SEK flows: SEK continues to strengthen after stronger CPI, but...

SEK strength extends, but current levels are stretched, particularly versus NOK

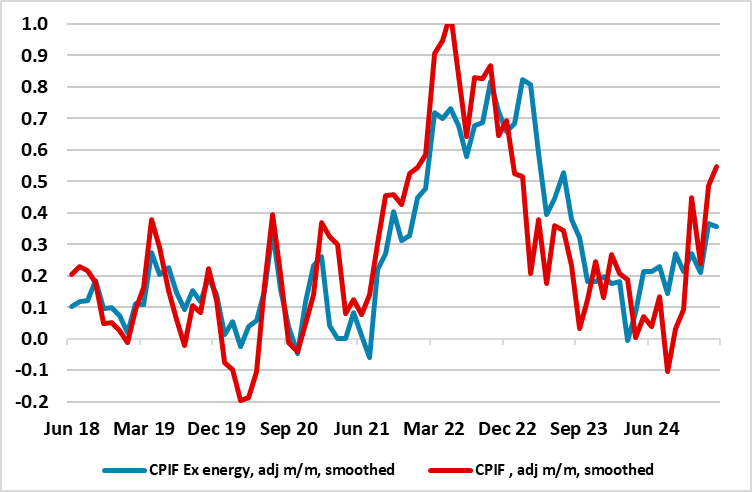

EUR/SEK has extended its recent decline in early trade after the flash February CPI data came in stronger than expected at 0.9% m/m, 2.9% y/y for the targeted CPI measure. The data further reduces the chance of any more easing from the Riksbank, with the inflation numbers now clearly showing a pick up in recent months on a seasonally adjusted basis.

Swedish CPI

Source: Ccontinuum Economics

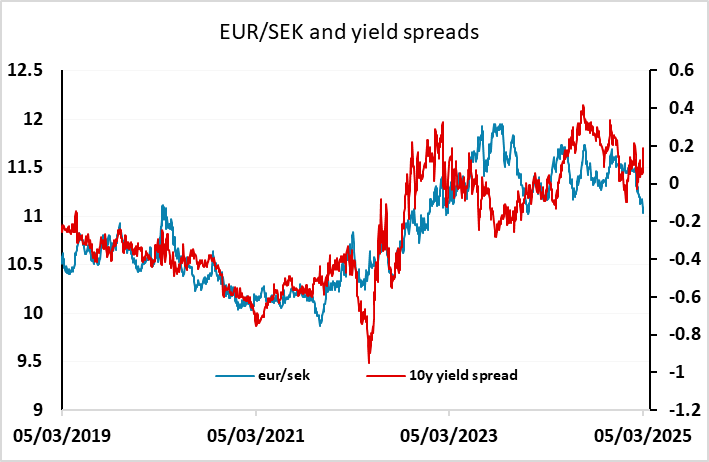

EUR/SEK has been declining steadily in then last couple of weeks, helped by a more positive take on the European economy and the stronger than expected 0.8% gain in Q4 Swedish GDP data that indicated that the Swedish economy is on an upward path. The SEK often benefits in periods of optimism about European growth, and is also favoured by hopes of a peace deal in Ukraine. But recent gains have exceeded the moves in yield spreads which it typically follows, and progress below 11 is likely to be more difficult.

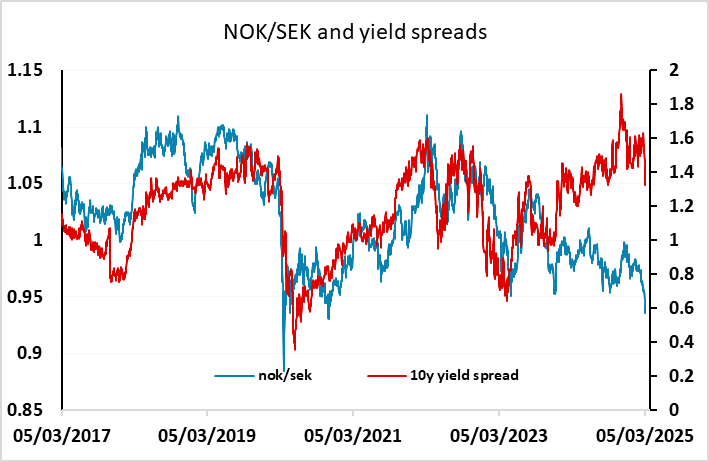

NOK/SEK continues to move lower and is testing the May 2020 low of 0.9260 which is the lowest level seen since the early 1990s excluding the immediate pandemic spike in March 2020. NOK/SEK disconnected from yield spread moves in 2024 and the NOK is now also suffering from worries about lower oil and gas prices. But it is nevertheless hard to see the case for such a low level in NOK/SEK, and longer term players will see current levels as a buying opportunity.