USD flows: USD gains on stronger employment cost index

Employment cost index pushes US yields and the USD higher

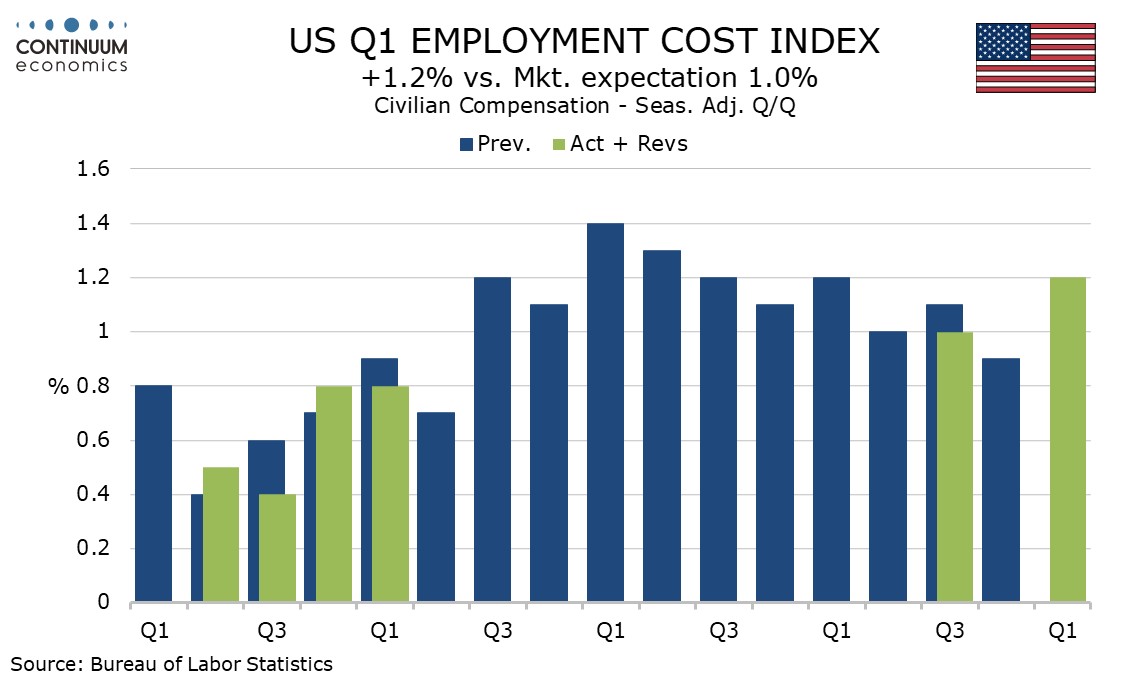

The Q1 Employment Cost Index with a 1.2% increase is stronger than expected and like Q1 inflation data, breaks a trend of gradual slowing seen in late 2023 to produce a renewed acceleration, rising by its most since Q1 2023. The data will add to Fed inflationary concerns as its starts its meeting. Given the matching rise in Q1 2023, yr/yr data is unchanged at 4.2% though wages and salaries did pick up to 4.4% from 4.3% while benefits slowed to 3.7% from 3.8% (before seasonal adjustment).

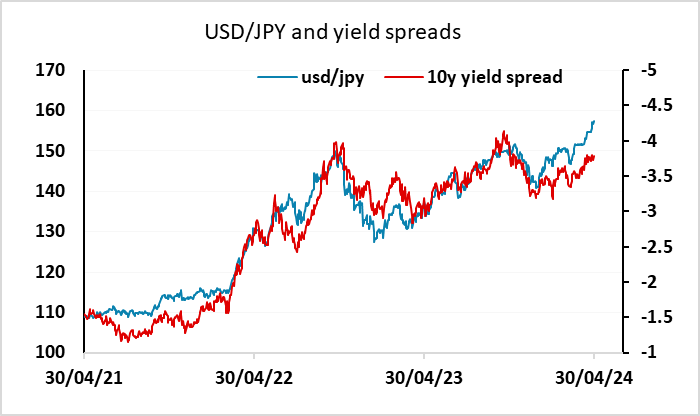

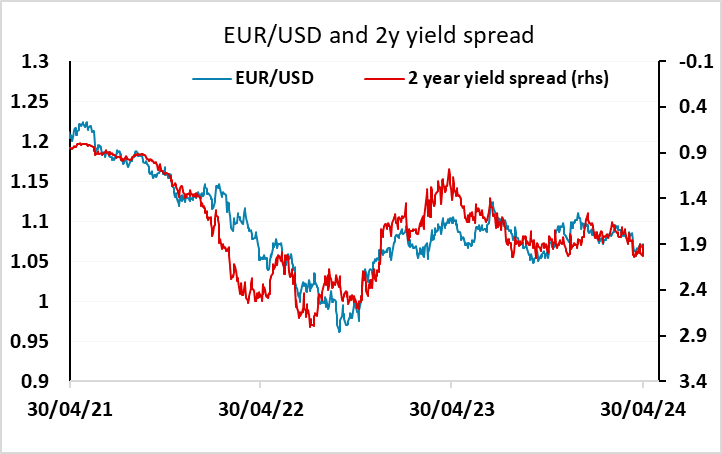

The result is another 5bps on UD yields up to 10 years, and a decline in equities. The USD is generally stronger, but particularly against the JPY, with European yields generally keeping pace with the rise in the US. There isn’t much net impact on equity risk premia, so we doubt the rise in EUR/JPY will last, especially given the intervention threat. But in the short term this is an excuse to test the BoJ’s resolve, so USD/JPY may well have scope up to 158 or beyond.