JPY flows: No mercy for the JPY, intervention necessary

New post-January highs for USD/JPY, new all time highs for EUR/JPY

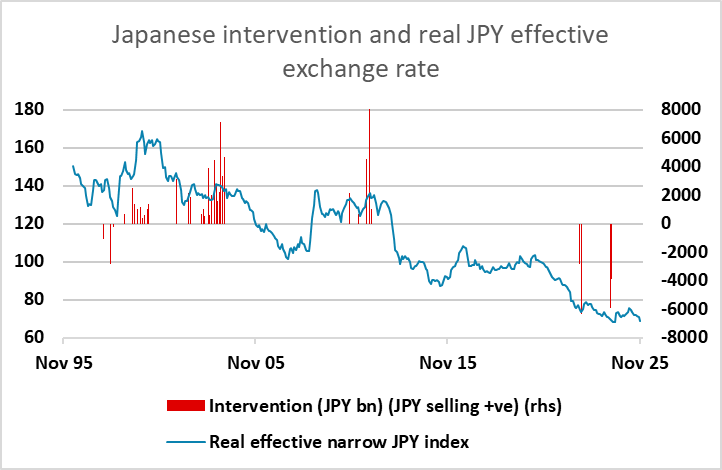

JPY weakness was once again a theme overnight. EUR/JPY hit another new all time high at 181.74, while USD/JPY made another new post-January high at 157.78. The USD was generally strong, helped by better than expected results from Nvidia, but JPY weakness was the most pronounced. Verbal intervention continued to no avail. Chief Cabinet Secretary Minoru Kihara told a regular press conference, "there are one-sided, sharp moves in the currency market and we are concerned. It is important for exchange rates to move stably and reflect fundamentals, and the government is assessing excessive fluctuations and disorderly movements in the market, including speculative trends, with a high degree of urgency." But these comments were ignored, and the government should by now be aware that verbal intervention is having no impact, and if they want to halt the JPY decline they will need to use physical FX intervention.

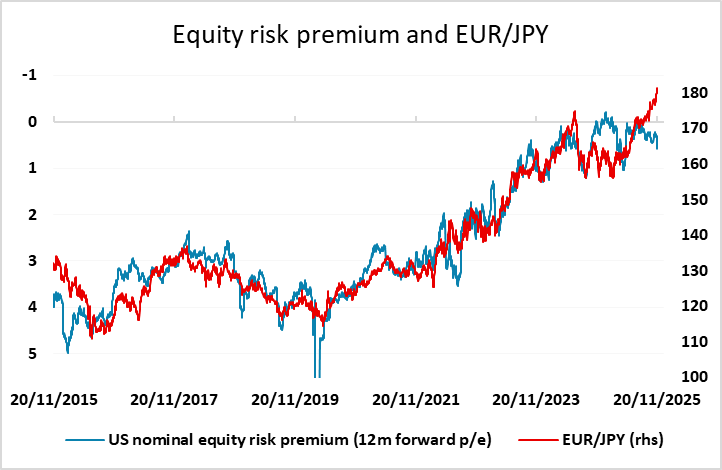

The other possible string to their bow is a rate hike from the BoJ. There was some increase in expectations of a December hike after comments from BoJ board member Junko Koeda, who said “the Bank of Japan must continue to normalise monetary policy by raising real interest rates to a state of equilibrium". But the market is still pricing a 25bp hike at the December 19 meeting as only a 30% chance. And while Japanese real yields are low, yield spreads are not large enough to support the degree of JPY weakness we are seeing. 10 year spreads have been narrowing sharply in recent months, but have failed to prevent the JPY decline. Relying on this possibility to halt the JPY decline would be a triumph of hope over experience. FX intervention, ideally with the support of the US (although there is little chance of this) looks necessary to halt the JPY slide ahead of any interest rate action.