Published: 2024-02-27T16:26:12.000Z

Preview: Due March 5 - U.S. February ISM Services - Slipping from a stronger January

Senior Economist , North America

-

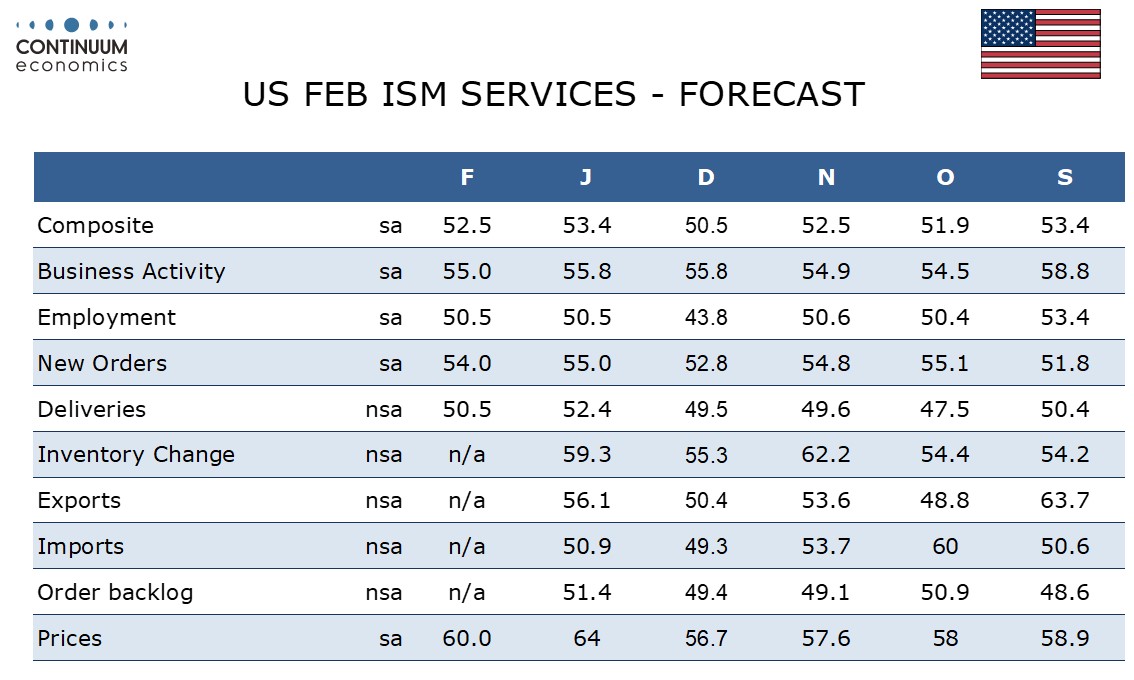

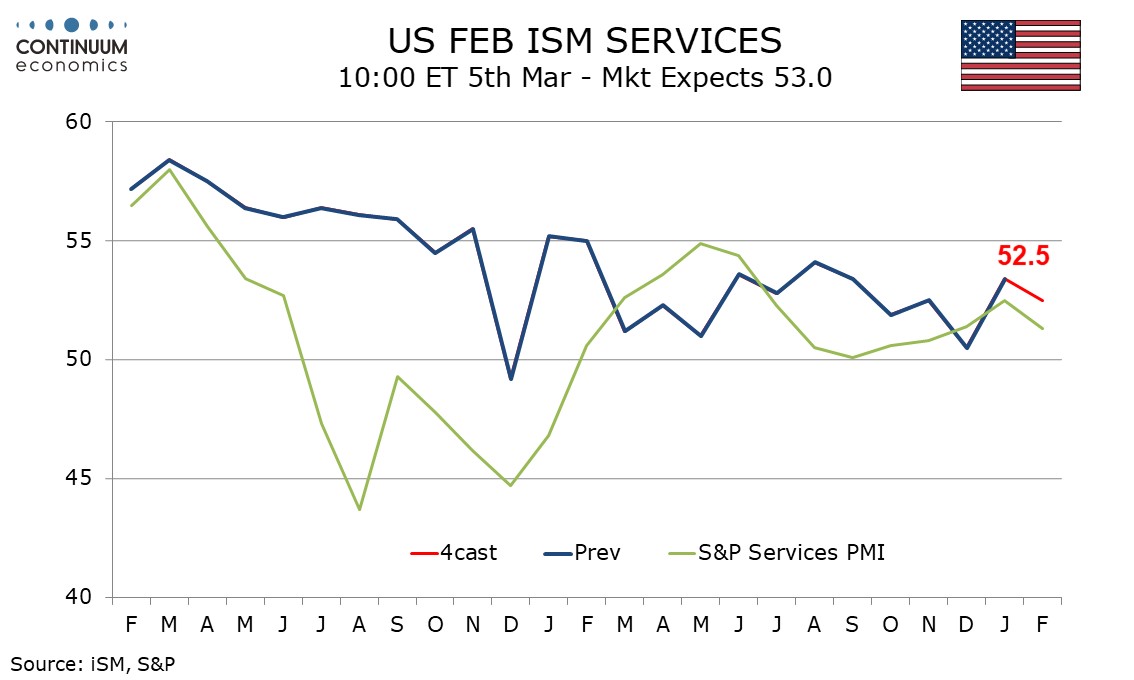

We expect February’s ISM services index to slip to 52.5 from January’s stronger reading of 53.4, putting the index back at November’s level which preceded a weaker 50.5 in December.

The S and P services index slipped after four straight gains, probably in response to rising bond yields, but is not a reliable guide to ISM services data. The Philly Feds service index slipped in February and re Richmond Fed index slowed significantly, though the Dallas Fed services index turned positive.

We expect slippage in three of the four components that make up the ISM services component, the exception being employment which we see unchanged, after a January bounce that represented a return to end after a very weak December. We expect modest slippage in new orders and business activity, and more significant slippage in deliveries after a January bounce that moved well above the preceding trend. Prices paid do not contribute to the composite. Here we also expect a correction from an above trend January, to 60.0 from 64.0, still above December’s 56.7 reading.