This week's five highlights

FOMC eases by 50bps but otherwise not strikingly dovish

BoJ Keep Rates Unchanged

Explicit Gradualism From BoE

Norges Bank's Head Still in the Sand

UK Inflation Stable and Services Resilience

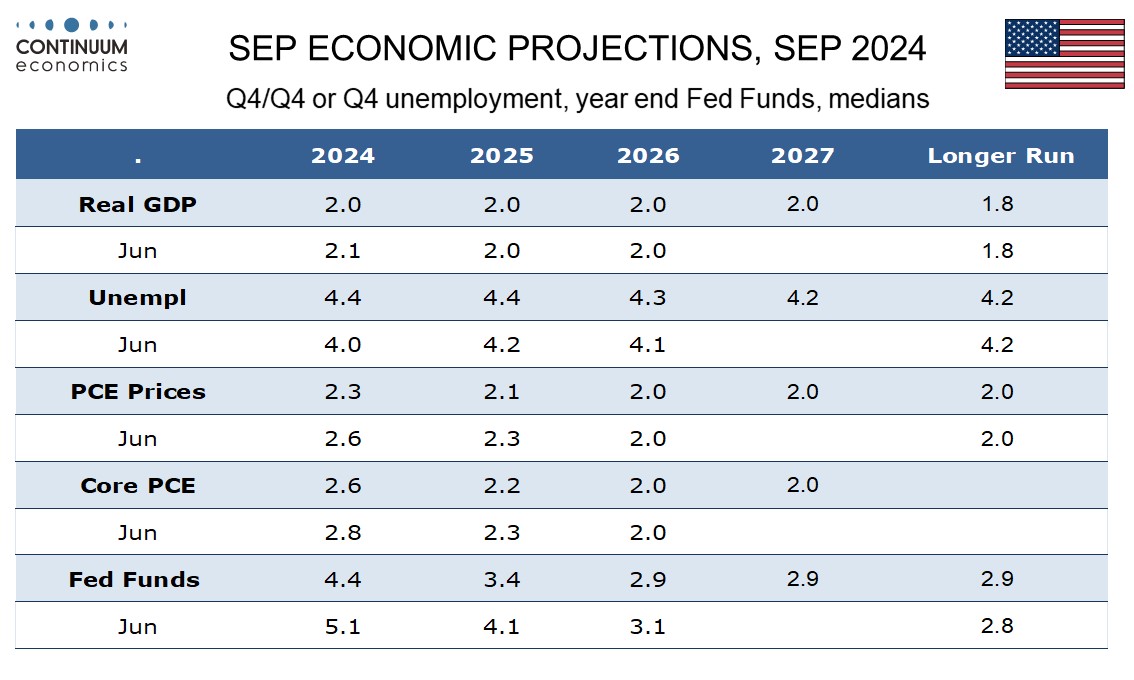

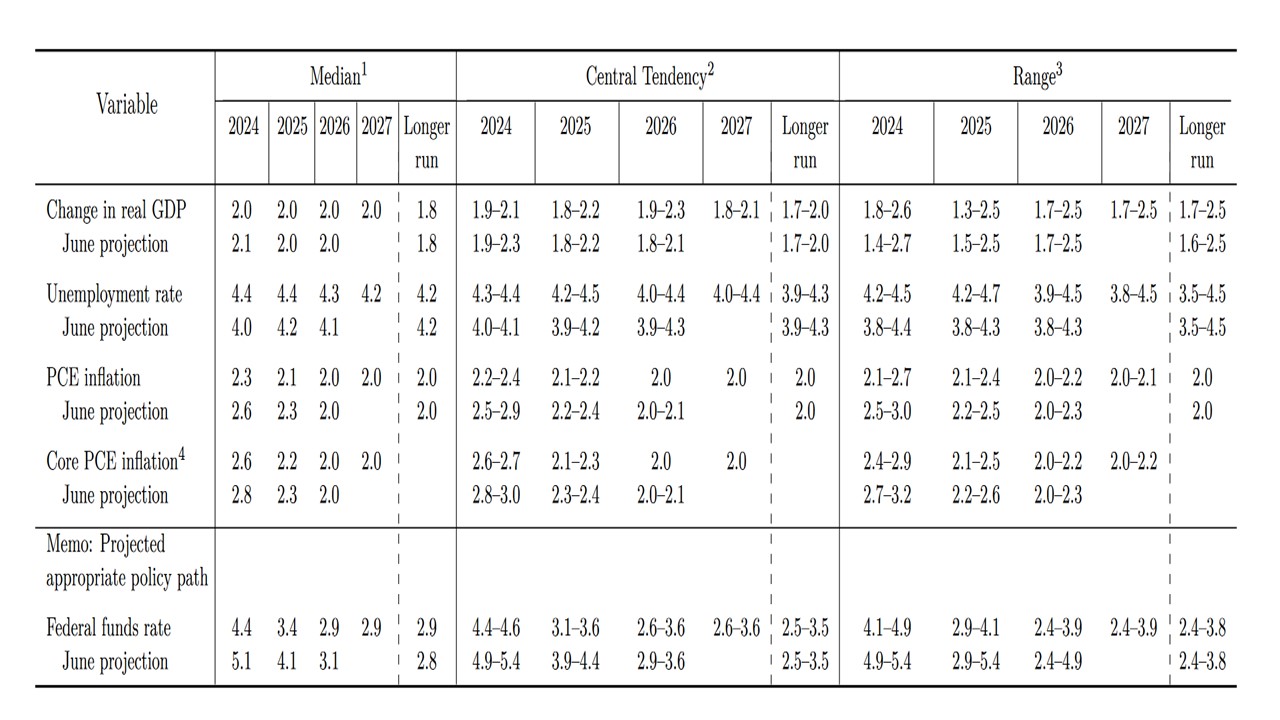

The FOMC has eased by 50bps with the dots looking for another 50bps this year (meaning 25bps at each remaining meeting) and a total of 100bps in 2025 (meaning only four 25bps moves). This would leave end 2025 rates at 3.25%-3.50%, still above a marginally upwardly adjusted neutral rate of 2.875%, which the dots assume will be reached in 2026.

The GDP view has hardly changed, seen at 2.0% through 2027 which is marginally above the longer run pace of 1.8%, and while the end 2024 unemployment rate has been raised to 4.4% from 4.0% (it is now 4.2%) no further increases are seen. PCE price forecasts have been revised down but not by much, with the core rate seen at 2.2% rather than 2.3% at end 2025 with the 2.0% target still seen being reached in 2026. The statement is not notably dovish, making only modest adjustments to the economic view and seeing risks to employment and inflation as roughly in balance. There was one hawkish dissent, from Governor Michelle Bowman who backed amore cautious easing of 25bps. The skew to the 2024 dots is upwards, with two seeing no more easing and seven seeing only 25bps, with nine on the median of 50bps and only one looking for 75bps (with none looking for two further 50bps moves).

The 50bps cut in the Fed Funds rate to 4.75-5.00% will likely be followed with two 25bps cuts in November and December. For 2025, we now look for 125bps rather than 150bps, given our soft landing view and also the 50bps being delivered at the September meeting. This would be a 3.00-3.25% Fed Funds rate and just above the revised long run estimate of 2.9%. However, if a harder landing is seen then we feel that the Fed would consider cutting to 2.50% or 2.00% depending on the scale of a slowdown i.e. stagnation versus mild recession.

At the September 20 meeting, the BoJ keep rate unchanged at 0.25% and guide there will be more tightening by suggesting the current inflationary trajectory aligns with BoJ's economic forecast in July 2024. The BoJ has taken a hawkish tilt in the July meeting by providing a hawkish forward guidance "If outlook for economic activity and prices are realised, will continue to raise policy rates and adjust degree of monetary accommodation accordingly" and did not repeat this line in the September statement. Instead, BoJ highlighted global economic development and domestic business' wage & price setting behavior as critical area to watch. They also mentioned that the impact of foreign exchange development towards domestic prices is increasing.

