Preview: Due October 3 - U.S. September ISM Services - Stable and slightly positive

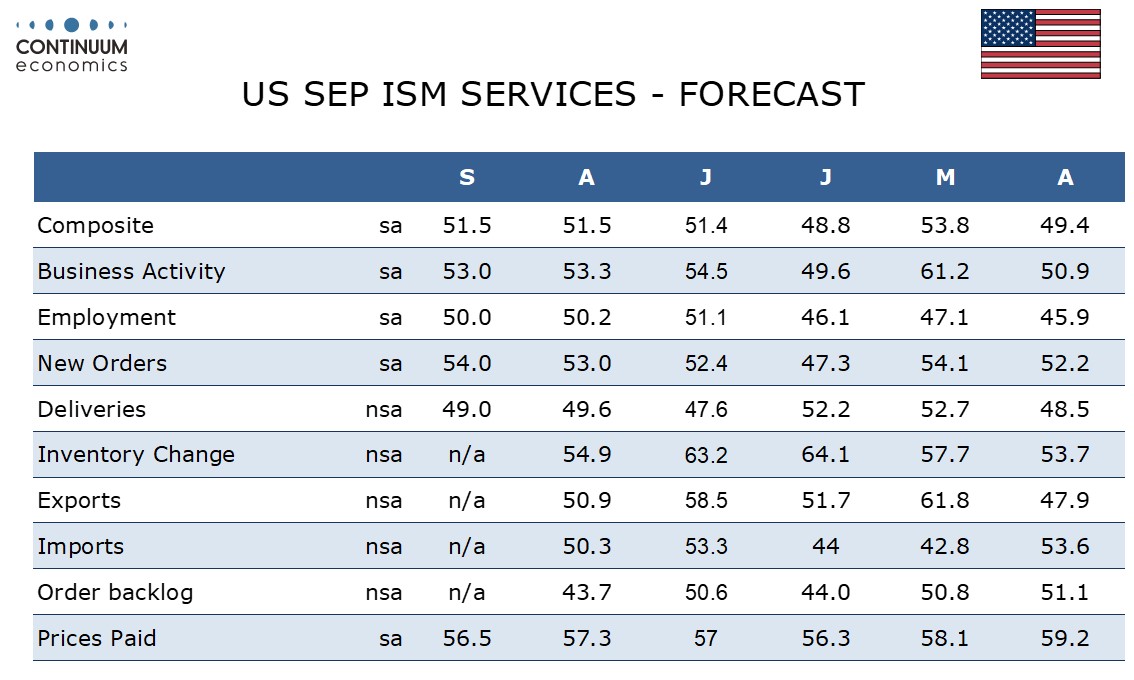

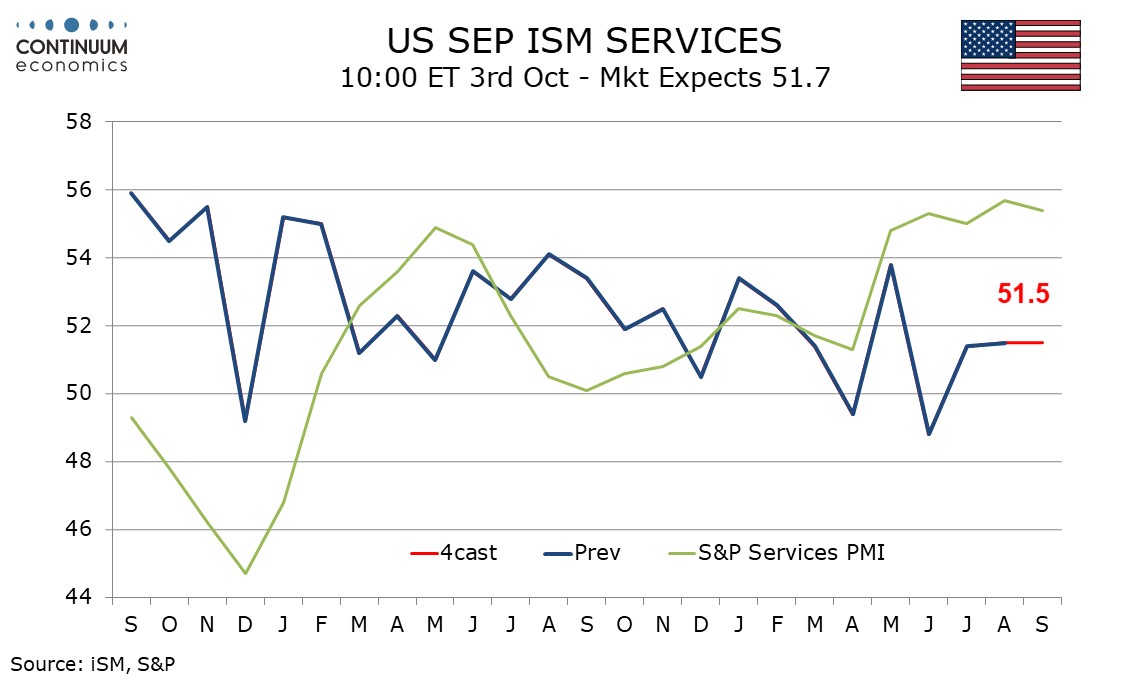

We expect September’s ISM services index to be unchanged from August’s reading of 51.5, and also almost unchanged from July’s 51.4, and implying only a modest pace of expansion through Q3.

A stable pace is probably a more important signal than a continued strong level from the S and P services PMI, with the S and P index looking more sensitive to prospects for lower rates. Regional Fed service sector surveys have been mostly subdued, though those from the Philly and Richmond Feds were significantly less negative, arguing against deterioration in the ISM services index.

Looking at the four components that make up the ISM services composite, we see new orders slightly firmer at 54.0 from 53.0, supported by seasonal adjustments, but marginal slippage in business activity to 53.0 from 53.3, employment to 50.0 from 50.2 and deliveries to 49.0 from 49.6. Prices paid do not contribute to the composite. Here we expect a modest slowing to 56.5 from 57.0, but trend has little direction.