USD flows: Mixed US data, JPY could benefit

Mixed Us data but initial claims rise may be most significant. If so, JPY favoured

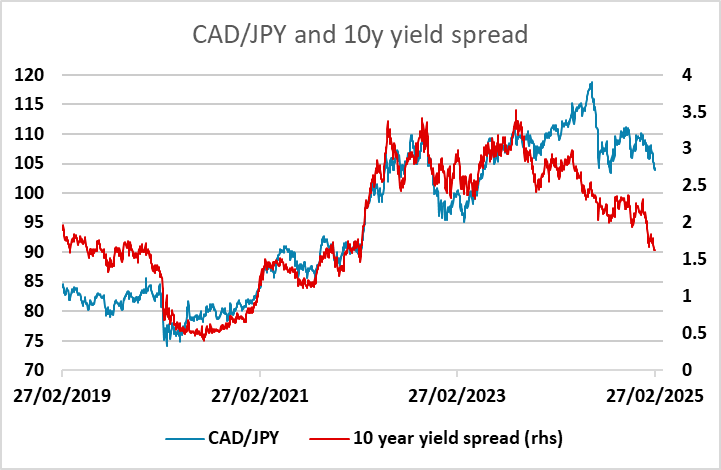

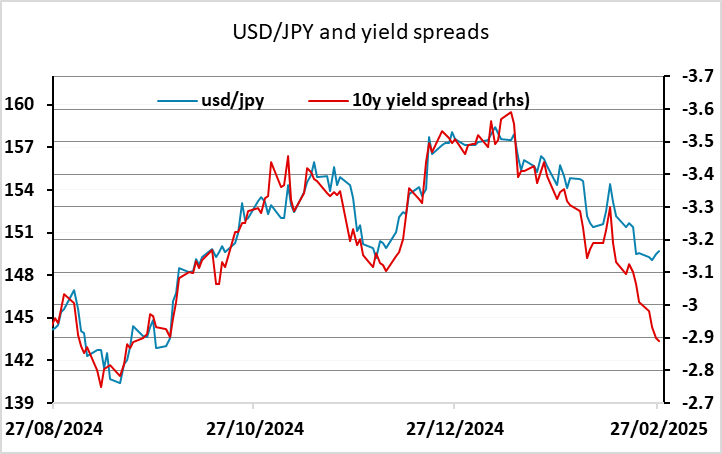

Mixed US data has had little immediate USD impact. Q4 GDP was unrevised but the price index for Q4 was revised slightly higher, while durable goods orders for January were stronger than expected don the headline but the core was a touch below consensus. Initial claims were higher than expected and at 242k, equalling the highest since October and may have been affected by weather, but probably more by DOGE. While there has been little immediate market reaction, we would see the claims numbers as potentially the most significant, so see a mild USD positive and risk negative bias. USD/JPY remains the pair that looks most obviously ripe for USD declines, but if the market sees the data as USD positive and risk negative, EUR/JPY or CAD/JPY may be more vulnerable near term.