GBP flows: GBP edges lower after labour market data

UK labour market data mixed but GBP slightly lower, perhaps focusing on the rise in the unemployment rate. But stronger than expected average earnings data may be more significant and could prevent a BoE rate cut in December

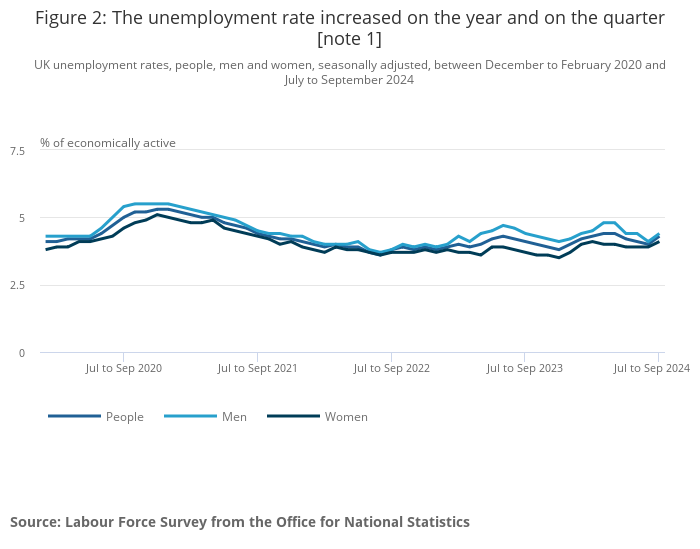

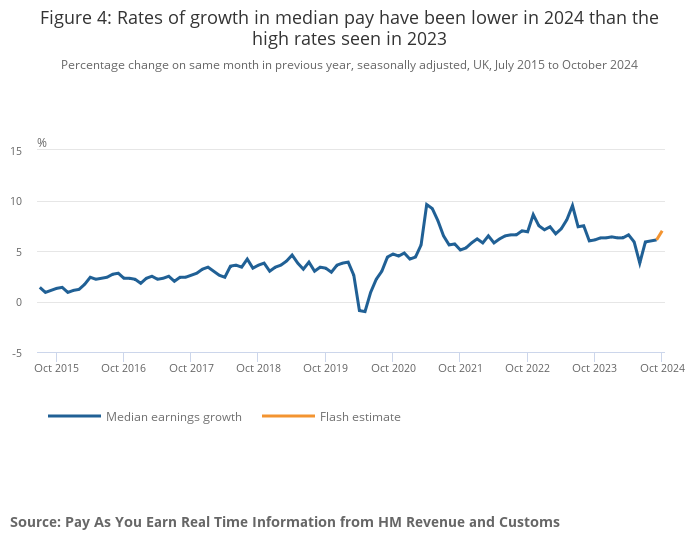

GBP has edged a little lower after the mixed UK labour market data, even though the data was on balance slightly on the strong side of expectations. The official ONS data is less up to date than the HMRC data, but shows stronger than expected average earnings growth in the 3 months to September at 4.3% including bonuses and 4.8% excluding bonuses (medians 3.9% and 4.7%). However, the unemployment rate rose to 4.3% from 4.1% (4.1% expected), and employment growth was slightly weaker than expected at 219k (290k expected). The provisional HMRC data for October showed a 5k decline in payrolled employment, which remains broadly steady on the year, but showed stronger than expected earnings growth at 7.0% y/y.

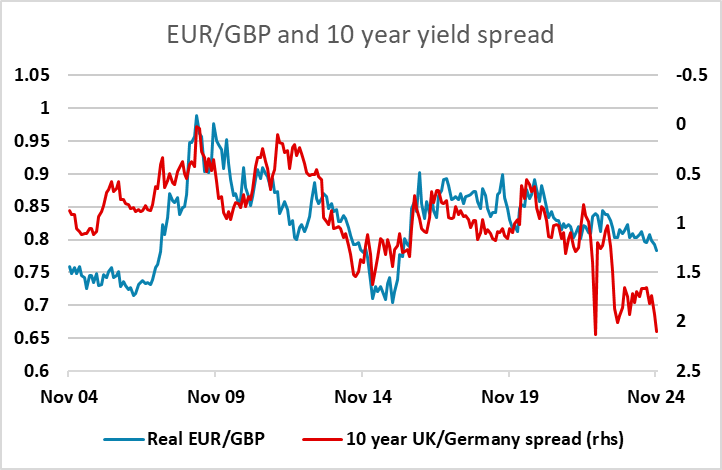

The (modest) decline in GBP after the data suggests the market is focusing on the rise in the unemployment rate, but this has been choppy in recent months and it looks fair to describe it as basically stable. The stronger than expected earnings data looks more likely to attract the BoE’s attention and should prevent a BoE rate cut in December. EUR/GBP should consequently hold below 0.83 and may edge lower if we see some sort of recovery in risk sentiment over the day. Early softness in equity markets is also tending to weigh on GBP and the other higher yielders.