U.S. September ADP Employment declines, initial claims and payroll releases face delay

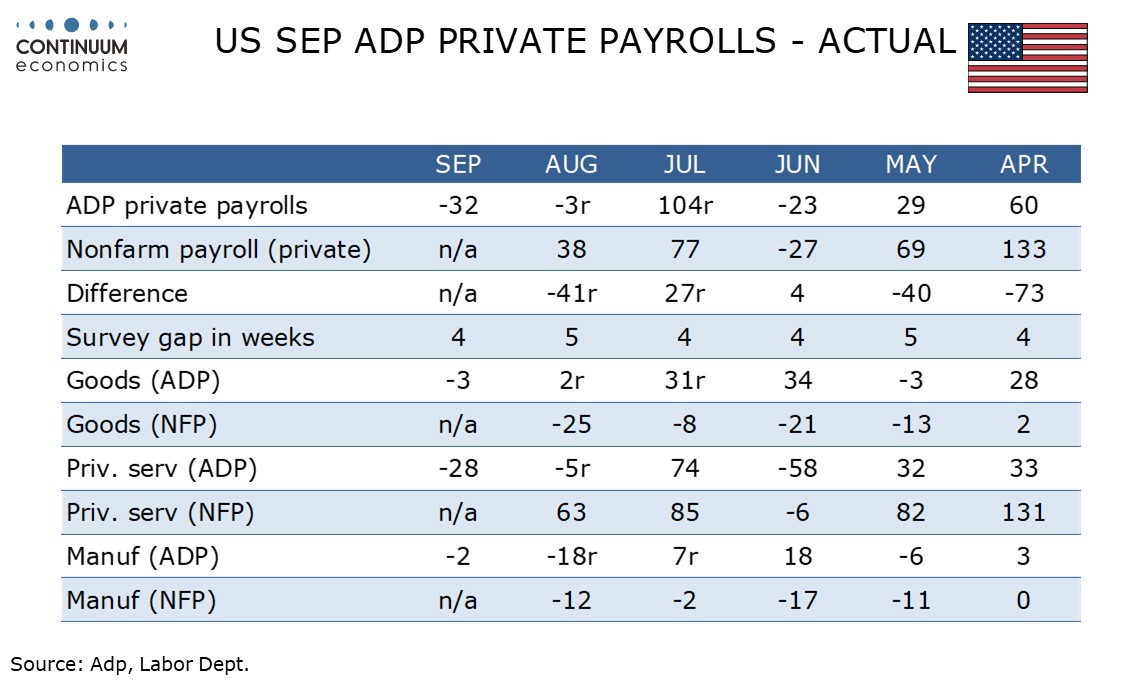

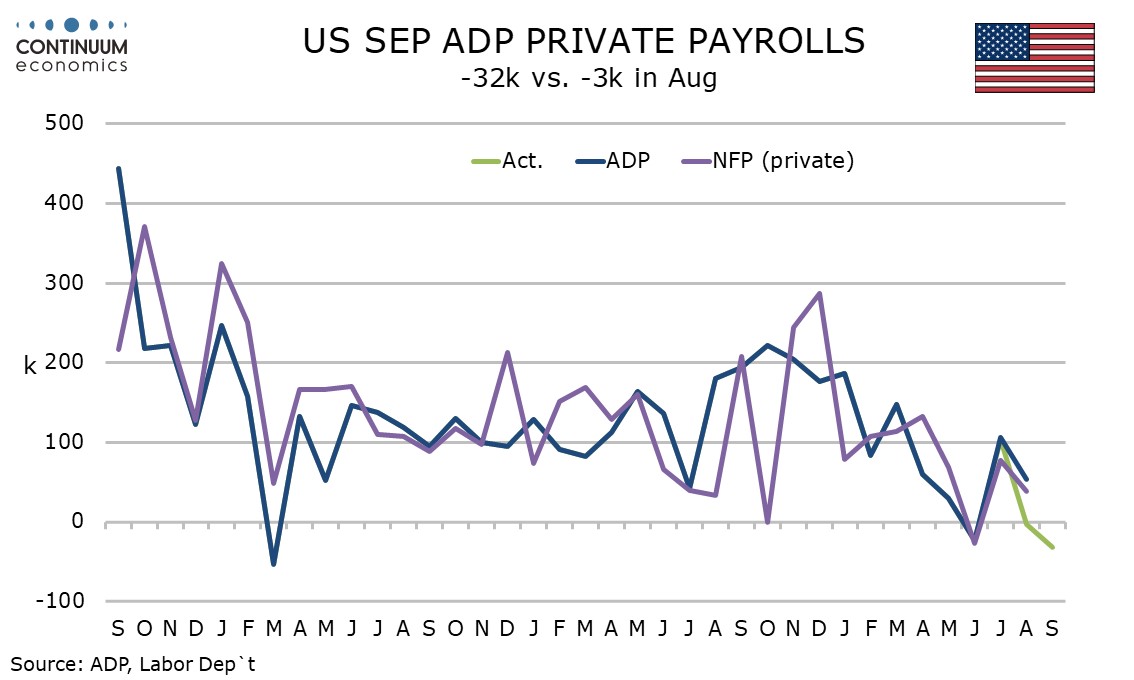

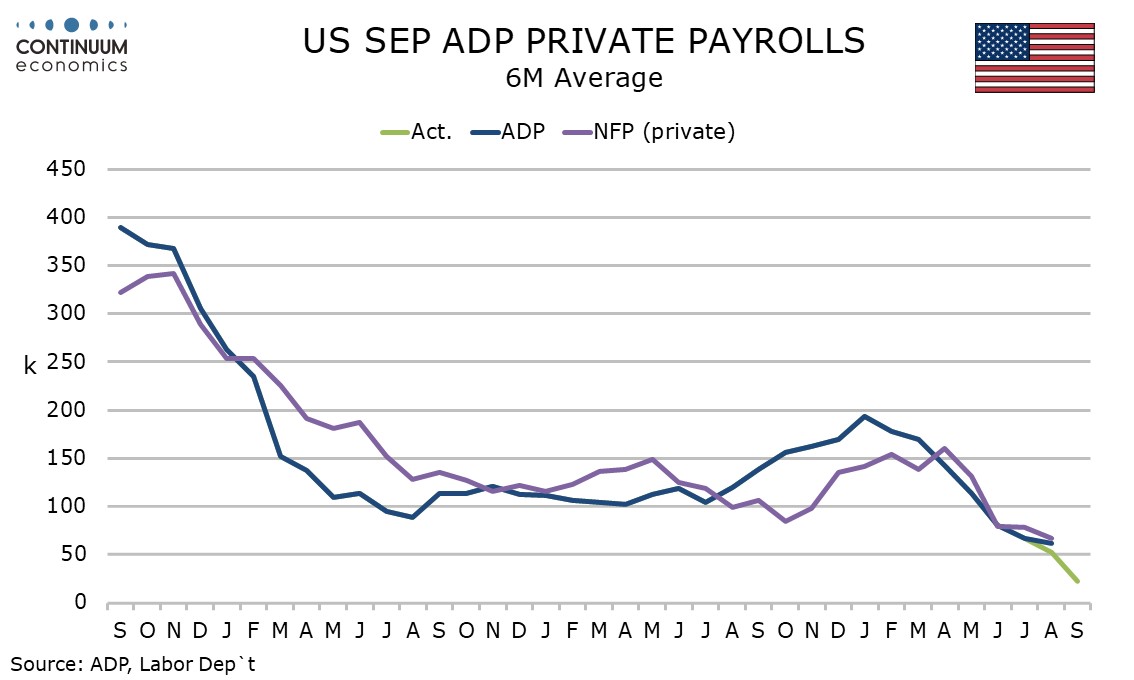

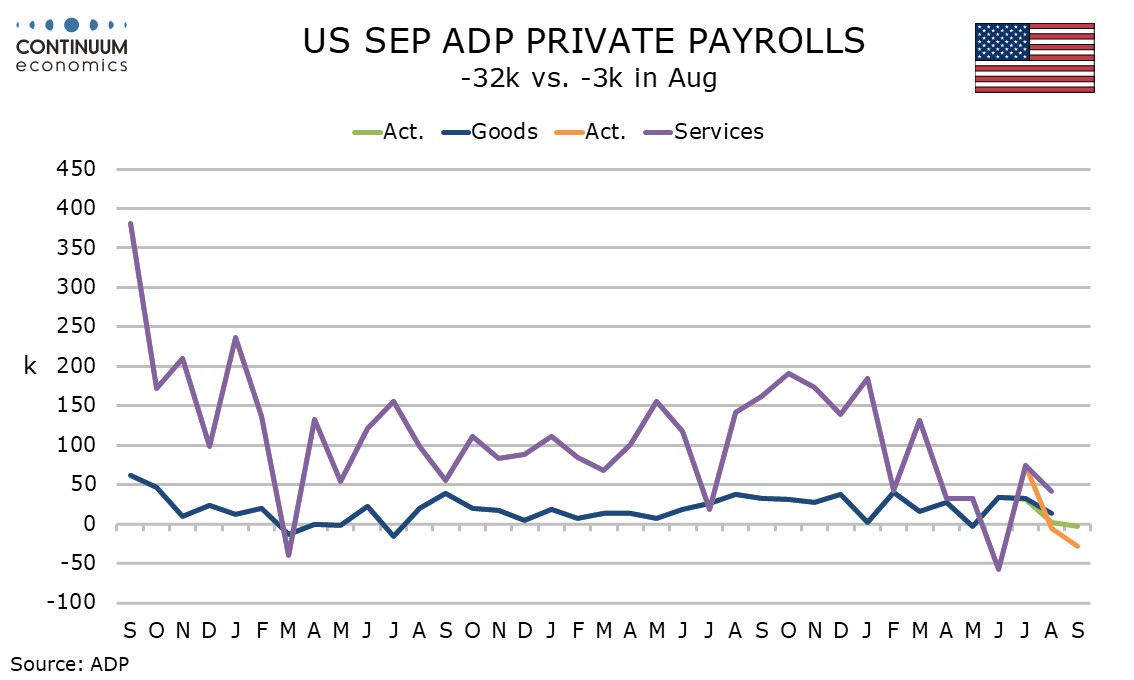

ADP’s September estimate of employment is weaker than expected with a 32k