JPY, EUR flows: USD and JPY firmer as equities slip

USD and JPY gain against riskier currencies as equities slip on tariff and AI concerns.

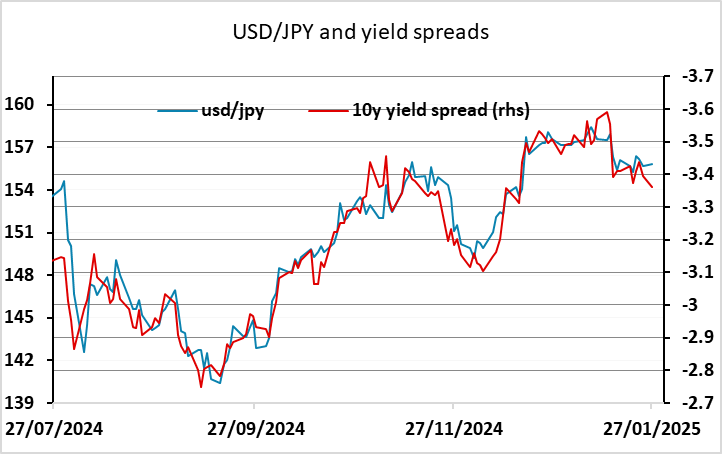

The USD and JPY are a little firmer overnight as equities have slipped lower. A combination of Trump announcing tariffs on Colombia and Chinese startup DeepSeek's launch of a free, open-source artificial intelligence model to rival OpenAI's ChatGPT have undermined equity sentiment, knocking the riskier currencies lower. Yields are also generally lower, and at current levels suggest scope for more JPY gains against the USD.

The German IFO survey is the main data today, and may be mildly EUR supportive if it confirms the more positive view of the Eurozone economy suggested by last week’s preliminary January PMI data. The Fed and ECB monetary policy meetings are the main focuses of the week, with Q4 GDP data from the US and Eurozone the main data events. We don’t expect significant surprises from the central bank meetings, with no change in rates from the Fed and a rate cut from the ECB near certainties, but if anything the risk is that the Fed statement is less hawkish than the market is pricing in, and this is even more likely if equities are soft going into the meeting, and this is another potential JPY positive.