Preview: Due February 18 - Canada January CPI - To fall on GST tax holiday

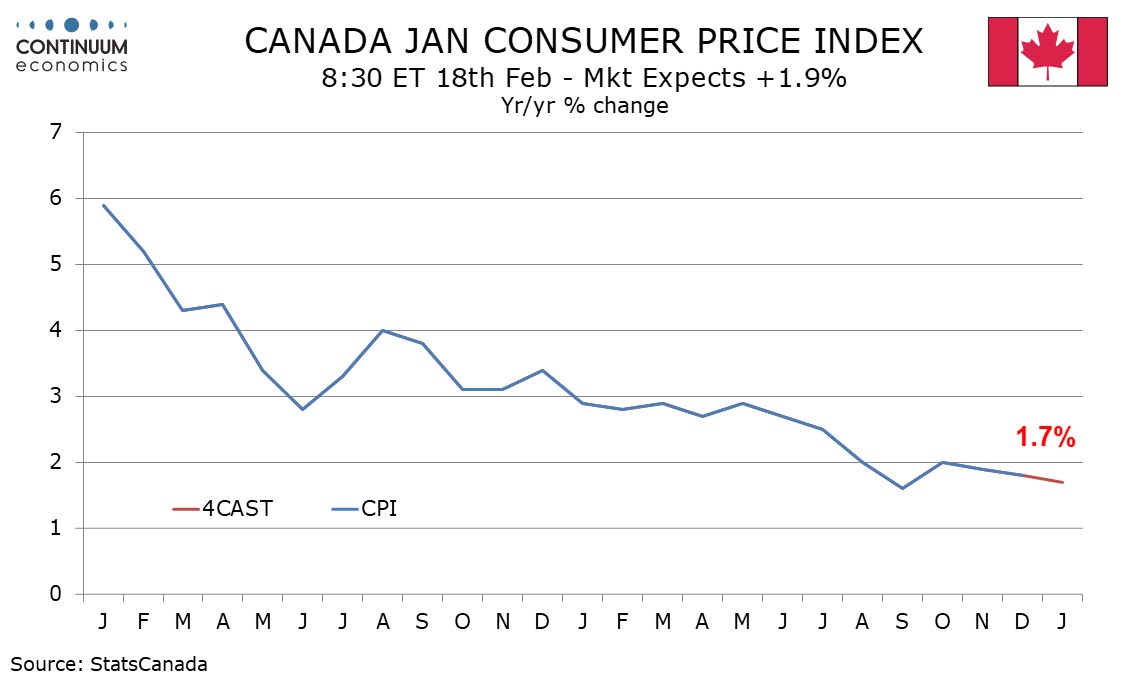

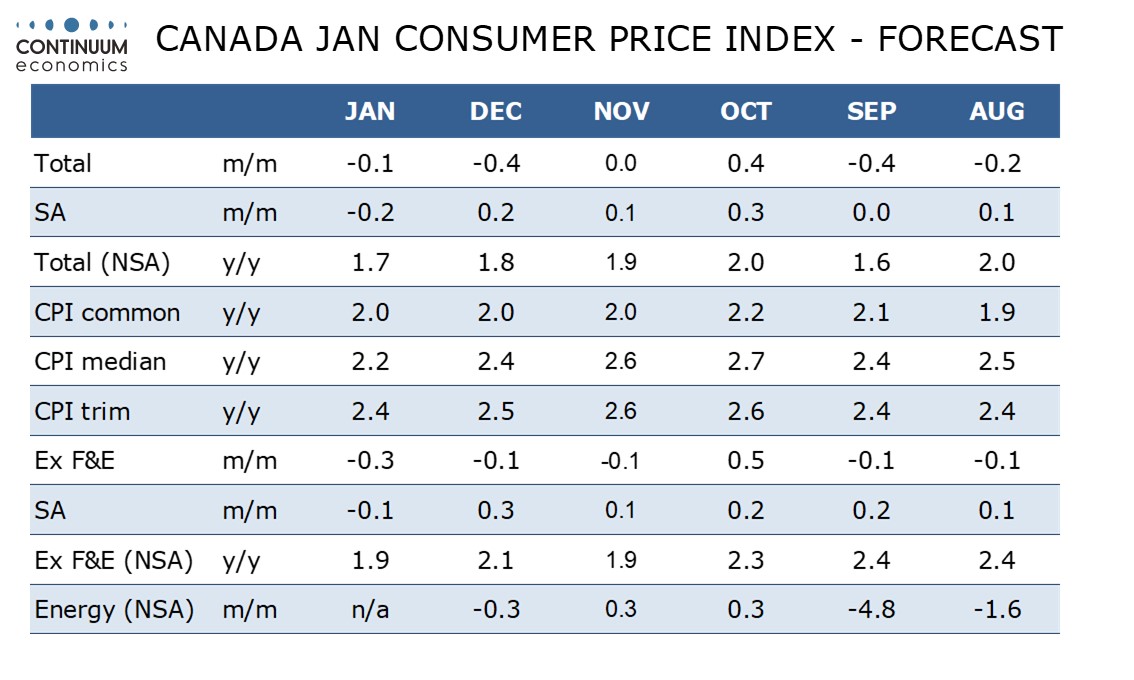

We expect Canadian CPI to slip to 1.7% yr/yr in January from 1.8% in December, the fall largely due to a temporary suspension of the Goods and Services Tax that will ran from Mid-December through Mid-February. Before slightly disappointing data, Bank of Canada Governor Tiff Macklem stated that the tax suspension is expected to move inflation down to a low of around 1.5% in January.

The full impact of the tax suspension will be felt in January with December and February data seeing partial impacts. December’s fall to 1.8% from 1.9% in the yr/yr pace was disappointing, and a 0.3% seasonally adjusted rise in the ex food and energy pace was particularly so, suggesting that CAD weakness may be acting as a partial offset to the tax holiday.

