U.S. May S&P PMIs - Gains follow reduction in tariffs on China

May’s preliminary S and P PMIs are unexpectedly improved, both manufacturing and services at 52.3, up from 50.2 and 50.8 respectively in April. The gains may reflect reduced trade risks after the cut in tariffs on China.

.

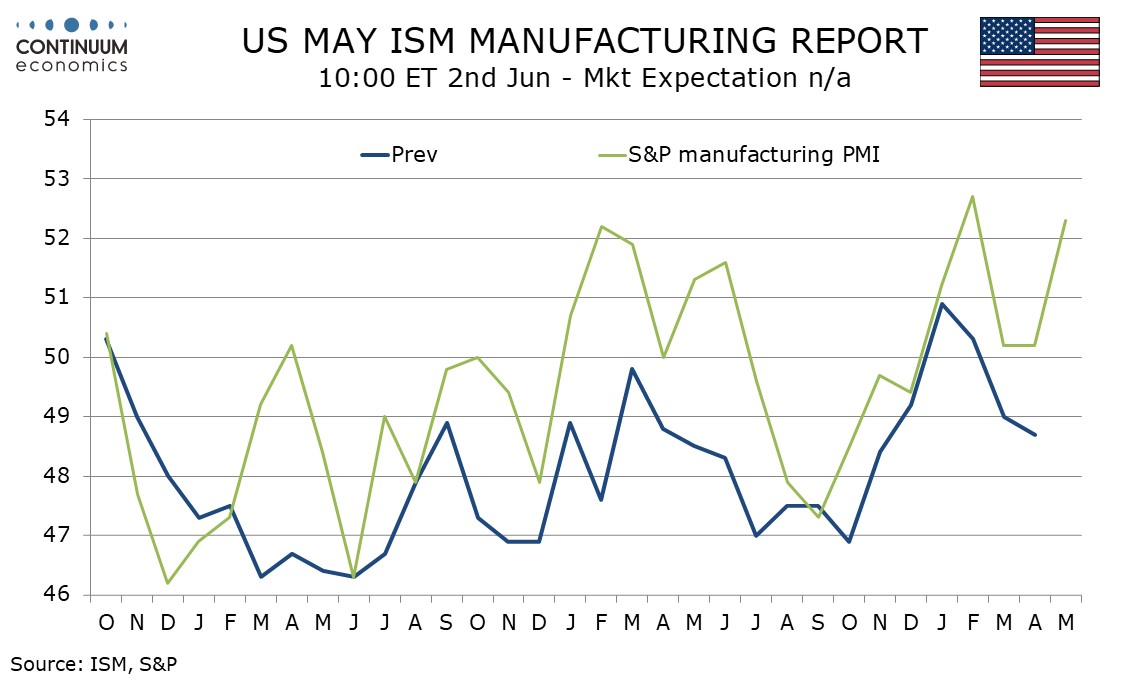

The manufacturing increase follows a stable April that outperformed weaker outcomes from most manufacturing surveys, and hence the surprise in this month’s gain. However May Empire State and Philly Fed surveys showed some improvement in their details, so this suggests some improvement in ISM manufacturing data is likely.

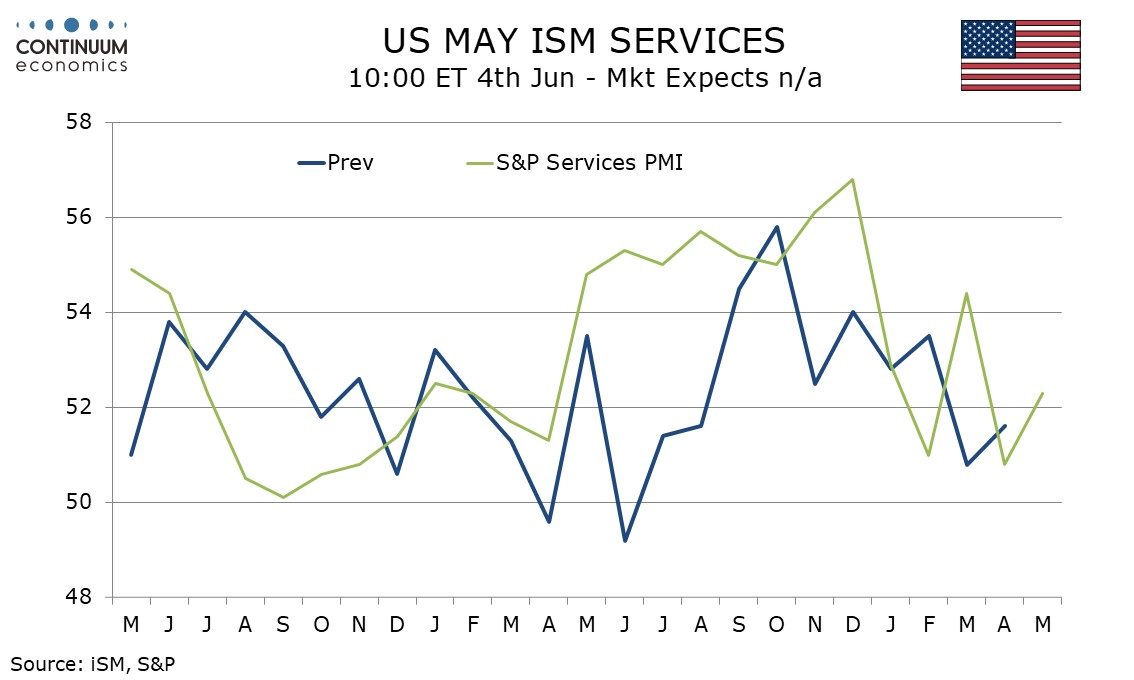

The bounce in the services index is modest and fails to fully reverse a decline seen in April, while each month of 2025 to date is weaker than the last eight in 2024. The gain is not sufficient to suggest much improvement in the ISM services index, though in remaining above 50 suggests we are not falling into a recession.