JPY flows: JPY continues to make gains

JPY strength continues as yield spreads narrow and equities weaken

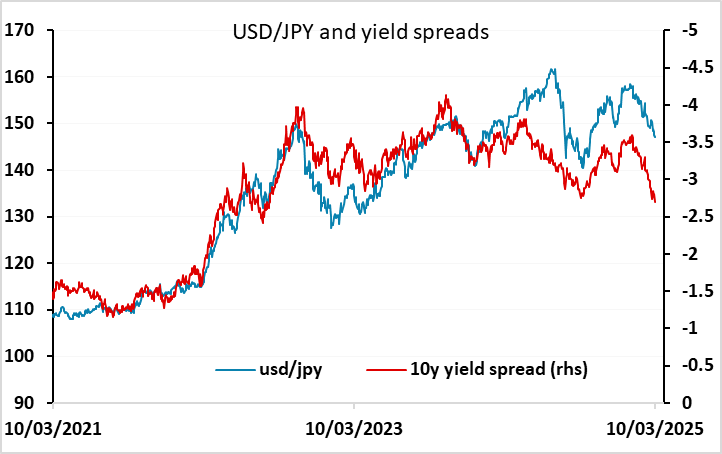

JPY strength is the main feature this morning, with yield spreads against the USD now the narrowest since 2022 and weaker equity markets providing some support on the crosses. USD/JPY looks clearly set to move lower, with scope sub-140 based on yield spread correlations, and only looks likely to be slowed down in more risk friendly conditions when the JPY comes under pressure on the crosses.

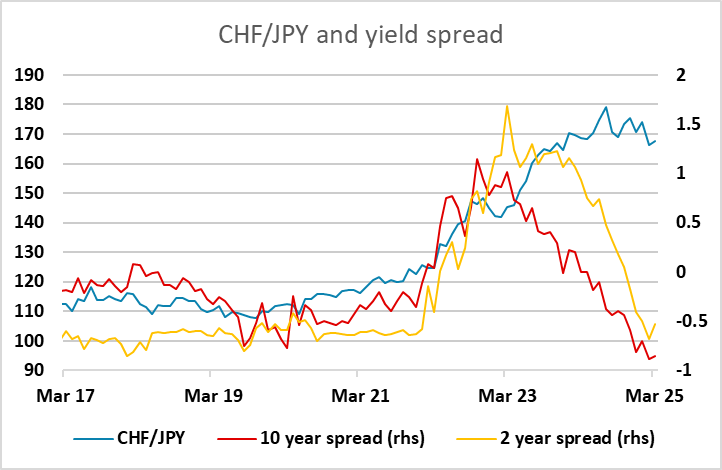

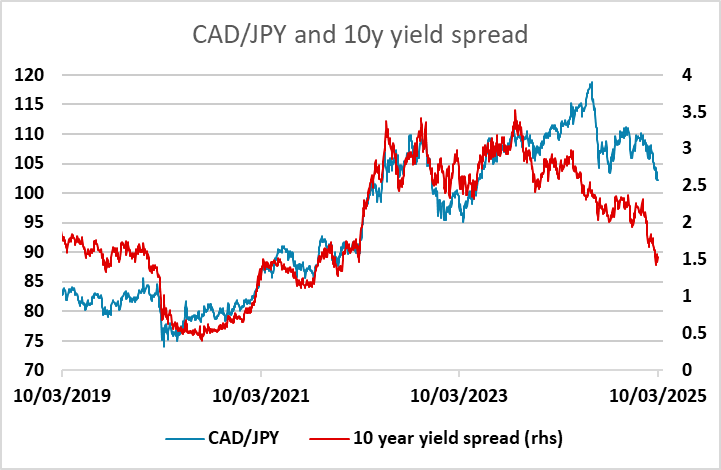

Currently, most JPY crosses continue to hold above key support levels. EUR/JPY and GBP/JPY have rallied quite a long way in the last week, with EUR/JPY bouncing from the 1.5440 support helped by the expectation of increased defence and infrastructure spending from Germany. But CHF/JPY, CAD/JPY and AUD/JPY are all closer to threatening major support areas. CAD/JPY looks particularly vulnerable short term, especially if the BoC cuts rates this week, while CHF/JPY offers the most clear-cut value play.