U.S. February Existing Home Sales - Unexpected bounce may be in part seasonal

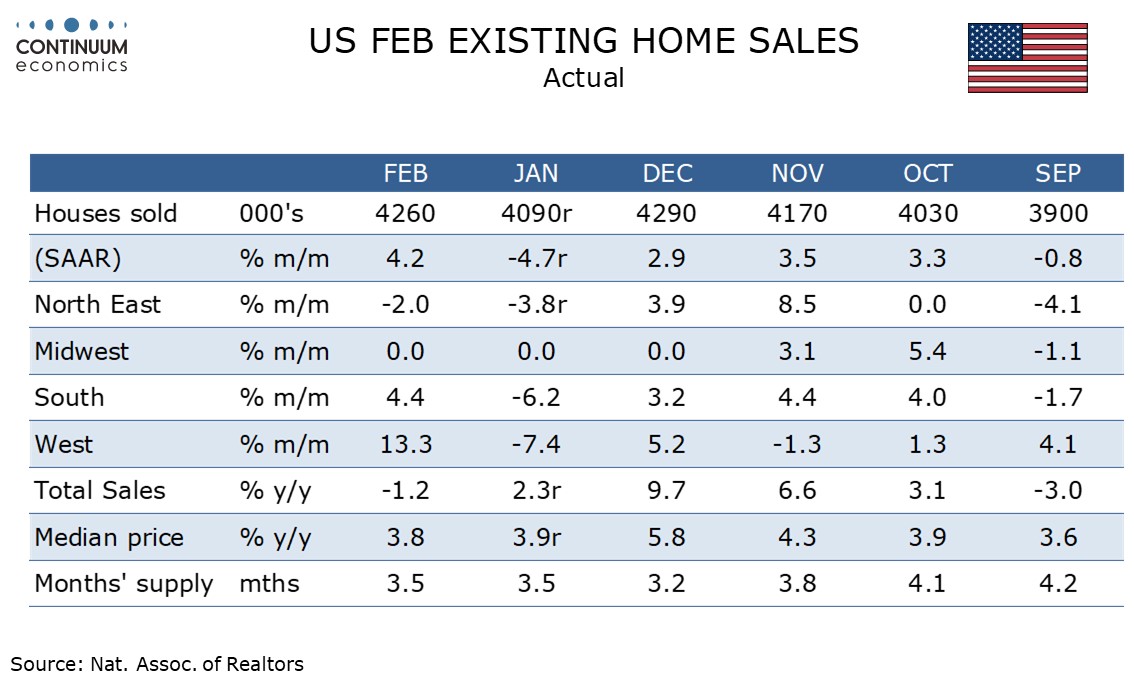

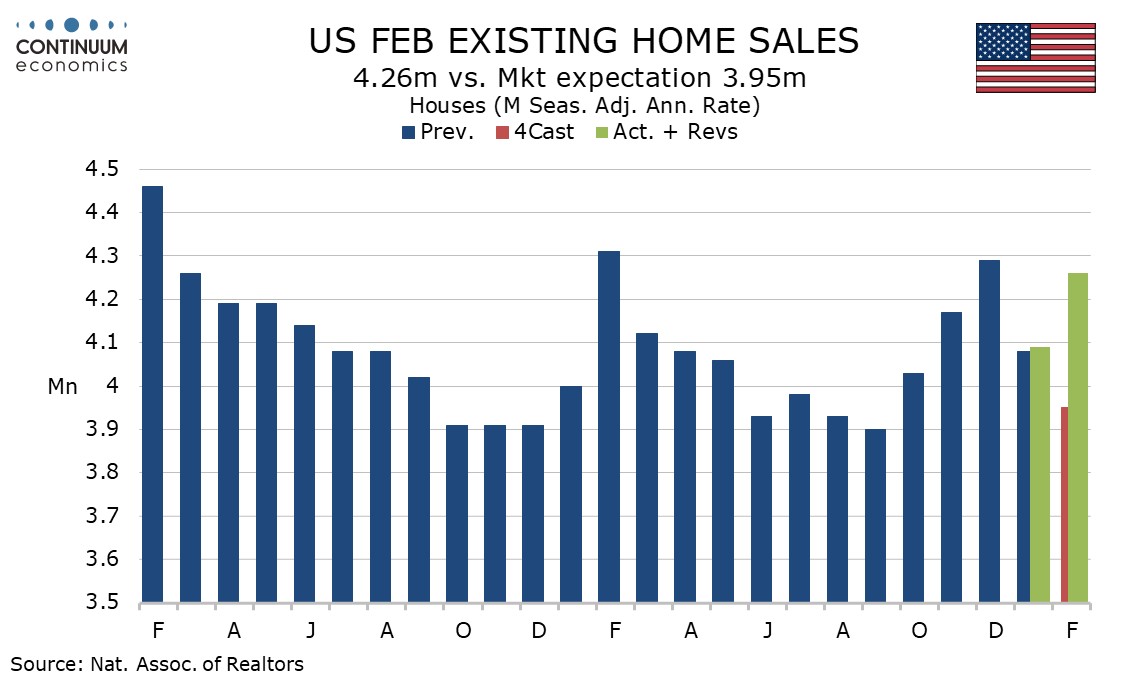

February existing home sales have seen a very unexpected 4.2% rise to 4.26m, contrasting the evidence of some surveys, though the decline does not quite fully erase a 4.7% fall in January.

There are a number of possible explanations for the surprise. January saw some bad weather, and mortgage rates have seen some recent declines. However the key factor may be seasonal. February saw very sharp gains in both 2023, by 9.3%, and 2024, by 7.8%. This February bounce is less sharp. Yr/yr data has turned negative, at -1.2%, versus a 2.3% yr/yr rise in January.

The data outperforms a record low level from January pending home sales, as well as weakness in the NAHB homebuilders’ survey that has extended into March. Regional detail shows a second straight decline in the Northeast, flat data in the Midwest fir a third straight month, but rebounds from January weakness in the South and West, with the West more than fully reversing its January decline. The median price saw a 1.3% rise on the month, but yr/yr data is little changed at 3.8% versus 3.9% in January.