U.S. July trade deficit increases on lower auto exports, Canada moves into surplus on lower auto imports

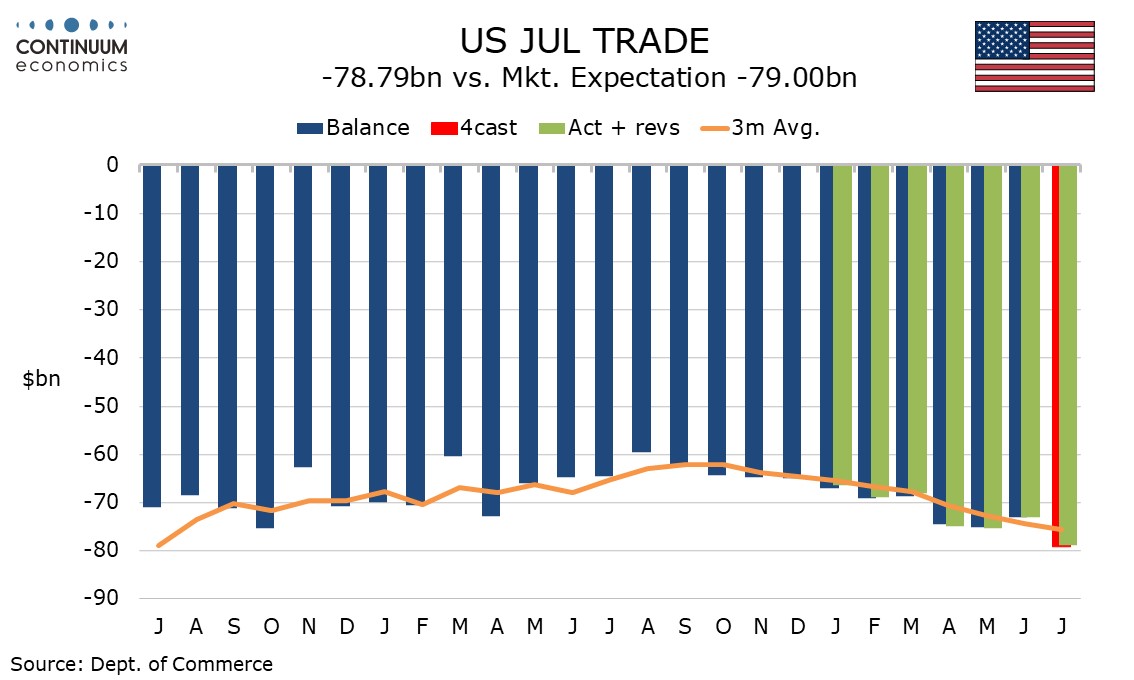

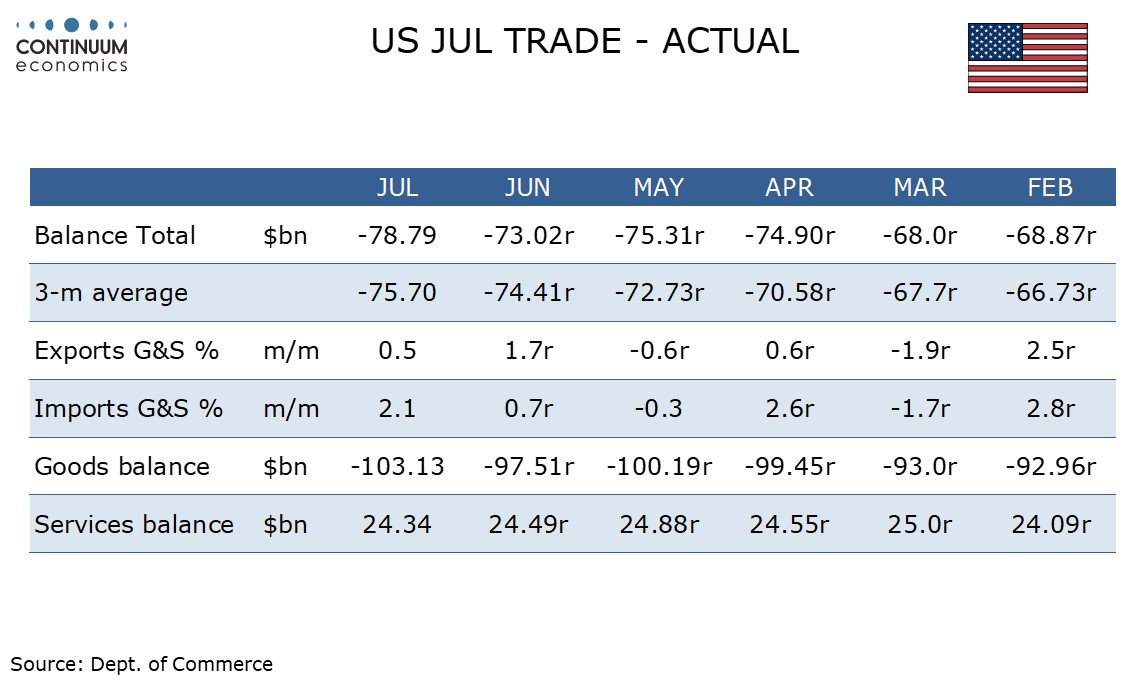

July’s US trade deficit of $78.8bn is up from $73.0bn in June and the widest since June 2022, restoring a deteriorating trend after a correction lower in the deficit in June, though July’s deficit is not quite as wide as expected. July’s deficit was inflated by a weak month from auto exports, which is unlikely to be repeated.