We expect monthly data for January to show seasonally adjusted declines of 0.2% overall and 0.1% ex food and energy, with the unadjusted data showing a 0.2% decline overall and a 0.3% decline ex food and energy. We thus expect a negative for gasoline after seasonal adjustment, but gasoline prices to increase in unadjusted terms.

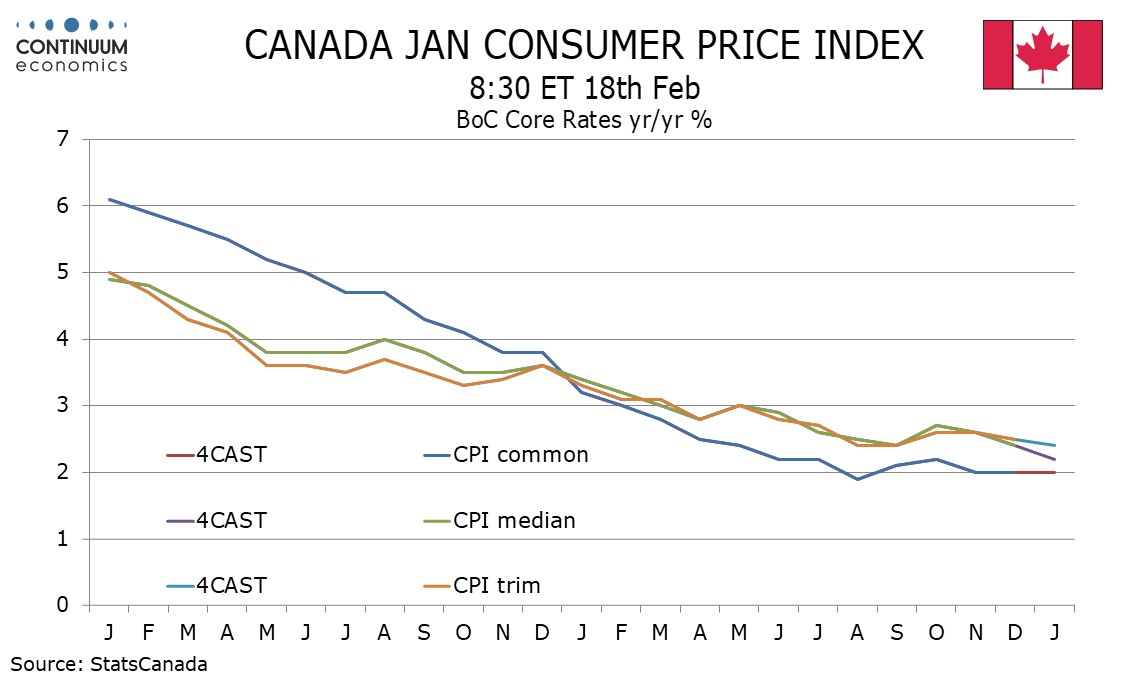

Soft data a year ago will restrain improvement in yr/yr rates. For the BoC core rates we expect CPI-Common to remain at 2.0% for a third straight month, CPI-Median to fall to 2.2% from 2.4%, repeating a 0.2% slowing in December, and CPI-Trim to fall to 2.4% from 2.5%, repeating a 0.1% slowing in December.