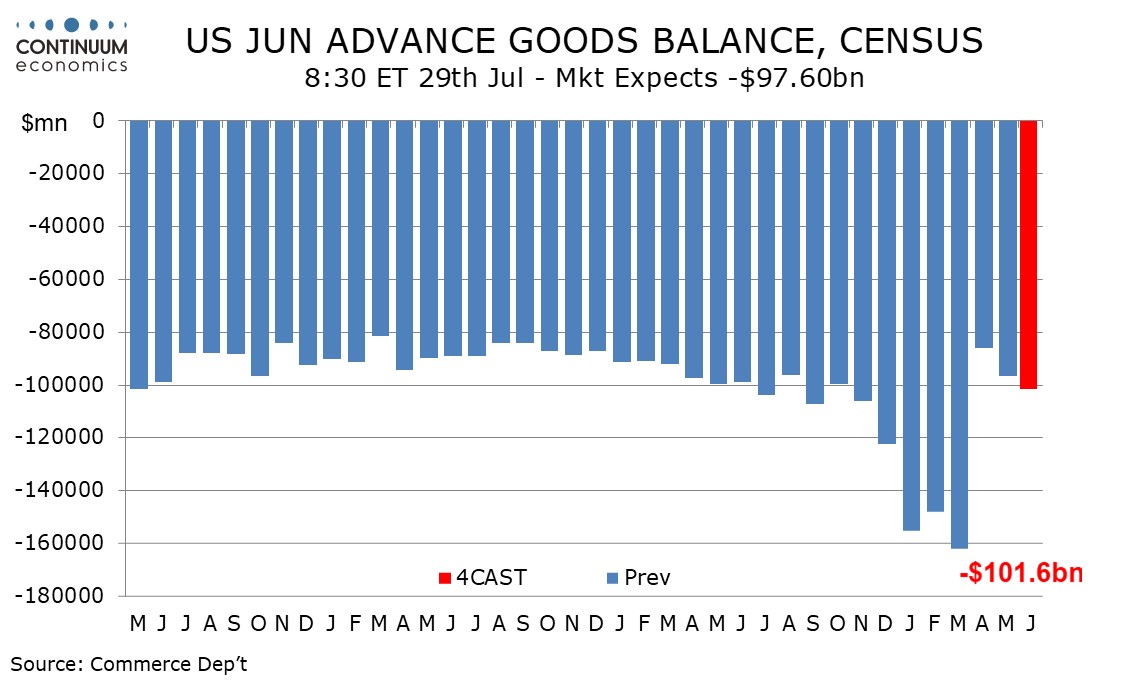

Preview: Due July 29 - U.S. June Advance Goods Trade Balance - Deficit to rise as imports from China recover

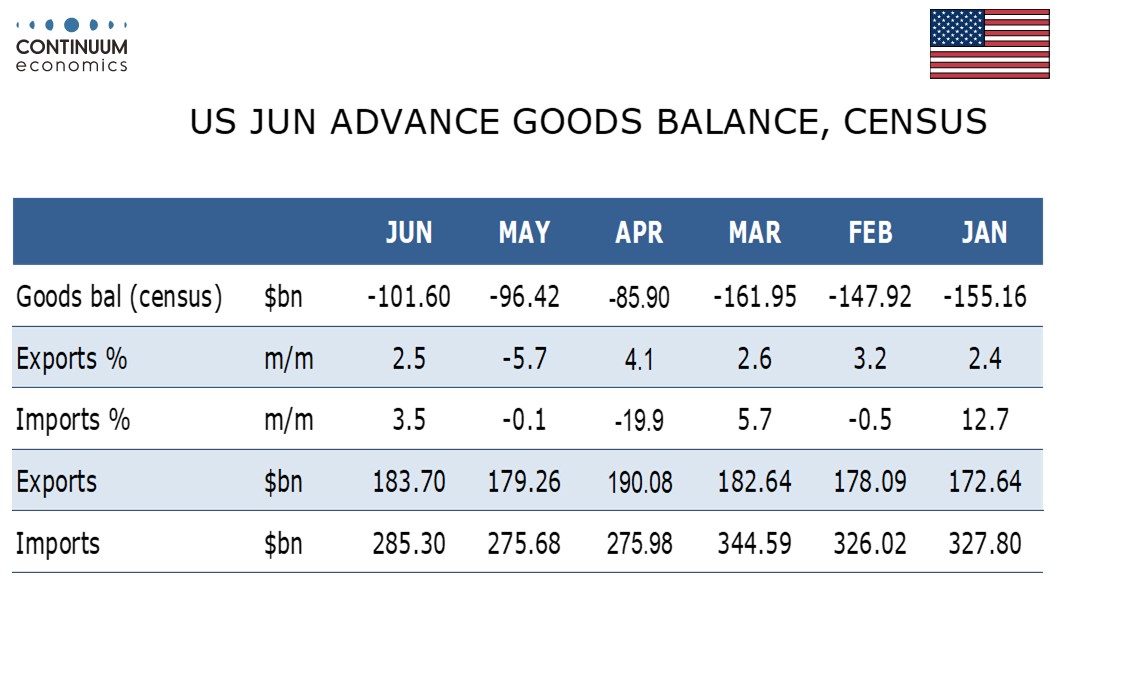

We expect an advance June goods trade deficit of $101.6bn, up from $96.4bn in May, This would be a second straight increase from April’s $85.9bn low which corrected a surge in the deficit in Q1 ahead of April’s tariff announcement. June’s deficit would be in line with where trend was before the November election.

We expect a 2.0% increase in exports after a 5.7% decline in May which followed four straight gains. While there is some risk that May’s export weakness could extend further, with Boeing exports stronger in June and manufacturing output former, we expect a correction from May’s slippage.

We expect imports to increase by 3.5% after a 0.1% decline in May saw some stabilization after a 19.9% plunge in April. June’s import increase is likely to come largely from China with Chinese data showing exports to the US recovered somewhat after tariffs were reduced from extreme levels.

The data may bring some late fine tuning to Q2 GDP estimates, which is due to be released on July 30. Advance June retail and wholesale inventory data due at the same time should also be watched, as any sharp move in imports could be offset by a similar move in inventories.