AUD, JPY, NOK, SEK flows: AUD slips with Chinese equities

AUD lower as Chinese equities reverse recent gains after Golden Week. JPY edging higher, SEK to come under pressure.

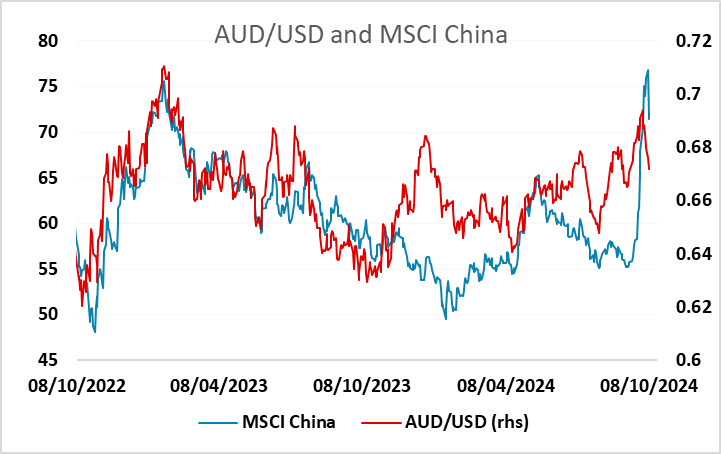

The main news overnight was the sharp decline in Chinese equities after the return from Golden Week. Futures had risen steadily over the previous week while the cash market was closed, but these gains were largely erased. The decline undermined the AUD, but otherwise there was little FX movement overnight.

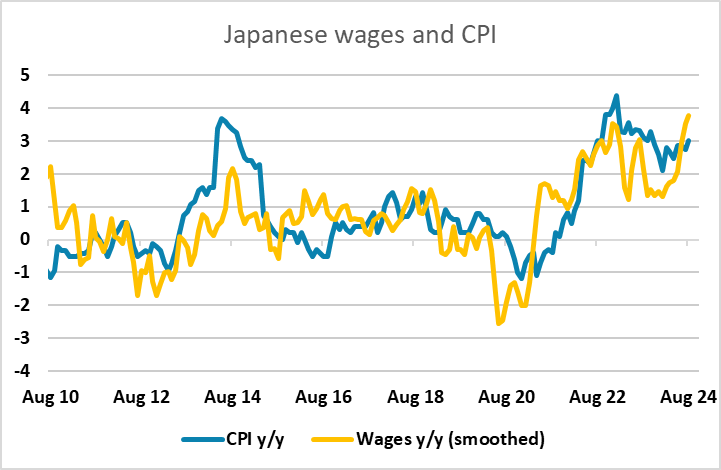

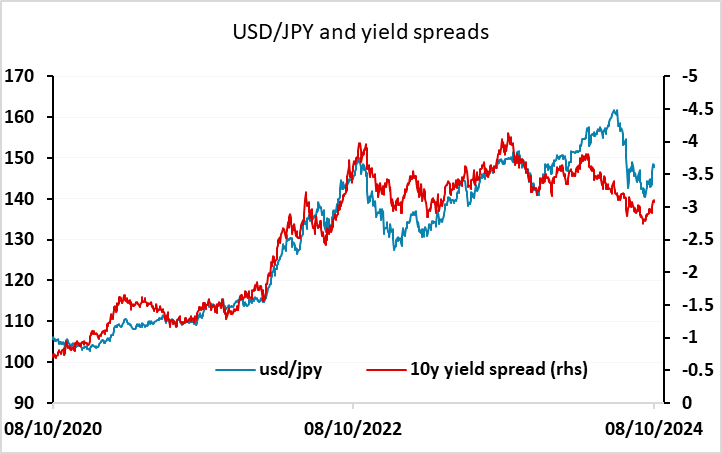

The Japanese cash earnings data came in as expected at 3.0% y/y, which represented a modest softening in the y/y rate, but the previous two months were stronger so on a smoothed basis wage growth is still picking up. The JPY was unaffected, but with household spending also stronger than expected at 2.0% m/m in August, the data still suggests scope for BoJ tightening in December, even though the recent comments from Ueda and Ishiba suggest that an October move is unlikely. The JPY was not much changed, but is edging a little higher early in Europe helped by the softer global equity tone due to the Chinese equity decline and consequent decline in yields in the US and Europe.

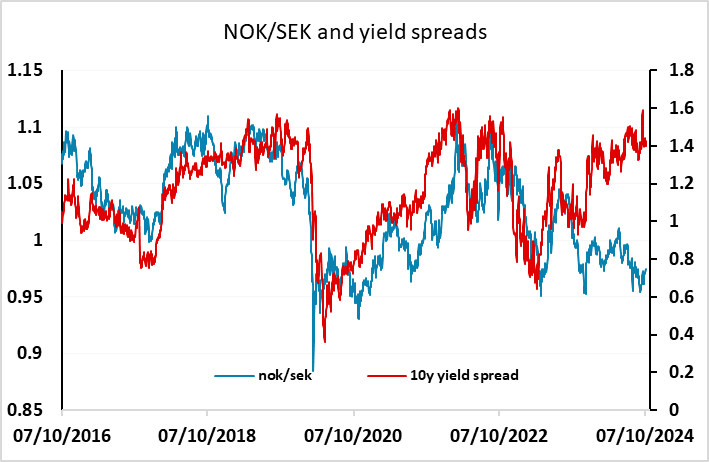

This morning’s flash Swedish CPI data for December has come in in line with expectations at 0.2% m/m and 1.6% y/y. This still supports further aggressive easing from the Riksbank, and the market continues to price in a 50% chance that the Riksbank cuts 50bps in November. We still see scope for NOK/SEK gains with spreads likely to widen further in the NOK’s favour, and Middle East tensions likely to continue to support the oil price.