GBP flows: GBP steadies after initial dip on PSNB data

June PSNB second highest on record, confirming need for fiscal tightening, but little net GBP impact

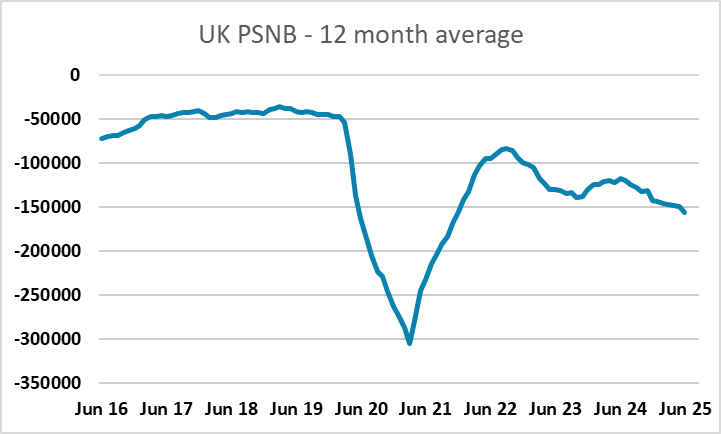

UK PSNB data this morning provided evidence of a deteriorating UK public finance situation, although this came after two better than expected months. The June deficit of GBP20.68bn was the second largest June deficit on record, well above the market consensus of a GBP 17.4bn deficit. Over the first three months of the fiscal year which began in April, Britain borrowed 57.8 billion pounds, 15% more than in the same period last year and the third-highest April-to-June deficit on record. However, the figure was back in line with the year-to-date forecast by the OBR, after two months of lower-than-expected borrowing. Even so, the data supports the view that there will need to be significant revenue raising measures of at least GBP20bn in the Budget this autumn. UK yields are a little firmer this morning, but have only risen marginally more than US and European yields, and GBP is not much changed after an initial dip after the data. GBP may prove vulnerable to further evidence of fiscal problems, as this would increase expectations of more rapid monetary easing, but for now should stabilise below 0.87.