Goods data showed exports up 0.4% in contrast to advance goods data that showed exports unchanged, though this was well below a 2.3% rise in goods imports that was consistent with the advance data.

In real terms goods exports fell by 1.2% but goods imports increased by 1.9%. Exports were healthy outside a sharp 11.2% fall in autos. Imports were strong despite a modest 0.5% fall in autos.

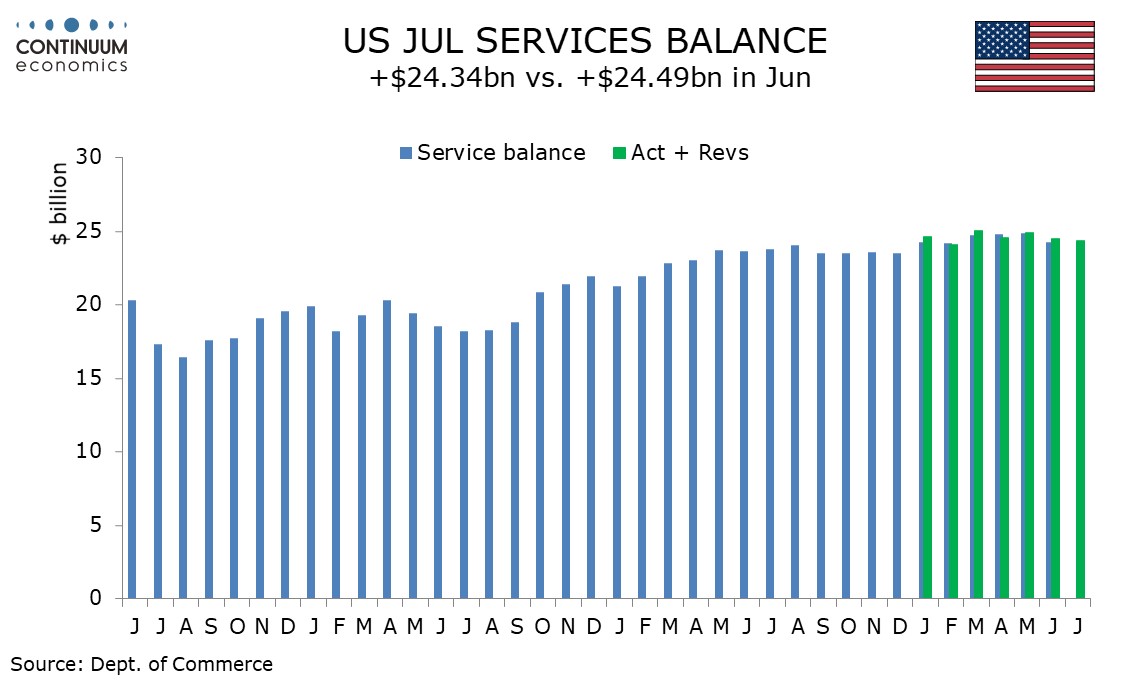

Services showed exports up by 0.7% and imports up by 1.1%, causing a marginal fall in the services surplus and leaving overall exports up by 0.5% and overall imports up by 2.1%.

