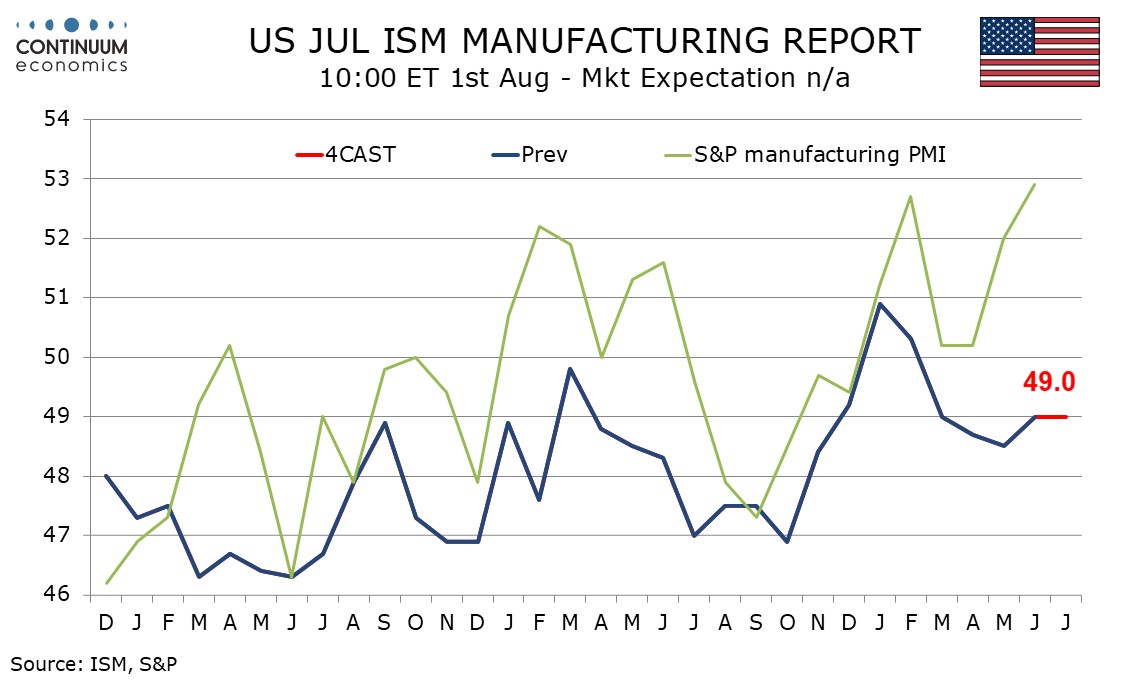

Preview: Due August 1 - U.S. July ISM Manufacturing - Tariff risks to restrain composite and lift prices

We expect an unchanged ISM manufacturing index of 49.0 in July. Tariff concerns may prevent any extension of a modest June improvement, and could extend recent strength in prices paid, we expect to 71.0 from 69.7. Strength in June’s S and P manufacturing PMI, with July data due on July 24, will be difficult to sustain.

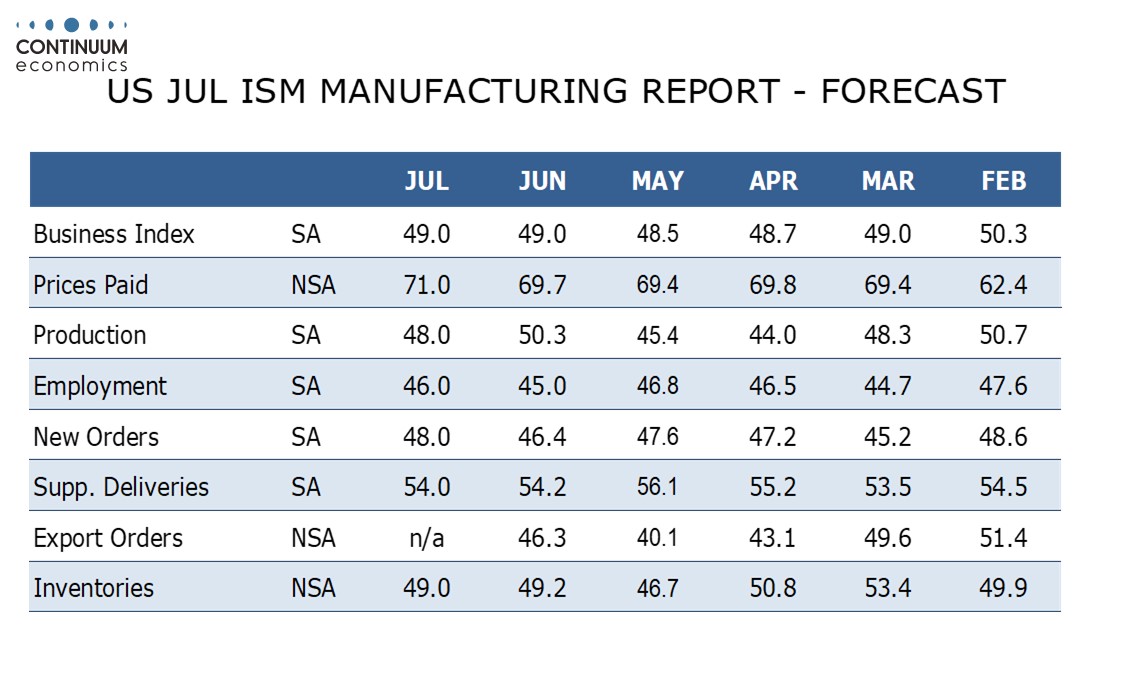

We expect the breakdown of the composite to see new orders and production both at 48.0, the former bouncing from a weak 46.4 but the latter slipping from a marginally positive May reading of 50.3. Employment has scope to correct from a weak May at 45.0, we expect to 46.0. We expect marginal slippage of 0.2 points in both deliveries, to 54.0, and inventories, to 49.0, to complete the breakdown of the composite.

Prices paid do not continue to the composite but after four straight readings on a 69 handle, already well above pre-tariff levels, we expect a rise to 71.0, which would be the highest since June 2022. Two other indices that do not contribute to the composite are worth watching, exports and imports. Both bounced from very weak April readings in June while remaining well below 50. Like in the composite, there is probably little scope for June’s gains to be extended with tariff concerns escalating.