JPY flows: Mild gains as BoJ rate hike prospects increase

JPY slightly firmer, but move still just corrective for now, although JPY bottom is likely close

A quiet calendar in Europe ahead of the US data this afternoon. German final Q3 GDP data was unrevised at 0.0% q/q. The JPY is a little firmer overnight, having gained ground in early Asian trade, helped by some hawkish comments from Kazuyuki Masu, a BoJ policy board member who said in interviews with the Jiji news agency and the Nikkei business daily that conditions have been met for the BoJ to raise rates. This pushed front end JGB yields a little higher, while US front end yields edged lower in the US afternoon helped by dovish comments from Waller. A December Fed cut is now 70% priced while a BoJ hike is 30% priced, but forecasters are close to evenly split on whether the BoJ will act.

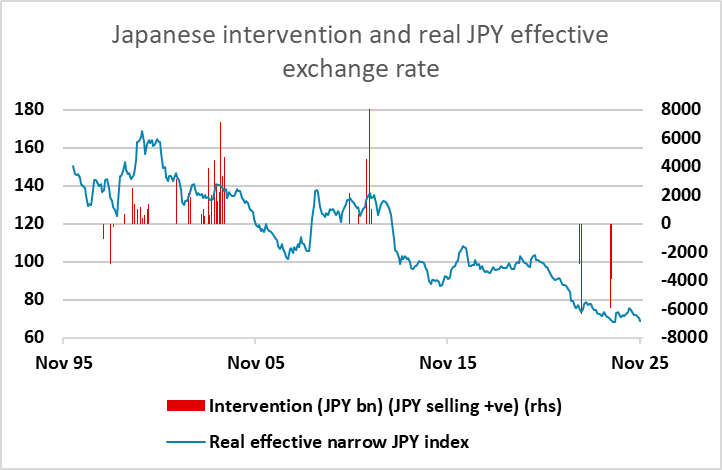

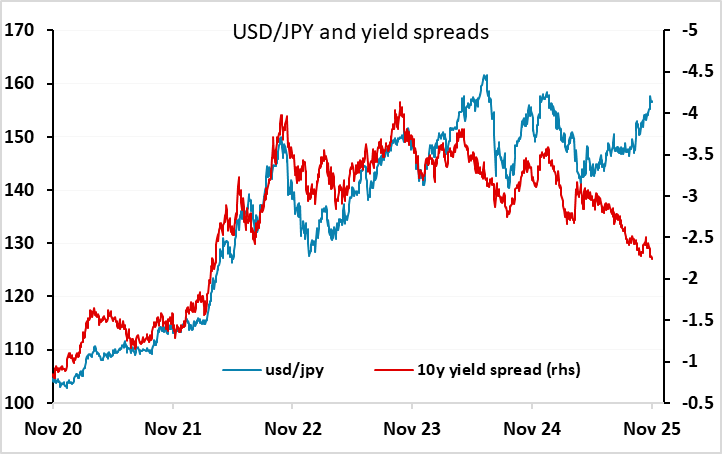

However, yield spreads have already moved dramatically in favour of the JPY in recent months, but USD/JPY has moved sharply higher, so it is unclear whether these moves in monetary policy will be sufficient to turn the JPY trend. While the JPY is modestly higher overnight, it still looks like a corrective move rather than a change in the trend, and it would be no surprise to see a renewed surge higher in USD/JPY at some point. But with the Japanese authorities now primed for intervention the risk/reward for JPY bears is deteriorating. Japanese intervention has historically been effective at marking (if not creating) the highs and lows in the JPY, so we are likely close to a JPY bottom here.