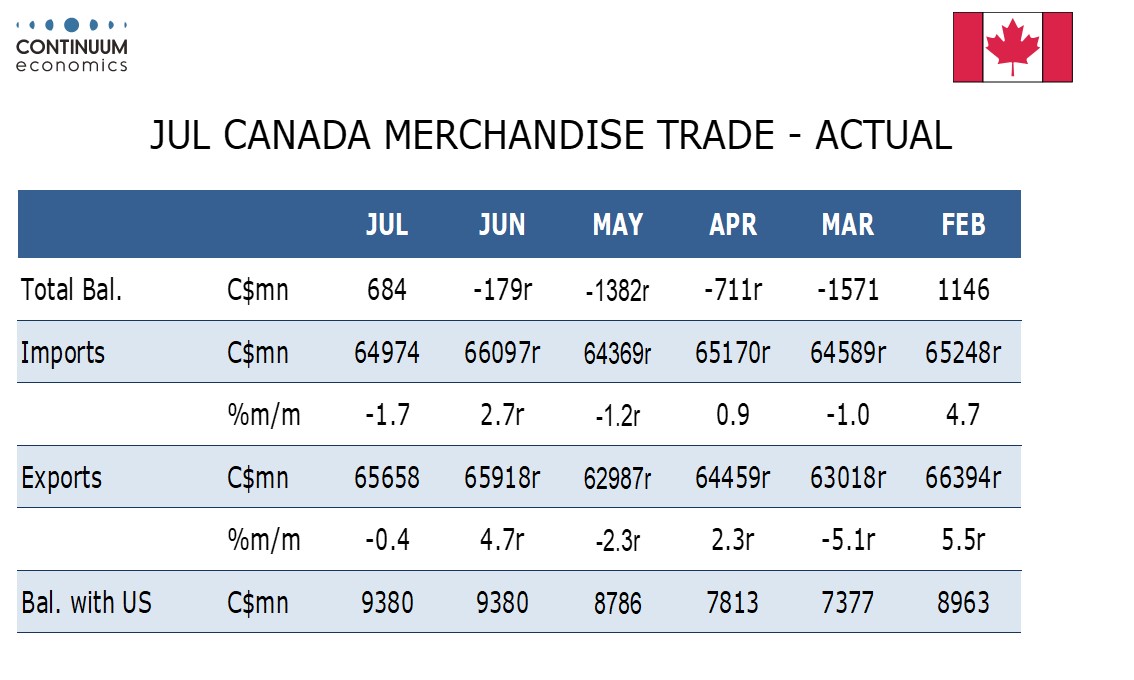

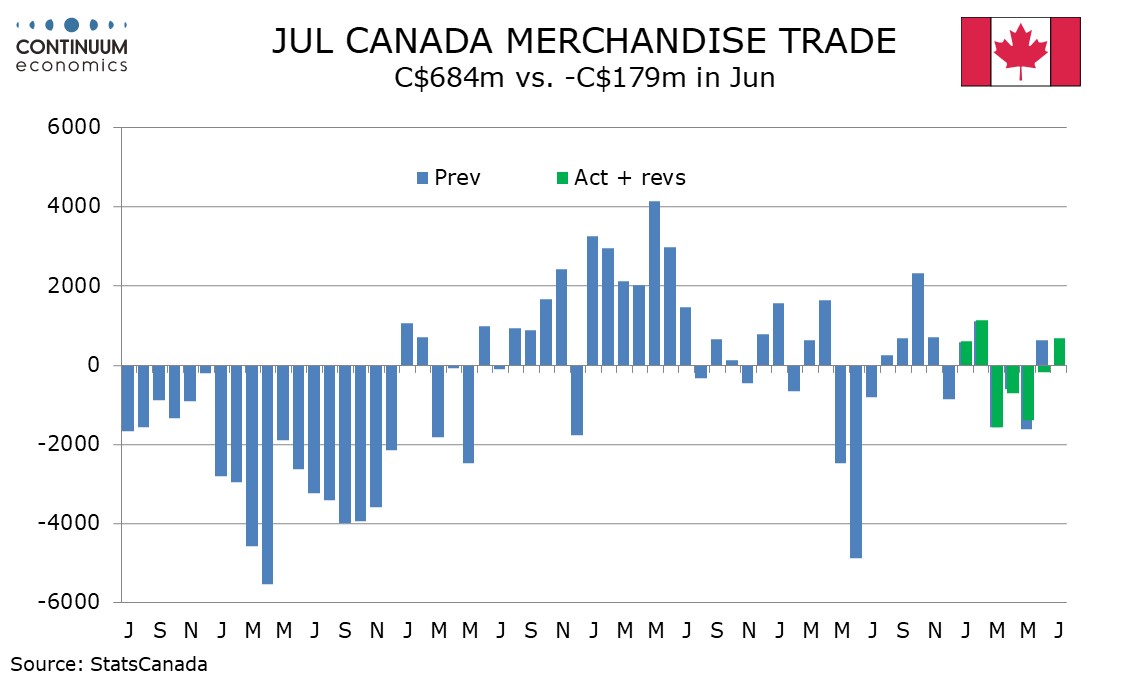

Canada’s July goods trade surplus of C$0.68bn is near consensus, though June was revised to a C$0.18bn deficit from a C$0.64bn surplus, leaving July’s data as the first surplus since February.

Imports fell by 1.7% from a record high in June, or by 2.0% in real terms. Autos fully explained the July decline. Exports fell by 0.4% after a 4.7% June increase, with the fall in real terms being 1.5%. Excluding autos, exports increased by 0.3%.