USD, JPY flows: JPY weakness unlikely to persist

JPY weakness on Takaichi election victory unlikely to persist

USD/JPY is up 2.5 figures overnight after an unexpected victory for Sanae Takaichi in the LDP leadership election. She will now become Prime Minister. The rationale for JPY weakness is that Takaichi is an adherent of Abenomics, and is expected to favour both easy fiscal policy and easy monetary policy. The markets have consequently essentially eliminated any expectation of an October rate hike. While the BoJ is independent, the suspicion is that the LDP’s desires for monetary policy will have an influence on BoJ board members. BoJ governor Ueda sounded as if he was in no hurry to hike in his comments last week, and will likely be inclined to delay any action until the government’s policies are clearer.

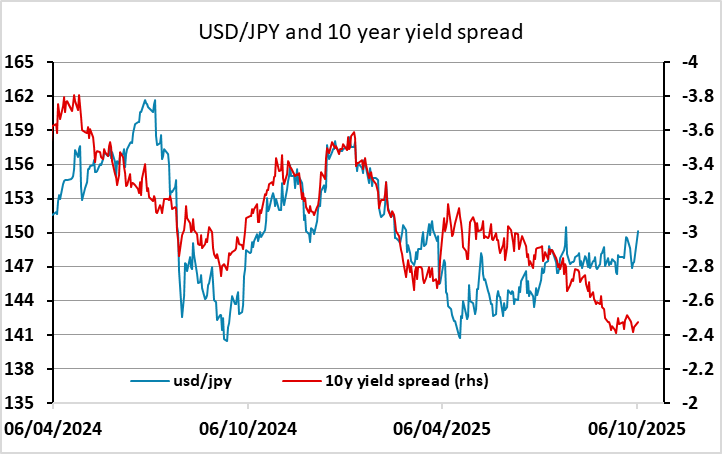

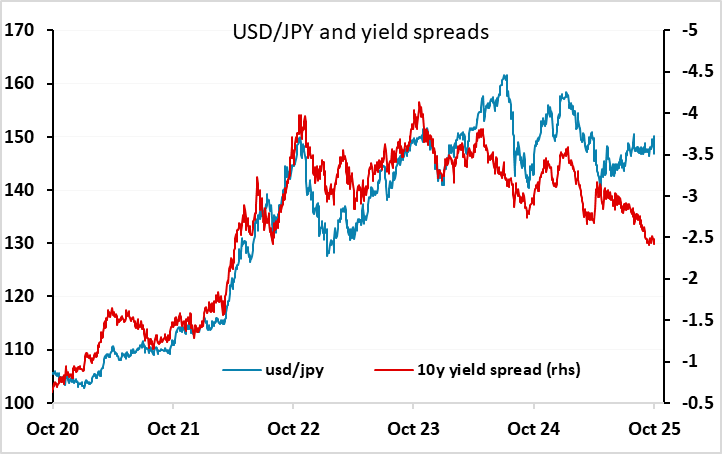

However, long term JGB yields are if anything slightly higher, and yield spreads still strongly suggest scope for JPY gains. In the end, if the government does introduce easier fiscal policy, the BoJ is unlikely to be deflected from their intended tightening path indefinitely. But in any case, the main driver of US/Japan yield spreads has been US rather than Japanese yields, and spreads would still suggest USD/JPY weakness even if JGB yields were to decline. We therefore would not expect JPY weakness to persist. The knee jerk negative reaction has sent EUR/JPY to a new all time high, but we expect this will be short lived.