decline, extending a recent slowing in trend. Adding to the negative message, August was revised to a 3k decline from a 54k rise. Given the government shutdown starting today this may be the last look at the labor market we get until the situation is resolved, with initial claims tomorrow and Friday’s non-farm payroll set to be delayed.

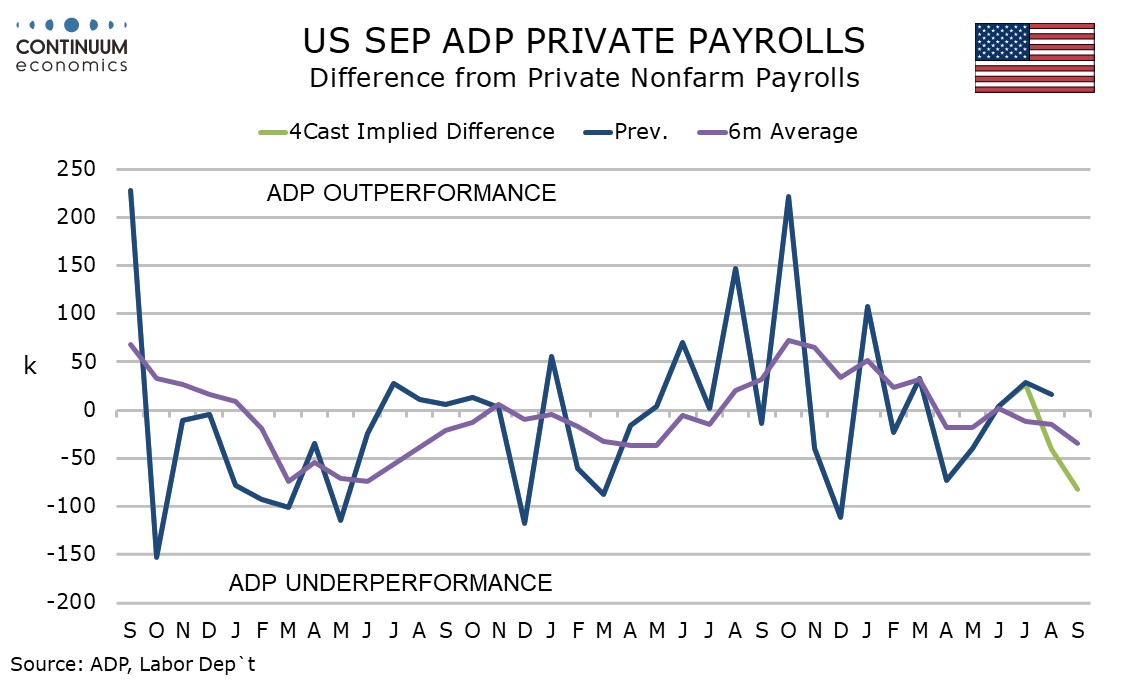

ADP data has generally been seen as an unreliable guide to payrolls, though recently the record has been better, with no discrepancies as high as 100k since January, and the sharp downward revisions to non-farm payrolls released with the July report making the data more consistent with the ADP’s.

