USD flows: USD surges on strong employment report

US employment report generally strong. USD up 0.5% across the board except against the CAD as the Canadian employment report shows similar strength

Another strong employment report has sent the USD higher across the board, with the CAD being the exception as the Canadian employment report shows similar strength. The 256k rise in payrolls exceeded expectations by 92k, with just a net 8k of downward to revisions to offset. The unemployment rate also fell to 4.1%. A slight offset was the 0.3% rise in average earnings with the y/y growth of 3.9% a touch below consensus.

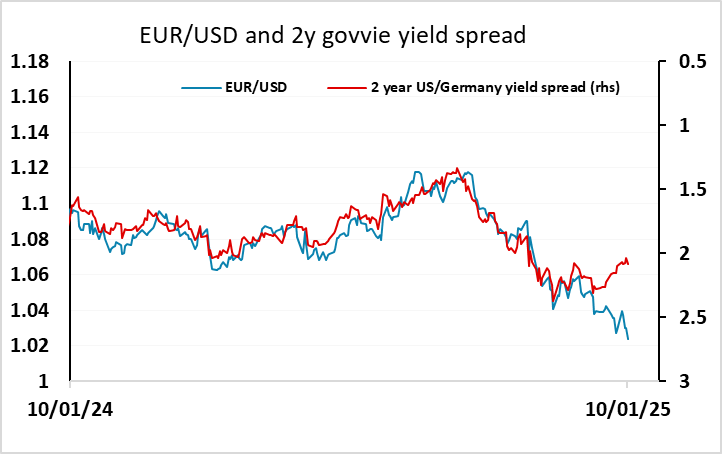

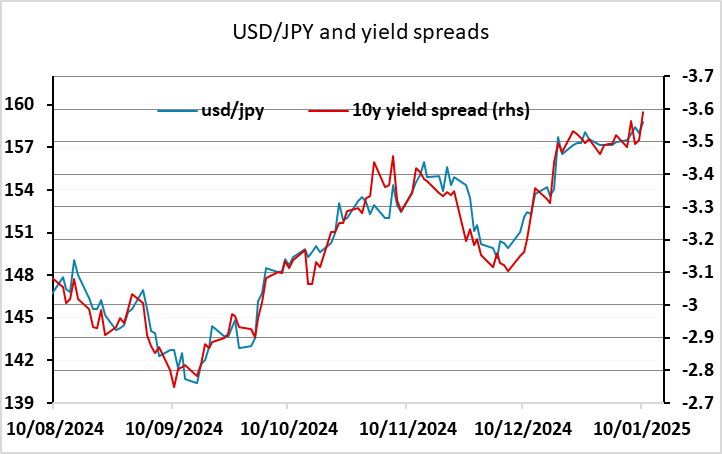

US yields are generally up strongly, and there is now no rate cut fully priced into the US curve before September. This looks a little overly hawkish, as at the December meeting the median expectation from the Fed was 50bps of easing over the year, but it will require some evidence of weaker growth if the market is to back away from the more hawkish view. Nevertheless, it does make it hard for US yields to rise a lot further form here this side of the FOMC and a more hawkish statement. As it stands, USD/JPY looks to have potential to 159 based on the recent yield spread correlation, but spreads are still not really supportive of further EUR/USD losses. While equity markets are a tad lower after the data, risk premia are if anything lower given the rise in yields, suggesting the JPY will struggle on the crosses.

The Canadian unemployment rate came in at 6.7%, down a touch after the sharp rise to 6.8% in November, and the 90.9k rise in employment is even more impressive than the US rise given the relative populations. Canadian yields have consequently matched he rise in US yields, and USD/CAD has risen only very modestly, while the USD is up around 0.5% elsewhere.