The July policy tilt has been viewed too hawkish even when headline inflation approaches 3% by us and a September hold makes more sense. As the underlying shows more cost driven than demand driven inflation, further confirmed by the weak retail trade and household consumption data. The September meeting could be viewed as a pit stop for the BoJ before they continue tightening. The move aligns with BoJ's forecast towards trend inflation and wages after y/y July CPI forecast spiked to 2.8% & August CPI reached 3% and Labor cash earning y/y continue to run above 2% at 3.6% y/y in July. Wage is still expected to experience accelerated growth above from the historic results from March's wage negotiation. Even if the average wage hike does not meet the historic sub five percent negotiate for large firms employees, a three to four percent wage growth would be sufficient to bring real wage to positive and stimulates consumption.

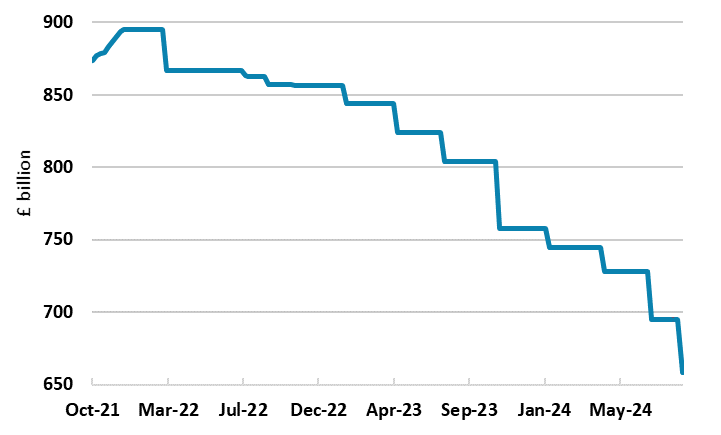

Figure: BoE QT Extended as Expected

The expected unchanged MPC decision came with what some may regard was a lack of any major dissent beyond that from arch-dove, Swati Dhingra. But that 8:1 vote is very much a reaction to the closeness of the MPC vote last month to cut Bank Rate by 25 bp to 5.0%. It is also preference from the MPC majority to pursue gradual easing, this laid out more formally this time around suggesting overtly that ‘a gradual approach to removing policy restraint remains appropriate’. This slightly more explicit policy guidance also reflects moderate differences within the MPC principally over how quickly current restrictive policy stance will temper underlying domestic inflationary pressures. Clearly, a further cut is on the cards for the November meeting which will have fresh forecasts which should reiterate the inflation undershoot projected in August. But that may now be the only further move this year but with over 100 bp of easing anticipated in 2025 when the MPC may be a little less ‘gradual’.

Indeed, in August, Bank Rate cuts to around 3.7% by 2026 saw an inflation outlook undershooting target at both the 2-year and 3-year forecast horizons, this showing the impact of a policy stance in restrictive territory is largely seen to have. But it is clear that the hawks on the MPC are more circumspect, their influence still palpable even with the loss of Haskel from their midst. This reflects what are clearly a range of views among MPC members. Firstly, there difference over the degree to which the unwinding of past global shocks, the normalisation in inflation expectations and the current restrictive policy stance would lead underlying domestic inflationary pressures continuing to unwind. Secondly, whether these pressures could prove more entrenched, possibly as a result of more structural factors or greater momentum in demand.

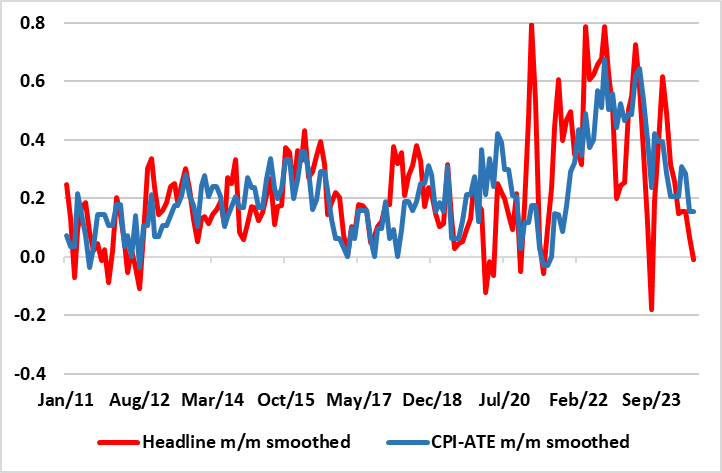

Figure: Inflation – What Inflation?