With the August revision this makes two straight negative ADP releases, and three in four months, though June’s 23k decline was corrected by a 104k increase in July. Private sector non-farm payrolls looked similar, with a 27k fall in June followed by a 77k increase in July. Our forecast for September private sector payrolls remains for a 50k increase though it is unknown when we will see that data.

Initial claims, contrasting previous government shutdowns, are also set to be delayed in this shutdown. Recent weeks have shown some hints of an uptrend in initial claims (though last week saw a significant decline) but continued claims have been moving lower, suggesting it is far from certain that payrolls will match the negative ADP outcome.

September’s ADP detail looks broadly weak outside a 33k increase in education and health, a sector that has provided the bulk of recent non-farm payroll growth but has tended to underperform in the ADP data. Leisure and hospitality, a sector that has shown some recent volatility, was weak in this ADP report, falling by 19k. Manufacturing and construction saw modest declines of 2k and 5k respectively.

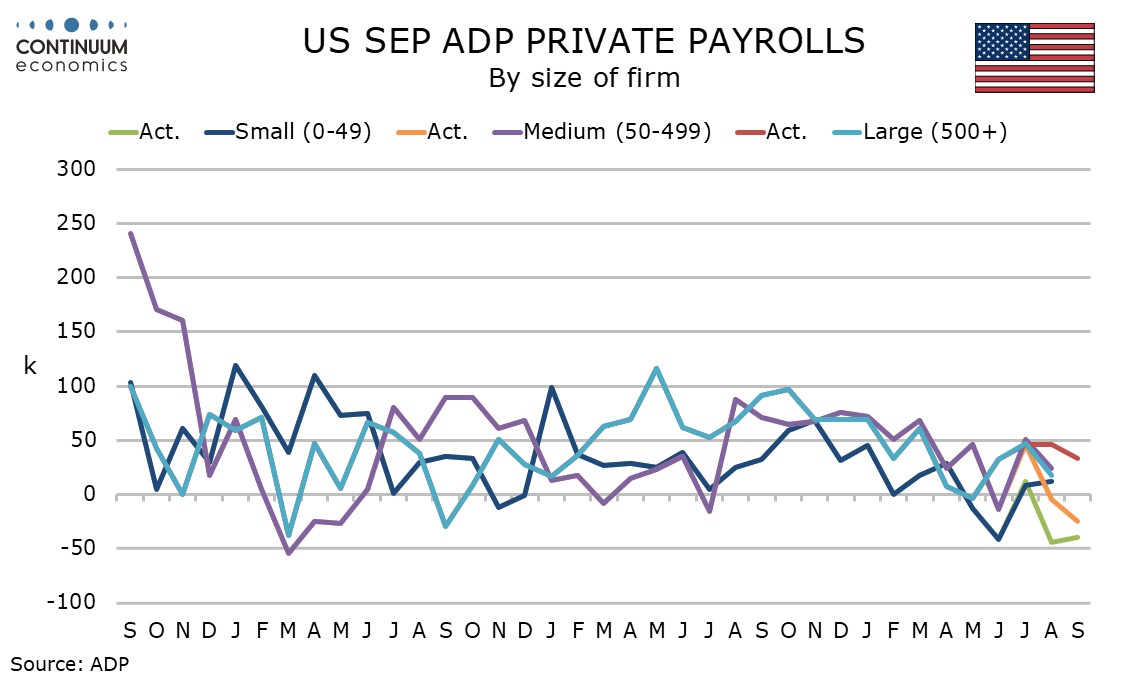

By region the ADP data slowed a 63k decline in the Midwest but modest gains in the other three regions. Large establishments added 33k jobs but small and medium sized firms saw declines. These mixed details make the ADP’s negative message look a little less convincing.

Wage growth as little changed at 4.5% yr/yr for job stayers but job changes saw a slowing to 6.6% from 7.1%. This is a sign that jobs are becoming harder to find. The labor market seems to be in a low hiring but still low firing mode.