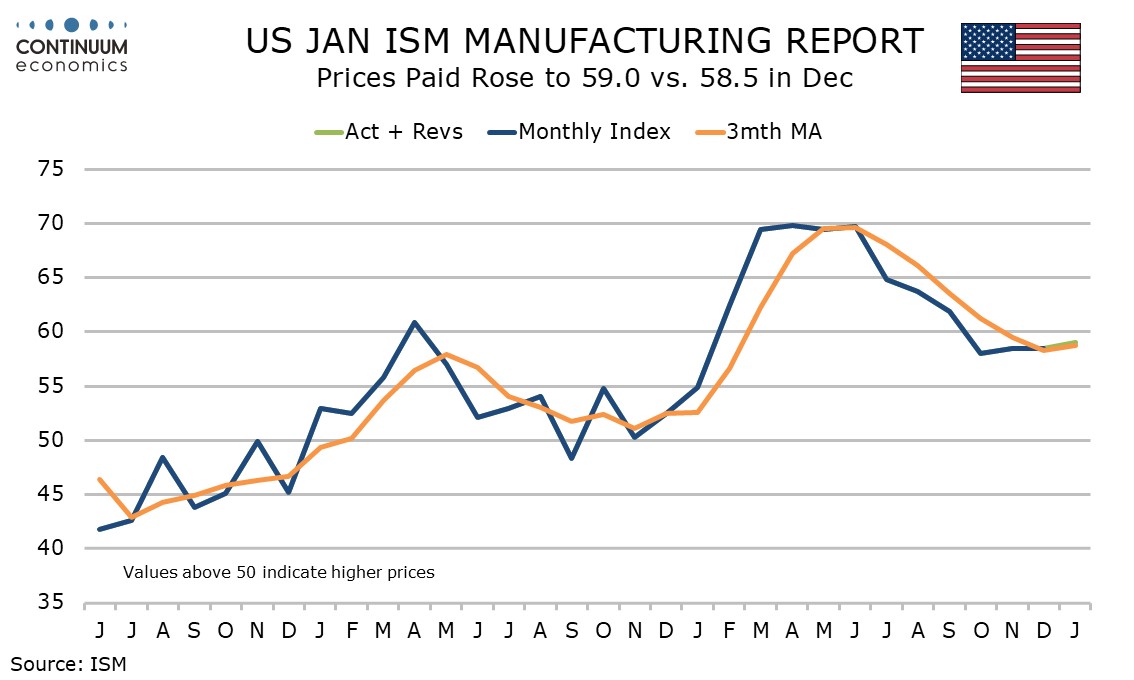

Prices paid do not contribute to the composite and at 59.0 are little changed from two straight months at 58.5. They are well below the recent high of 69.8 seen in April suggesting that the inflationary boost from tariffs is fading.

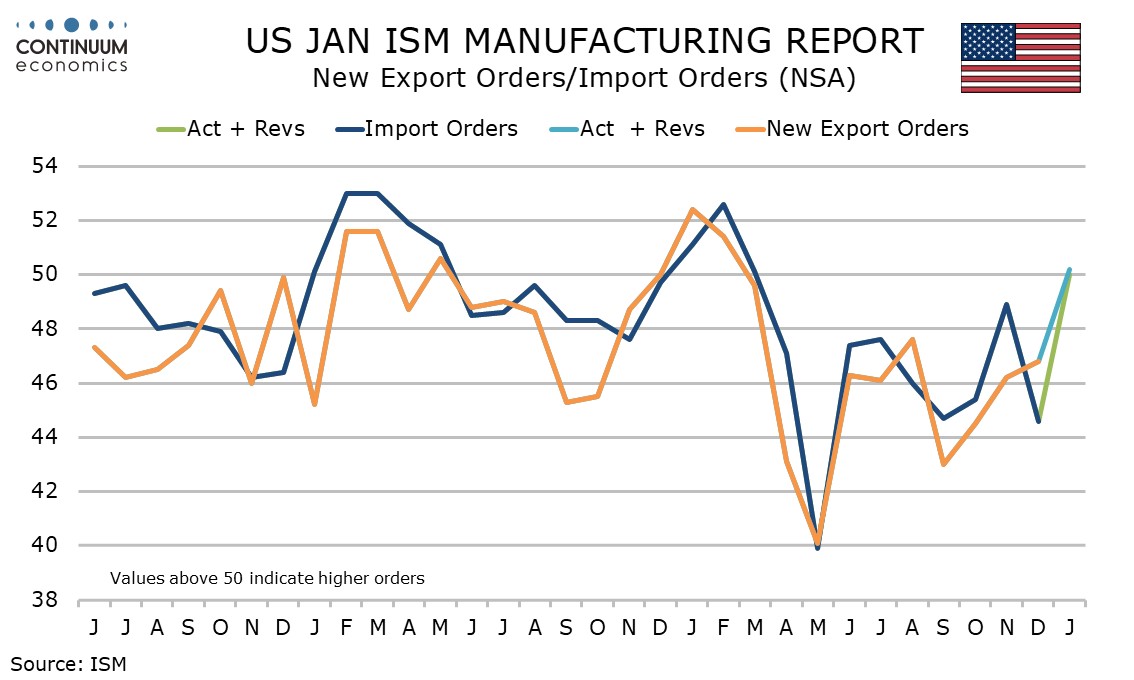

Export and import orders also do not contribute to the composite, and at 50.2 and 50.0 respectively have improved to near neutral levels from 46.8 and 44.6 in December. Both series had been consistently negative since April. This suggests the tariff impact on trade is starting to stabilize.