Preview: Due November 3 - U.S. October ISM Manufacturing - Firmer but still short of neutral

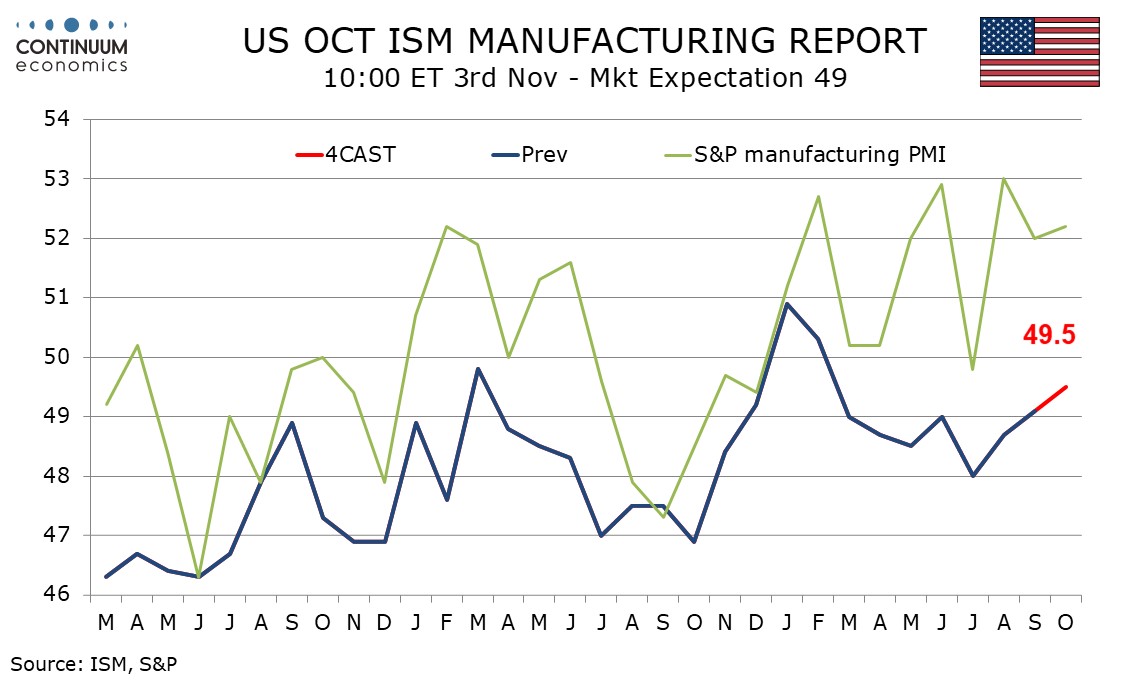

We expect October’s ISM manufacturing index to see a third straight increase to 49.5, from 49.1 in September, reaching its highest level since February, if still marginally below the neutral level of 50.

