U.S. January PPI also sees strong start to 2024, January Housing Starts hit by weather

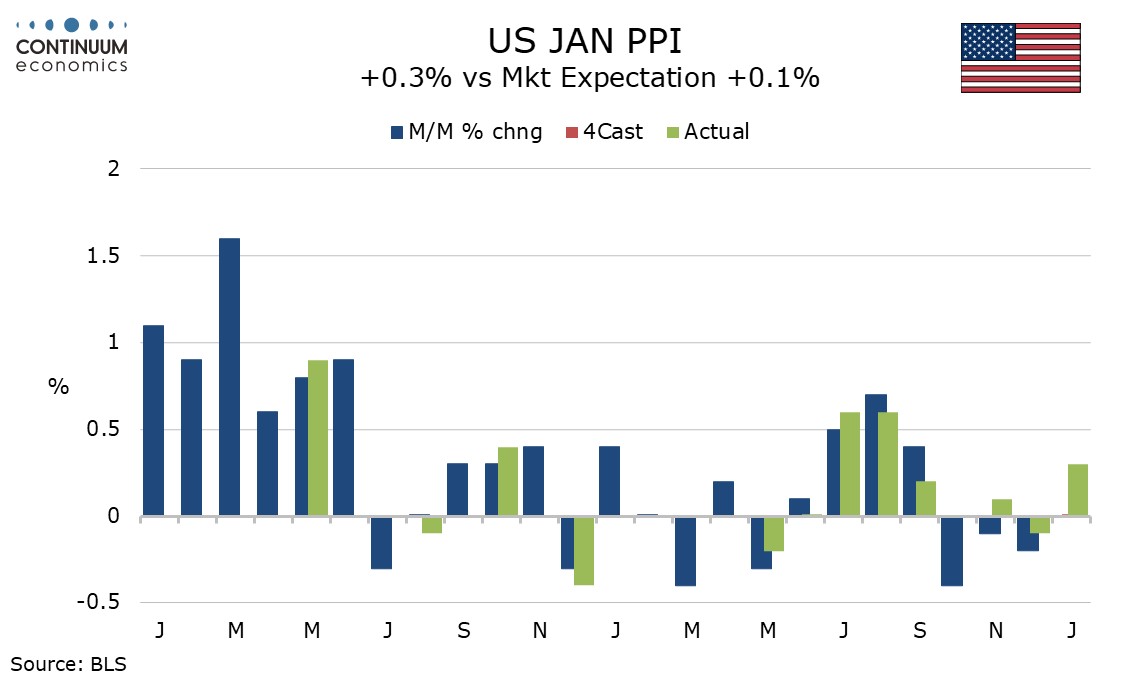

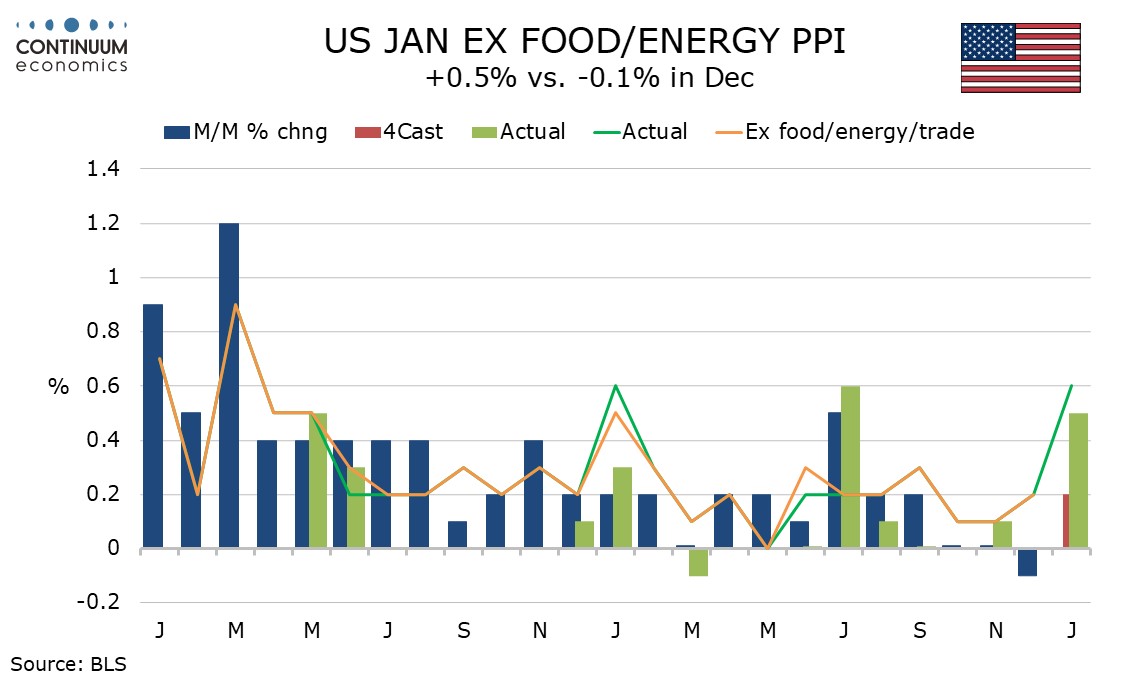

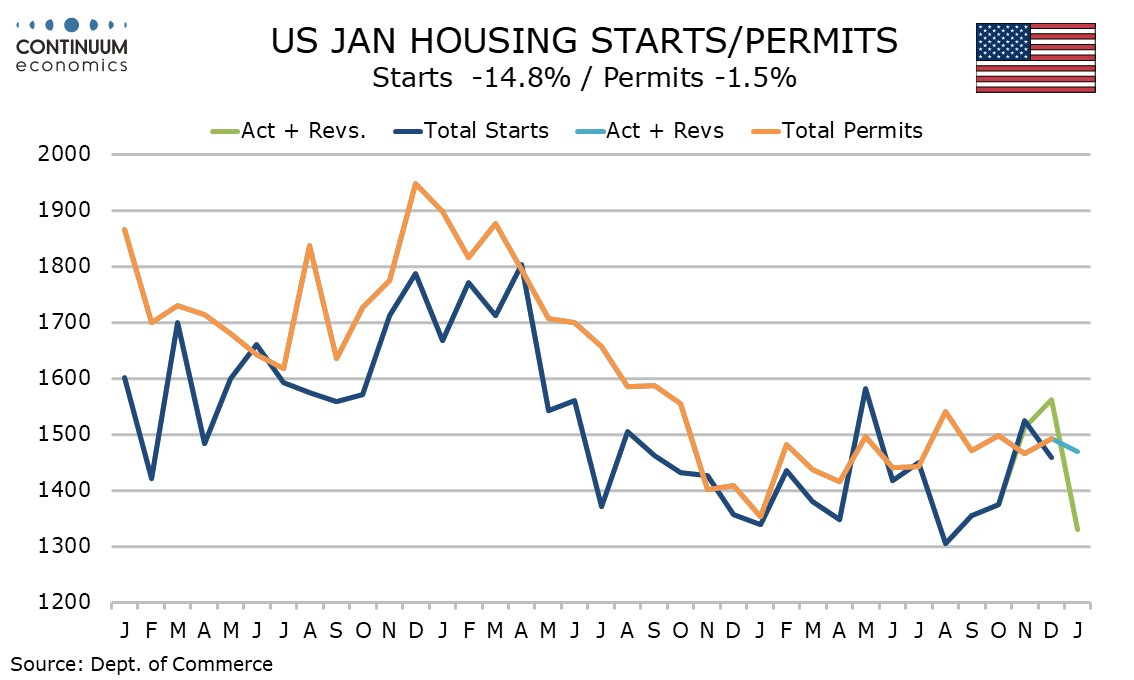

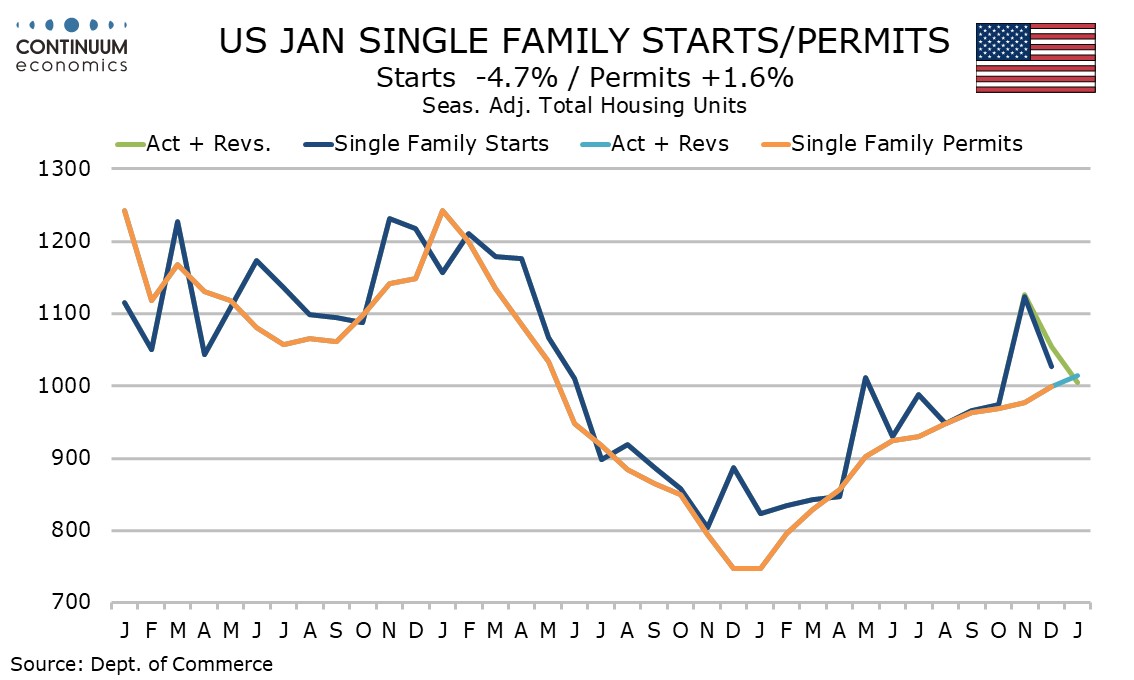

January PPI, like CPI, has surprised on the upside at the state of the year, with a gain of 0.3% overall, 0.5% ex food and energy and 0.6% ex food, energy and trade, suggesting pricing power persists with the economy still strong. A 14.8% fall in January housing starts looks weather-impacted. Permits did fall, but by a modest 1.5%, with singles maintaining a positive trend.

January inflation data reflects pricing decisions taken at the start of the year. January 2023 was also quite firm, with similar gains of 0.4% overall, 0.3% ex food and energy and 0.6% e food, energy and trade, but subsequent months reverted to a subdued picture. The January 2024 gains look unlikely to be repeated.

