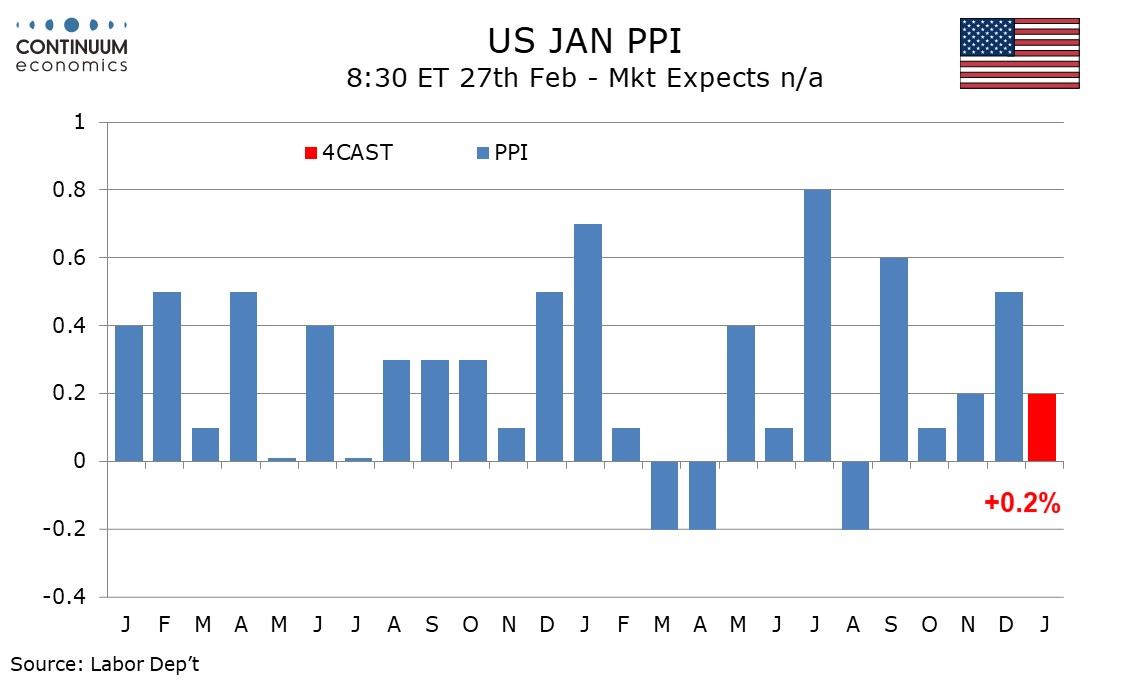

Preview: Due February 27 - U.S. January PPI - Slower than a strong December, but trend still quite firm