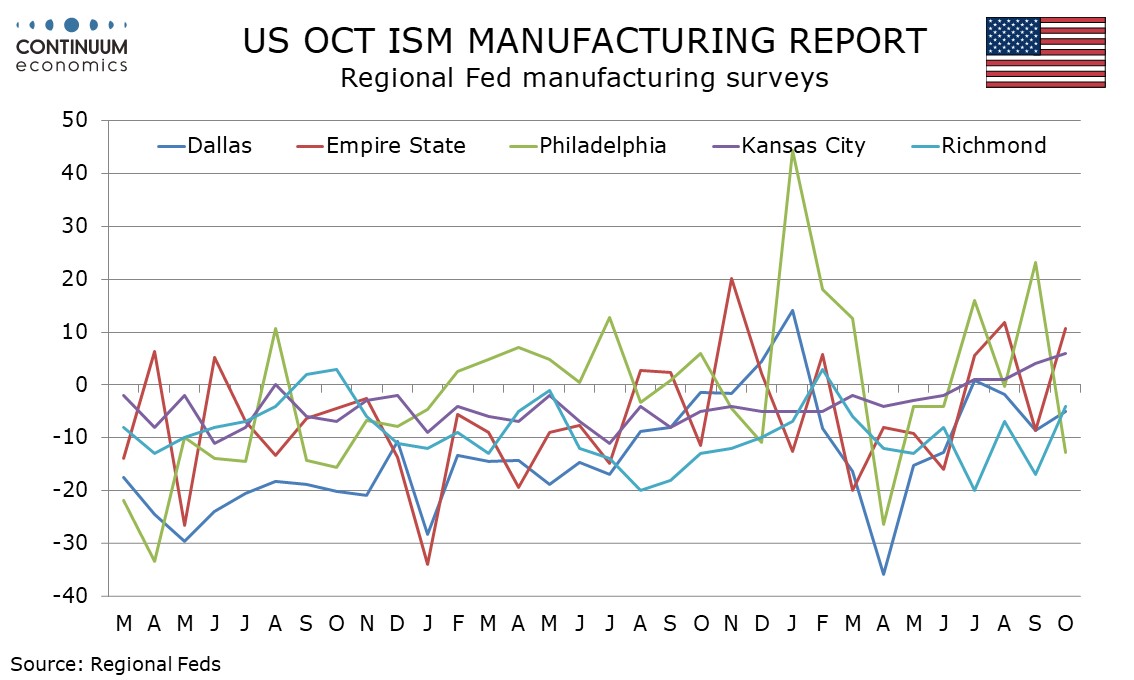

Other surveys are generally giving positive signals, with a modest improvement in the S and P manufacturing PMI, and most regional surveys stronger than if September if on mixed sides of neutral. Even a weaker Philly Fed index was less negative in its detail than the headline.

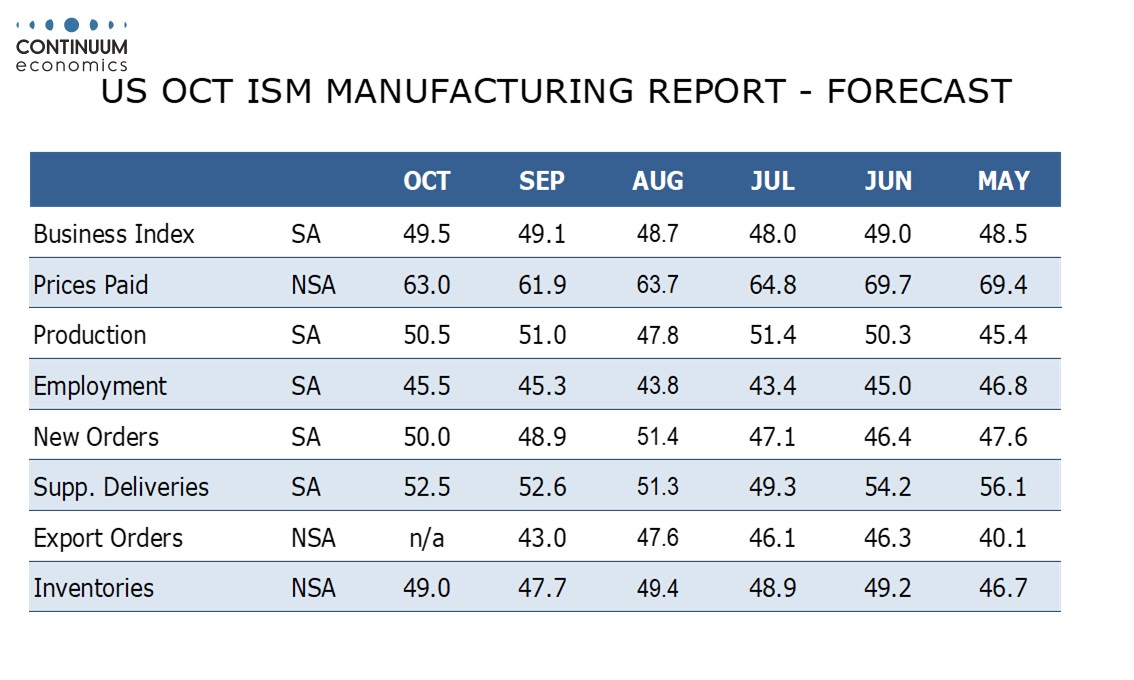

We expect ISM detail to show new orders returning to a neutral 50.0 from September’s weaker 48.9 but production correcting lower to 50.5 from 51.0. We see employment marginally improved at 45.5 from 45.3 and deliveries marginally slower at 52.5 from 52.6. The strongest increase is likely to come from inventories, rising to 49.0 from a weaker 47.7 in September.

Prices paid do not contribute to the composite and here we see a bounce to 63.0 from September’s 61.9 which was the weakest reading since January. The index is likely to remain well below this year’s high of 69.8 seen in April, when tariffs were announced, which was the highest since June 2022.