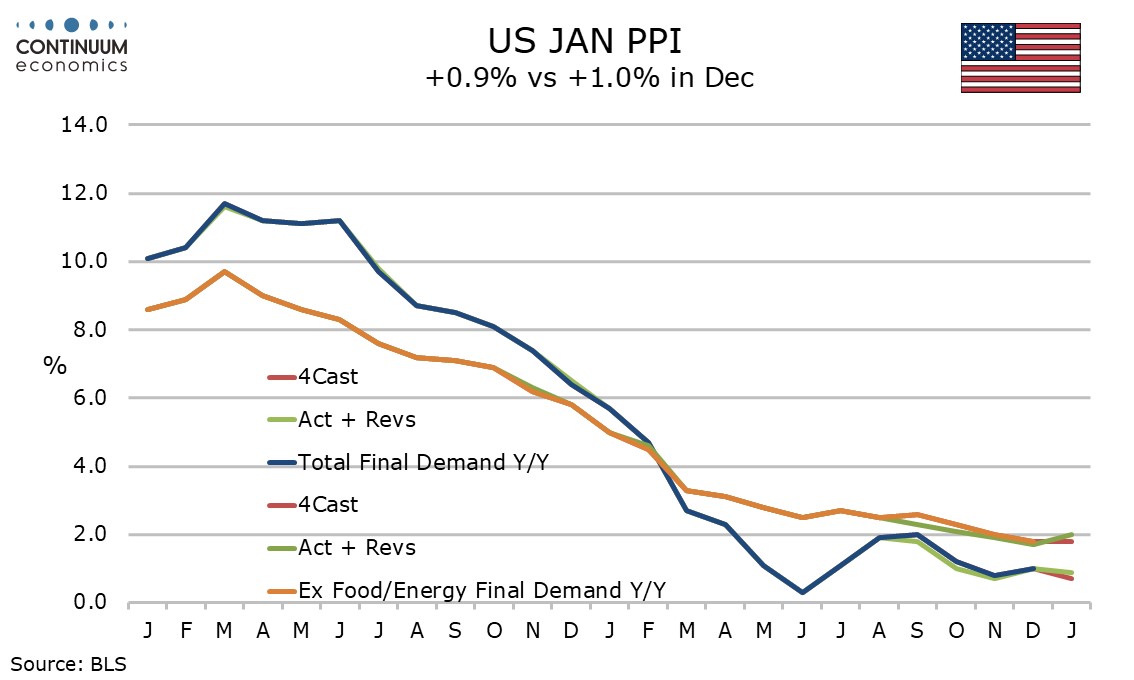

Yr/yr data has not changed much given the similar outcomes a year ago, with overall PPI at 0.9% from 1.0%, ex food and energy at 2.0% from 1.7%, and ex food, energy and trade unchanged at 2.6%. Still, the lack of further progress in reducing inflation is a disappointment. PPI inflationary pressures look similar to those of a year ago.

Like the CPI the PPI contrasted strength in services, which rose by 0.6%, despite a third straight decline in transport and warehousing, and weakness in goods, which fell by 0.2% on slippage in food and energy. Goods ex food and energy rose by an 11-month high of 0.3% however. Strength in services appears respondent to resilience in demand and wages, while goods are being restrained by improving supply.

Services were also firm on an intermediate basis, up by 0.5%, while intermediate goods were mixed. Processed goods fell by 0.2% but with a 0.3% rise ex food and energy, while unprocessed goods rose by 0.1% but with a 1.7% decline ex food and energy.

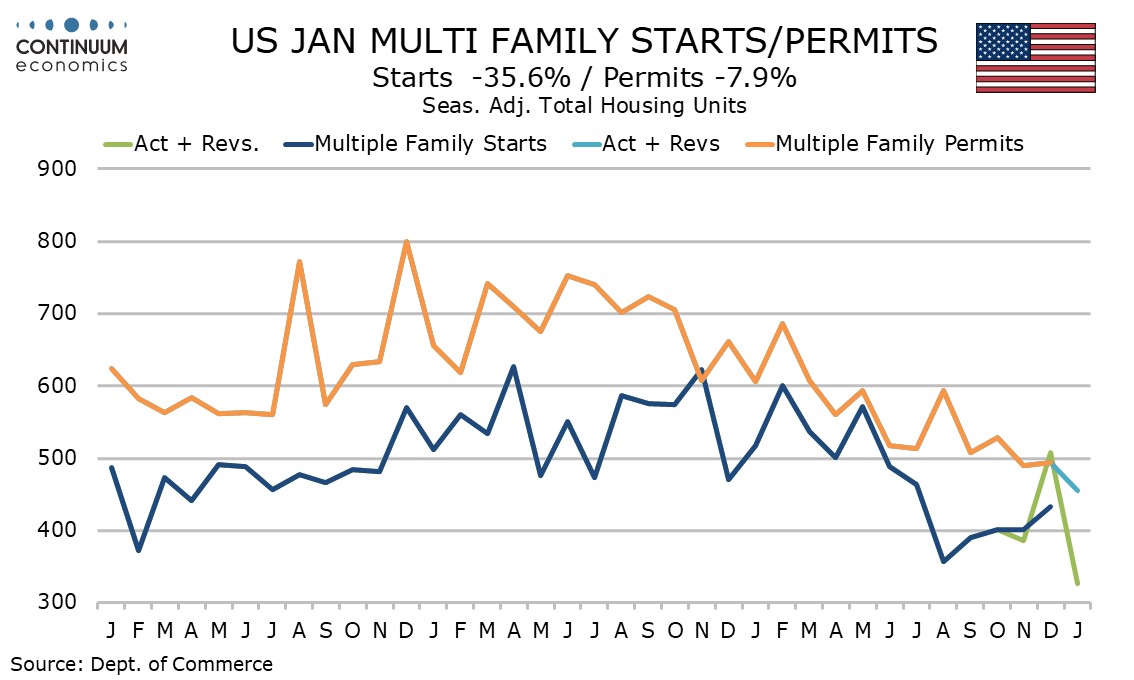

Housing starts at 1331k are down by 14.8% with singles down by 4.7% and multiples down by 35.6%. Permits at 1470k are down by 1.5% with singles up by 1.6% and multiples down by 7.9%. Single permits have now increased for 12 straight months and that suggests a positive underlying trend, with multiples data volatile and starts sensitive to weather.

Starts fell in all four regions but the steepest fall of 30.0% was in the Midwest where weather was harshest. Permits rose in three out of four regions, the one negative being the South which was the most resilient region in the case of starts.