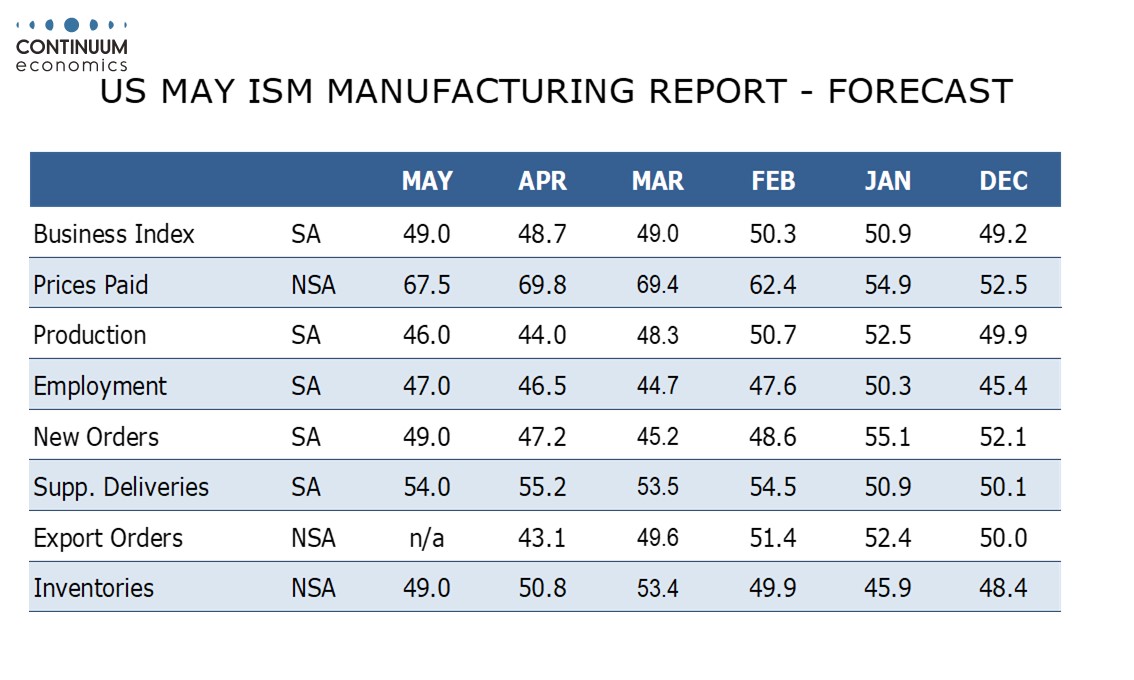

Preview: Due June 2 - U.S. May ISM Manufacturing - Modest improvement, but not as far as neutral