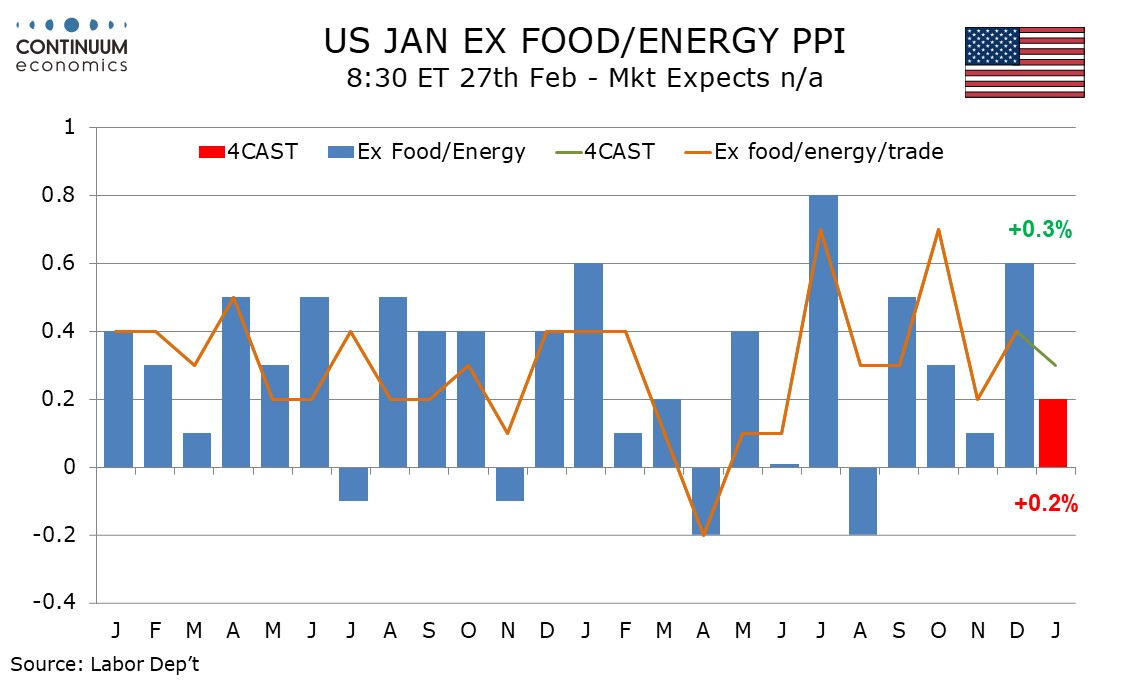

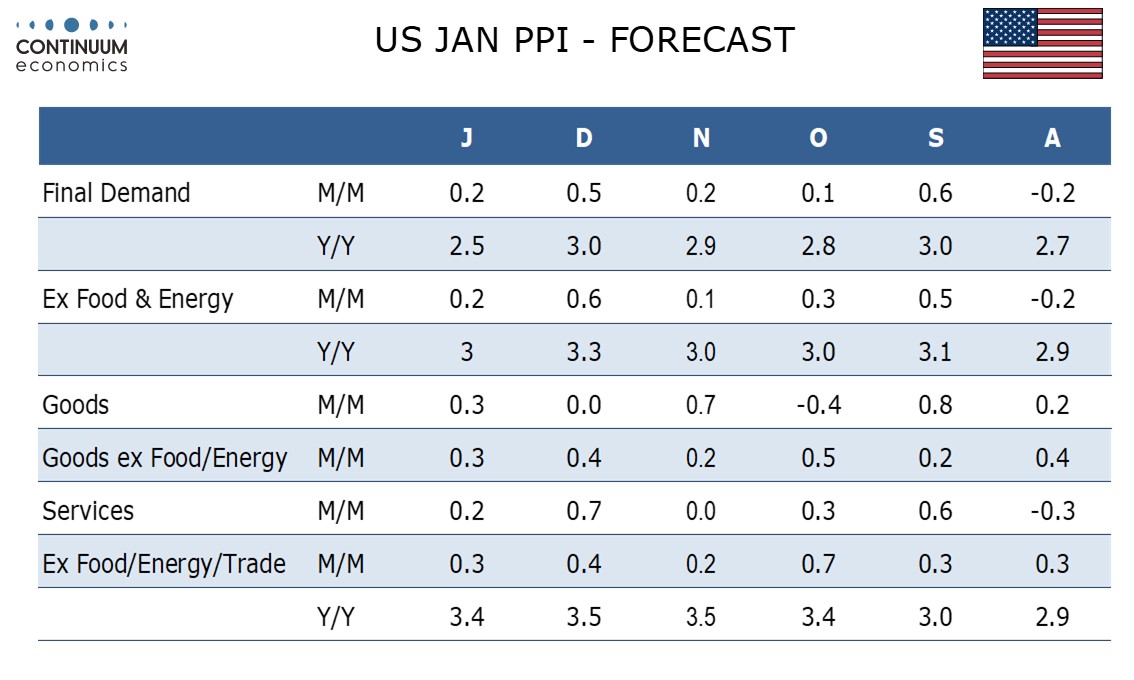

We expect PPI to rise by a slower 0.2% in January both overall and ex food and energy, after strong respective gains of 0.5% and 0.7% in December. The slowing will be largely in trade, though ex food, energy and trade we expect a rise of 0.3%, slightly slower than December’s 0.4%.

We expect gains of 0.3% in food and 0.5% in energy after both declined in December, but these gains will not be quite enough to lift the headline above the 0.2% ex food and energy rate.

We expect goods PPI ex food and energy to rise by 0.3% after a 0.4% increase in December. Trend has been accelerating modestly, with the last six months having seen four gains of 0.4% or above and two at 0.2%, while the first six months of 2025 saw four gains of 0.3% and two of 0.2%, while trend in 2024 was slightly below 0.2% per month. The acceleration is likely due to tariffs, and there may be more to come, though trend still appears to be fairly close to 0.3% [er month.

Services rose by 0.7% in December lifted by a 1.7% increase in trade which followed losses of 0.6% in November and 0.8% in October. Trade is volatile and is likely to slip back a little in January, restraining overall services PPI to a 0.2% increase, but underlying trend in services also seems to be running around 0.3% per month, signs of a slowing in mid-2025 having faded. This is a cause for concern with services less sensitive to tariffs, meaning early 2026 data should be watched closely.

We expect slower yr/yr growth given a strong January 2025, most significantly for overall PPI, which we see at 2.5%, the slowest since June, from 3.0% in December. We expect ex food and energy PPI to return to November’s pace of 3.0% after a bounce to 3.3% in December. Ex food, energy and trade however the slowing will be marginal, to 3.4% after two straight months at 3.5%. This will remain well above the 2025 low of 2.6% seen in June.