Preview: Due July 25 - U.S. June Durable Goods Orders - Trend still close to flat

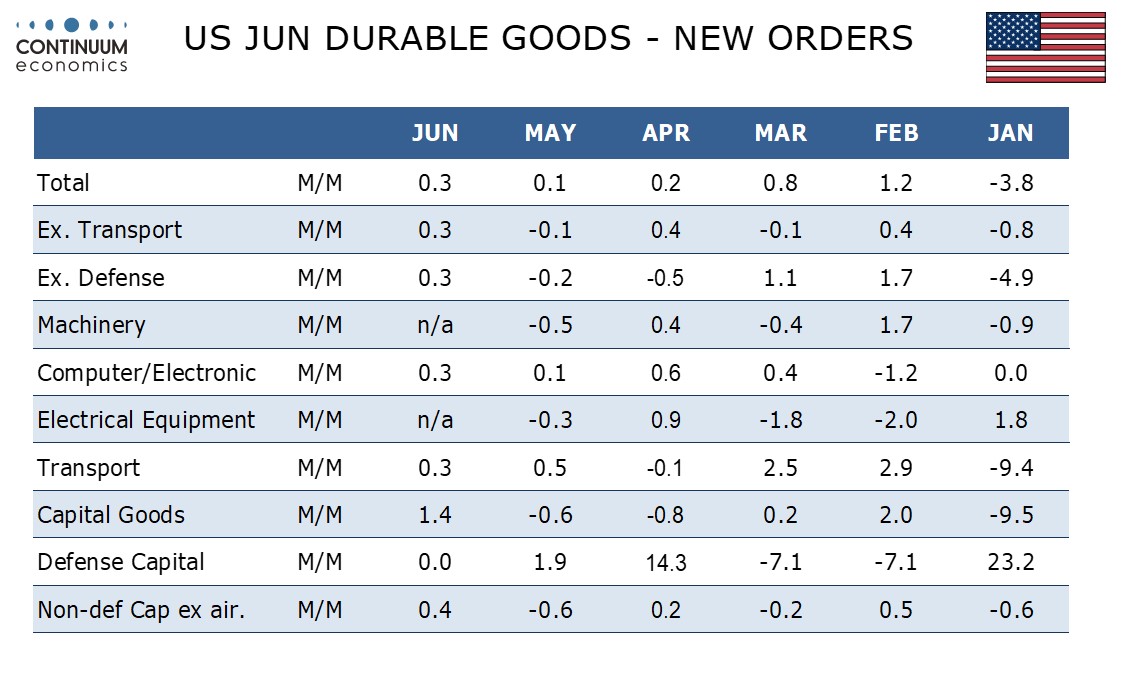

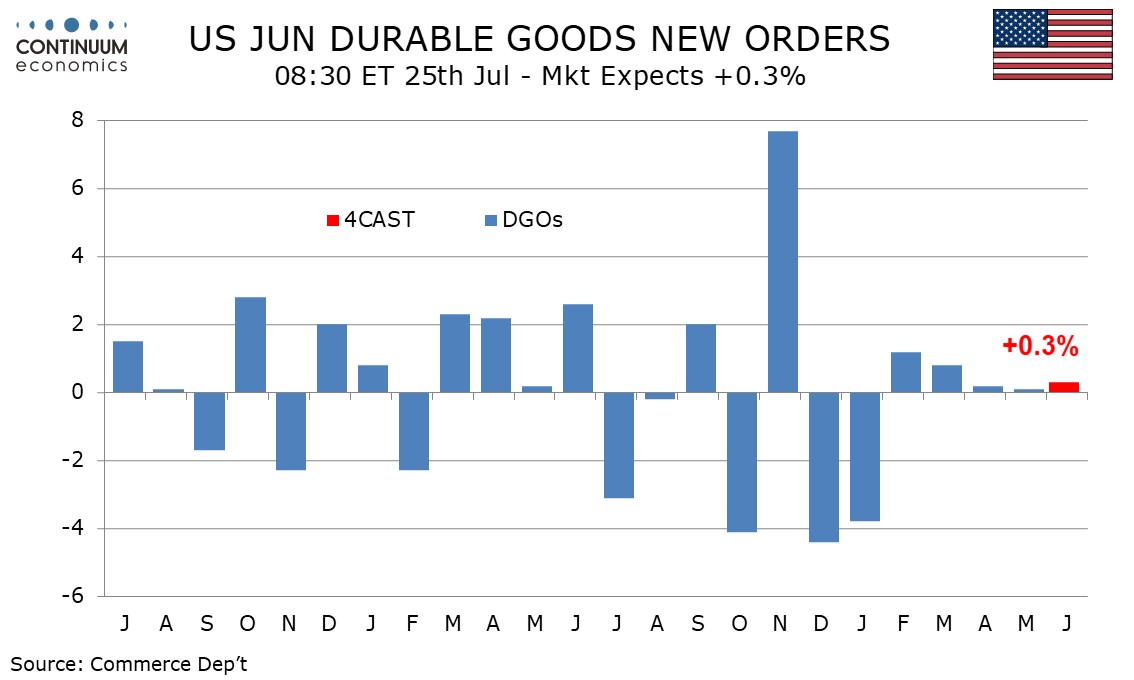

We expect June durable orders to increase by a modest 0.3% overall, ex transport and ex defense, following May data in which overall orders rose by 0.1% but ex transport fell by 0.1% and ex defense fell by 0.2%. This would keep trend close to flat.

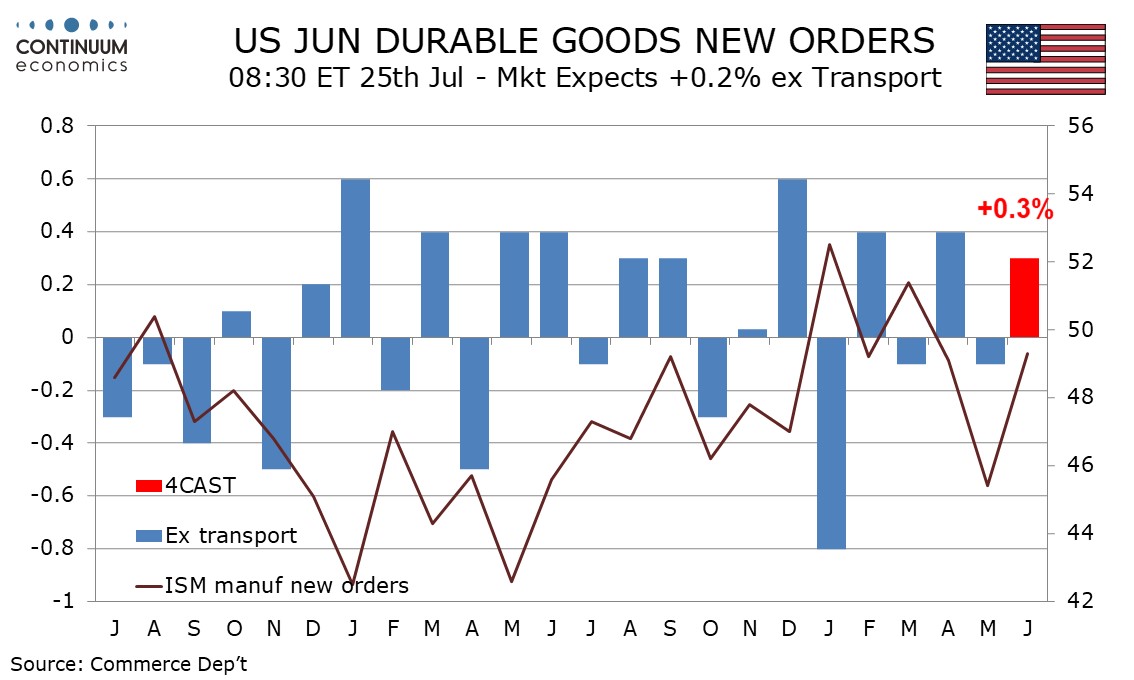

This would mark a twenty-ninth straight month in which the ex transport series has moved by less than 1.0% in either direction. With ISM new orders correcting from a weak May we expect ex transport data to recover from May’s marginal decline, though the ISM new orders index did not quite reach neutral.

We expect transport to see a marginal positive from aircraft as suggested by Boeing data but a correction lower in autos where recent orders data has been outperforming sales. We expect a neutral contribution from defense, which has a large overlap with transport.

We expect non-defense capital orders ex aircraft, a key indicator of business investment, to rise by 0.4%, slightly outperforming the ex transport data after May underperformed with a 0.6% decline. Trend in this series is also close to flat.