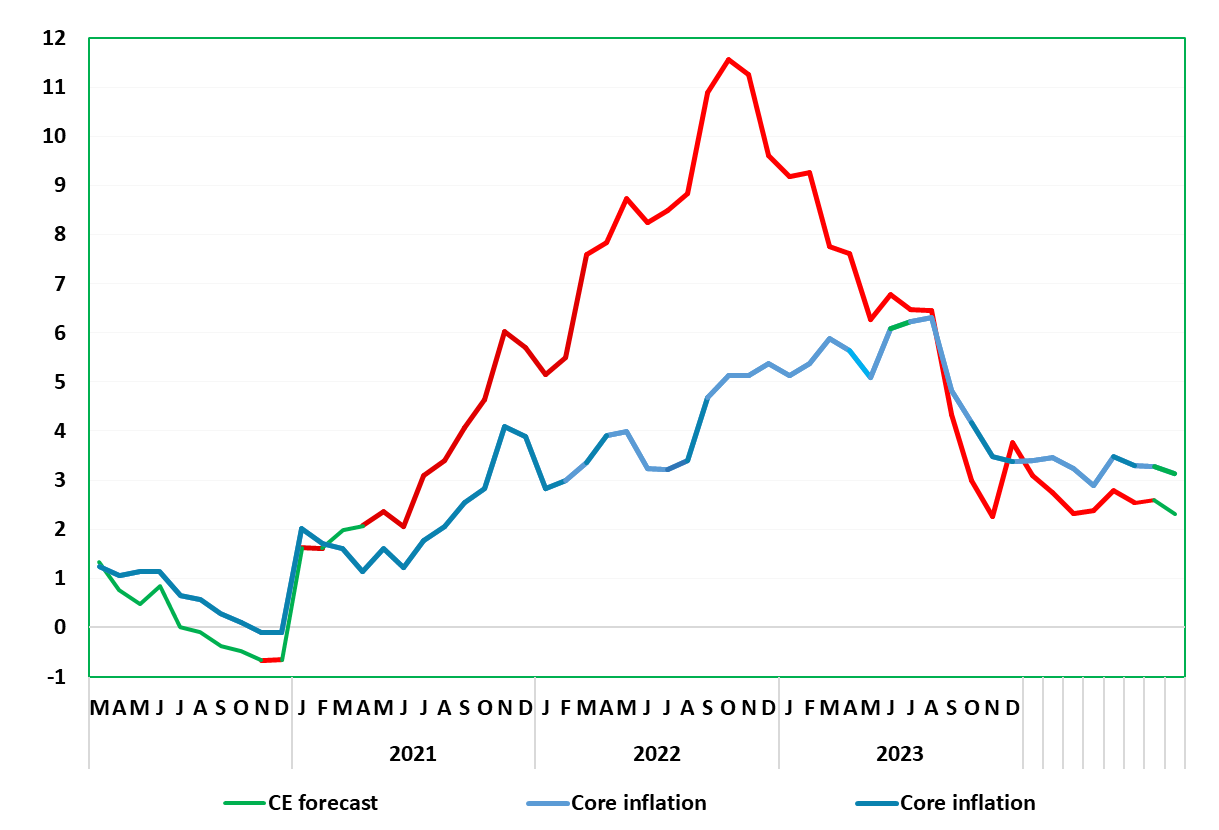

German Data Preview (Aug 29): Inflation Edges Back Down?

Base effects have caused the German disinflation process not to be smooth and this was even more clearly the case in the July data. This saw the headline HICP rate rise and unexpected 0.1 ppt to 2.6%, unwinding a third of fall seen in June. Details show stable services and core inflation but with less negative energy and slightly higher food inflation causing the higher headline outcome. To what extent both food and services were pushed higher by the European Football Championship is unclear, with the August numbers providing something of an answer. Helped by lower fuel process we see the headline rate falling to 2.4% and the core down a notch to 3.2%

Figure 1: Inflation Less Bumpy?

Source: German Federal Stats Office, CE

Regardless, looking ahead, the disinflation trend is seen continuing, mainly due to slower core goods and energy prices. As a result, headline inflation is likely to fall to around 2% in the autumn but perk back to possibly above 2.5% by end-year due to energy base effects.