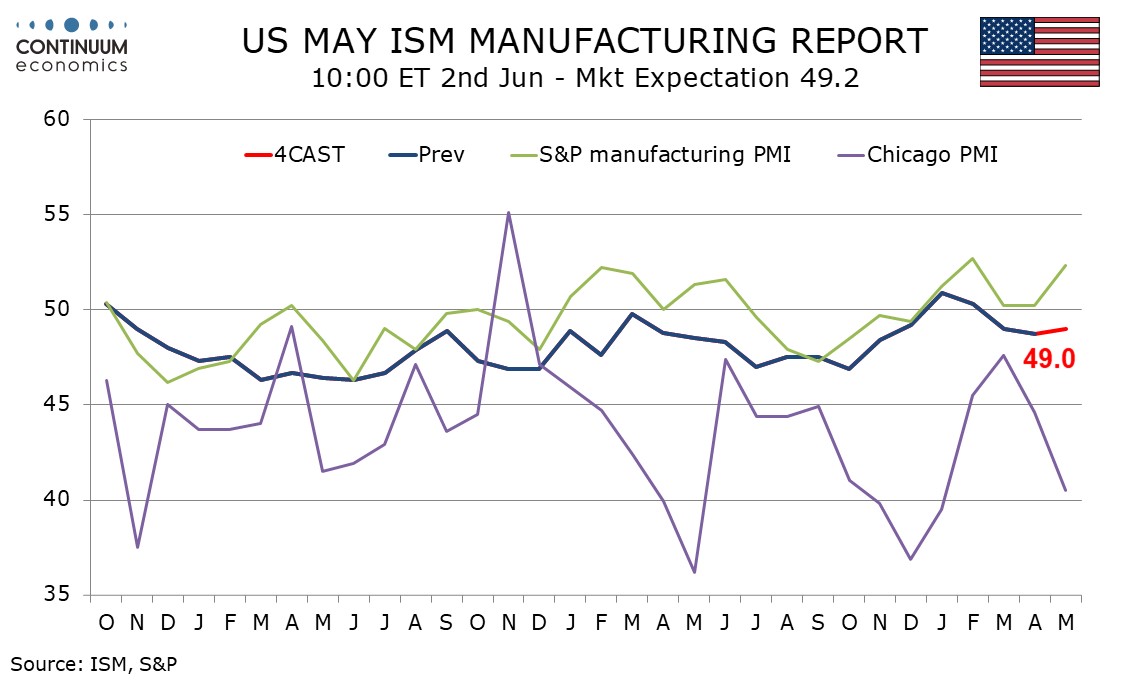

We expect a May ISM manufacturing index of 49.0, which would be a marginal improvement from April’s 48.7, which was the weakest since November. However the index would remain below the neutral 50 which was beaten in January and February for the first times since October 2022.

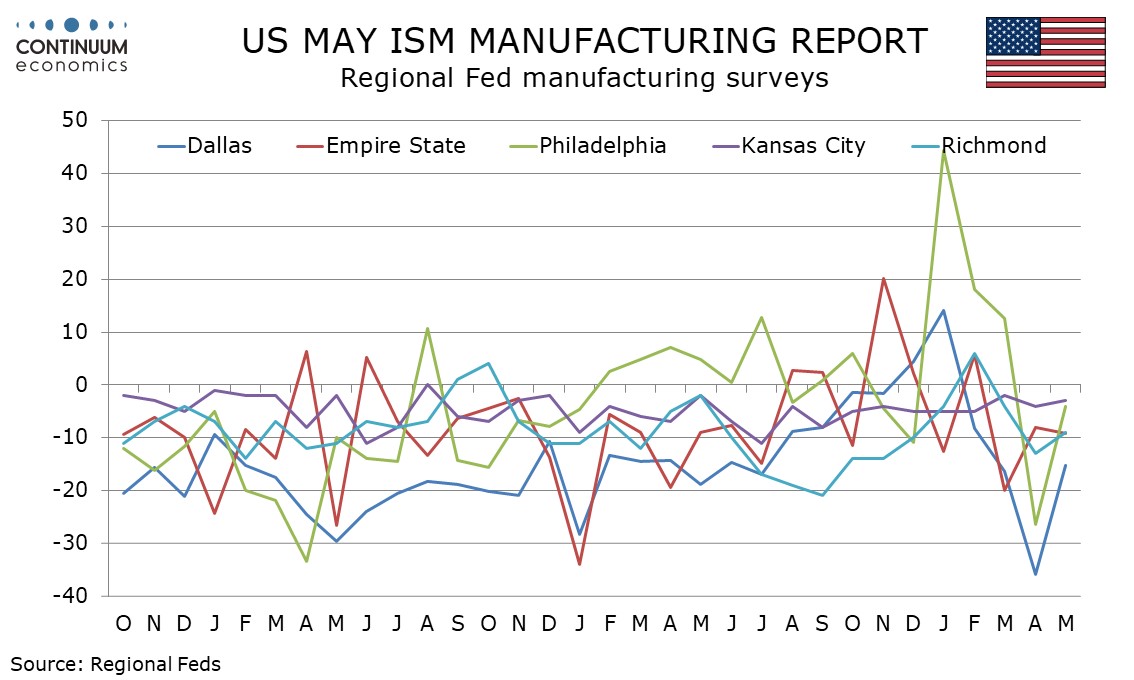

The S and P manufacturing index picked up in May, following a dip in March and an unchanged April which at 50.2 held marginally above neutral. Most regional Fed surveys also saw some improvement in May after weak April data, but these were unable to reach neutral. The Chicago PMI was weaker.

We expect the May ISM manufacturing breakdown to show improvements from weaker April data in new orders, production and employment, but slippage from stronger April data in inventories and deliveries, keeping the rise in the composite marginal. We expect the gain in the composite to be led by new orders, which at 49.0 from 47.2 would be at its highest since January.

Prices paid do not contribute to the composite but have accelerated recently, with April’s 69.8 being the highest since June 2022. An easing of tariff worries, particularly versus China, is likely to see a modest slowing in May, we expect to 67.5, but this would still be well above the 2024 high of 60.9 seen in April of that year.