USD, CHF flows: USD recovers slightly, CHF holds firm

USD recovers slightly after post-employment dip but Fed rate cut still largely priced in. CHF stays firm on geopolitics, Eurozone concerns

The USD has recovered some ground after the in initial USD decline after Friday’s employment report. That decline was never justified by the data, but the market continues to price in a Fed rate cut next week as an 85% chance, despite Fed speeches on Friday which indicated that a cut was far from a done deal.

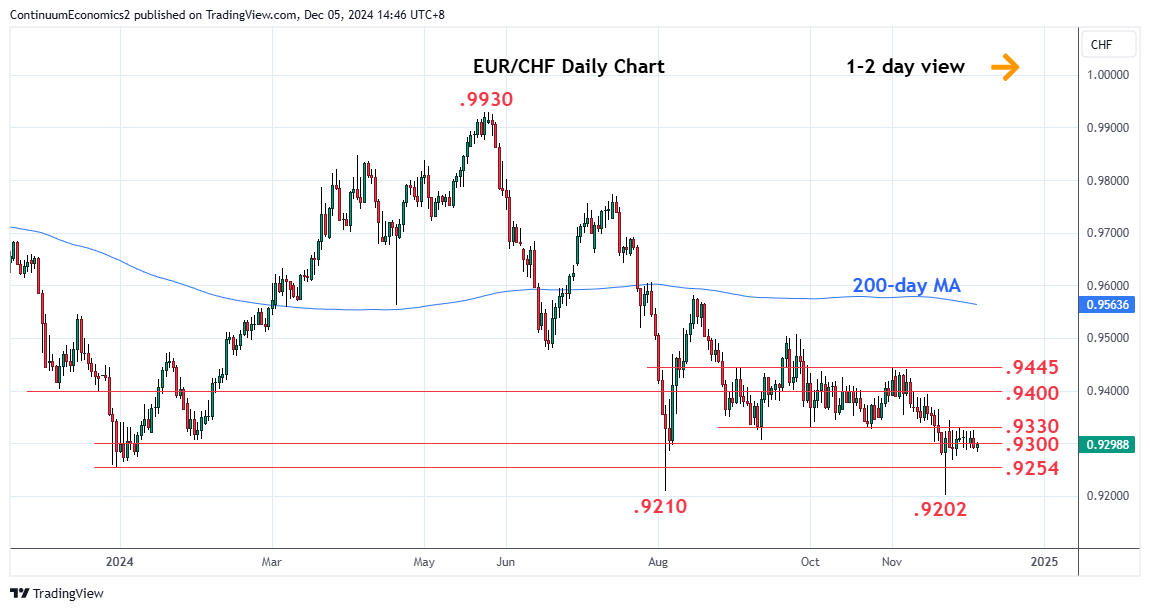

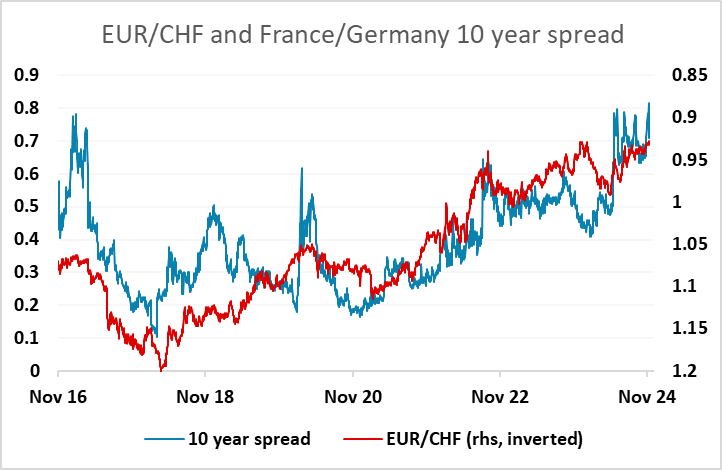

There’s very little of note on today’s calendar, and the focus will be on the central bank meetings later in the week, as well as any fallout from the Syrian developments over the weekend. EUR/CHF remains quite soft, helped by the geopolitical tension, and may convince the SNB to cut rates 50bp this week, especially given the lower than expected Swiss CPI data of late. Whether that will be enough to prevent further EUR/CHF losses is nevertheless unclear. The CHF rarely responds much to interest rate moves in anything other than the short term. For EUR/CHF to recover, there may need to be some evidence of a better performance from the Eurozone economy and some political stability in France and Germany. France in particular remains a focus as widening France/Germany spreads will tend to put upward pressure on the CHF.