As with the five previous policy meetings, the Norges Bank kept its policy rate at 4.5% and equally unsurprising moderated its previous hawkish rhetoric - slightly. While it still fought against market expectations by suggesting policy will remain on hold until year end it did drop its recent stress of ‘policy to stay on hold for some time ahead’, instead noting that ‘the time to ease monetary policy is approaching’. The scheduled decision on Jan 23 looks set to see the first rate cut, although this is not fully consistent with the little-revised official policy outlook, which indicates a slightly faster decline through 2025. The Bank sees policy risks still seem balanced, despite a slightly disappointing mainland real economy backdrop and what have been broadly softer than (Norges Bank) expectations for CPI data of late, and where underling price dynamics are very weak (Figure). Even so, amid this slight change in its rhetoric, the (weak) krone is still at the center of its thinking. This to us seems very puzzling as a) this hawkish policy leaning has failed to bolster the currency and b) the weak currency has not prevented a marked fall in inflation encompassing much reduced imported price pressures d (Figure 2). We now see some 150 bp of rate cuts in 2025 – 50 bp more than the Norges Banks is advertising!

The Norges Bank last month noted uncertainty about future economic developments, but this was more a result based around the balance of risks stemming from developments in the krone exchange rate and the potential implications for inflation. But possibly advertising that a change of thinking was then under consideration, the Board highlighted then that it will have received more information about economic developments ahead of this next looming monetary policy meeting especially as new forecasts will be presented.

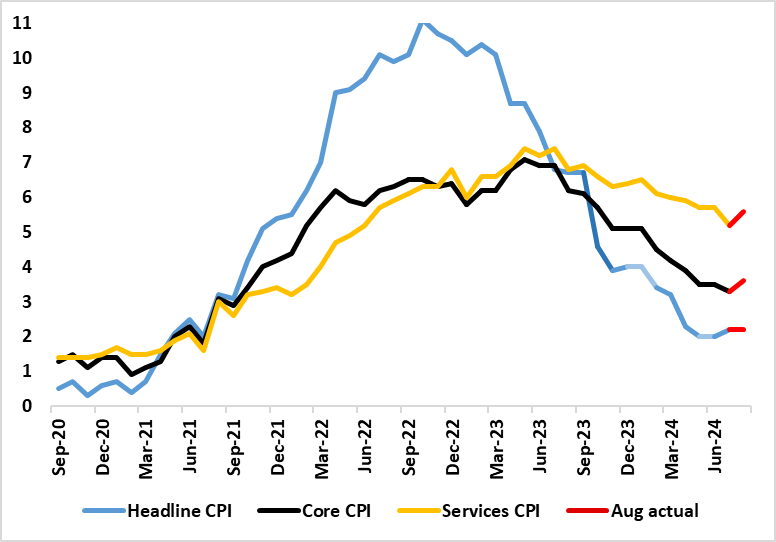

Figure: Mixed Inflation Signs?

The July CPI was notable for the clear and larger-than-expected fall in services inflation, one driven by a fall in restaurant/hotel inflation, this often seen as a bellwether indicator of price persistence. The August data showed mixed signs on such a basis. Indeed, services inflation rose back 0.4 ppt to 5.6%, up from a two-year low but still below the BoE projection and was almost solely driven by a swing in (very volatile) airfares without which services would have fallen (well) below 5% - this also accounting for the rise in the core rate. Indeed, the core would have fallen (well) below 3% without airfares. Moreover, restaurant inflation hit a new cycle low amid generally softer price pressures in which eight (of 12) CPI components fell. As a result, the overall CPI headline rate stayed to 2.2% in August this chiming with the consensus and two notches under BoE thinking. The data (especially ex-volatile services) do not rule out a further rate cut at tomorrow’s MPC decision, but what may be key will be rhetoric and the closeness of the vote – it may see at least 2-3 dissents in favor of further immediate easing!

As for underlying trends, the core rose from 3.3% in July (Figure 1), the lowest in almost three years and adjusted m/m data suggest a clear slowing short-term price dynamics. There were always risks to the August numbers as a good part of the July services price inflation was due to so-called volatile items which did reverse in July and this was unwound in August. But as for upcoming inflation data, airfares may drop back and the fall in oil prices now evident could see the headline rate drop back in September numbers and move further below BoE projections.