U.S. July New Home Sales - Trend has little direction, prices weak

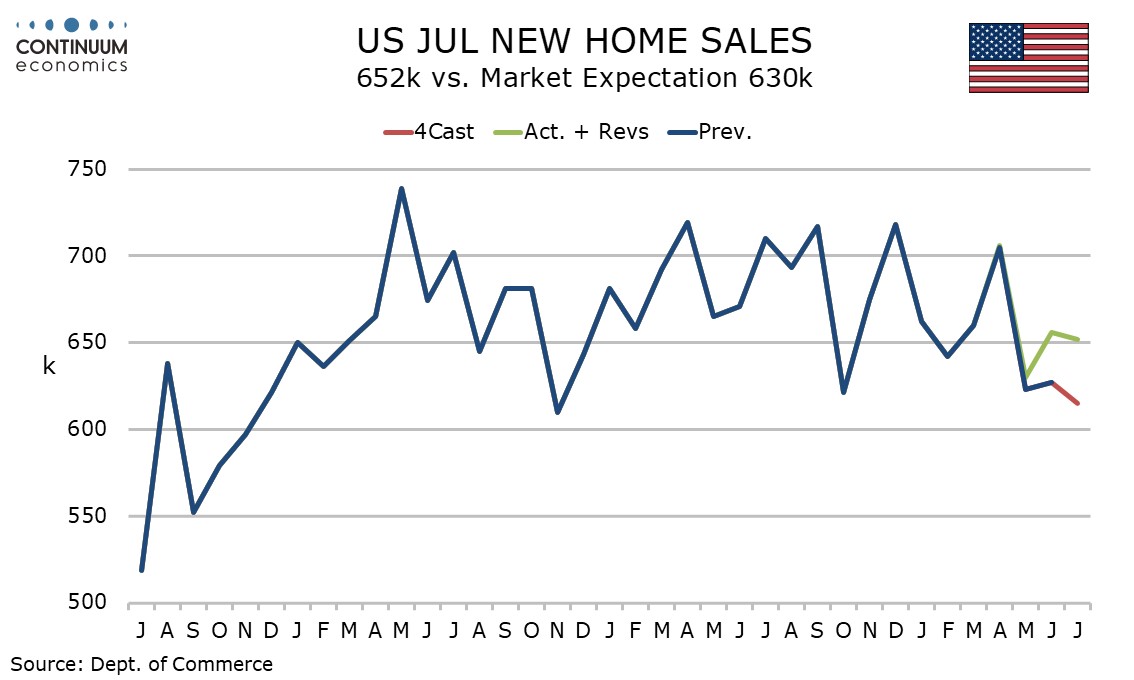

July new home sales at 652k are on the firm side of expectations and down 0.6% from June only because June was revised up to 656k from 627k, now up 4.1% rather than 0.6%. Trend still looks fairly stable and downside risks are fading as prospects of Fed easing increase.

The data follows stronger than expected July housing starts and a modest rise in July expecting home sales, though the NAHB homebuilders’ survey was still weak in August. Housing activity is still quite subdued but should Fed easing start in September, is likely to receive some support, though a sharp acceleration in activity is unlikely.

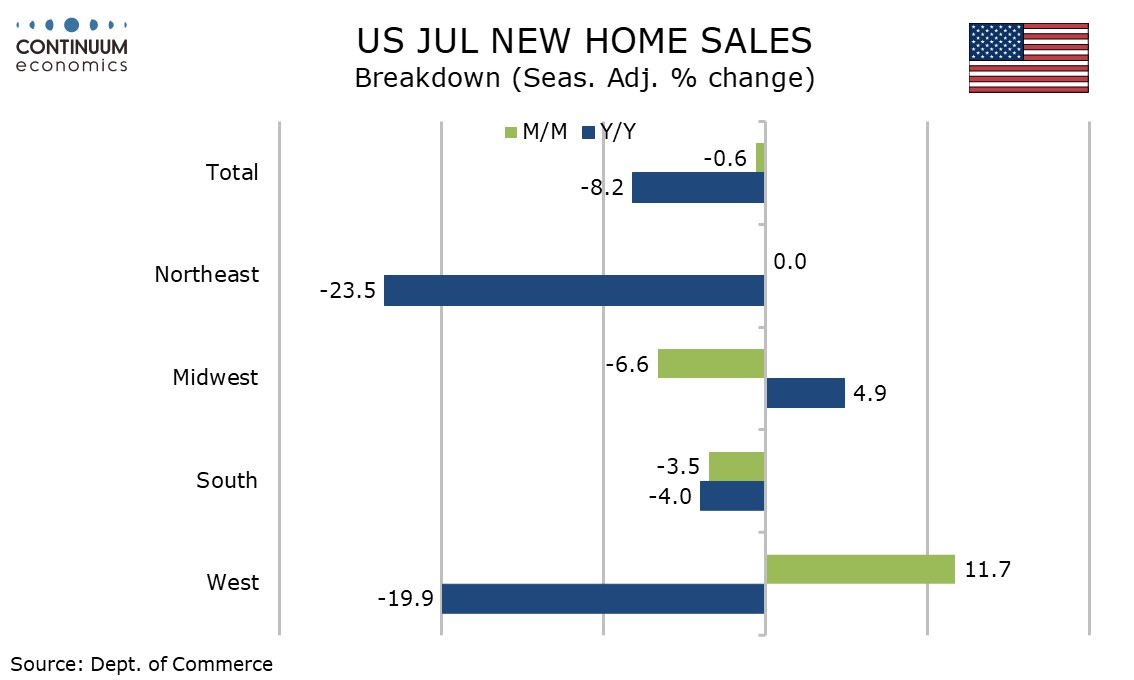

Regionally sales increased only in the West, but 11.7% after three straight declines. The South and Midwest corrected June increases while the Northeast was unchanged.

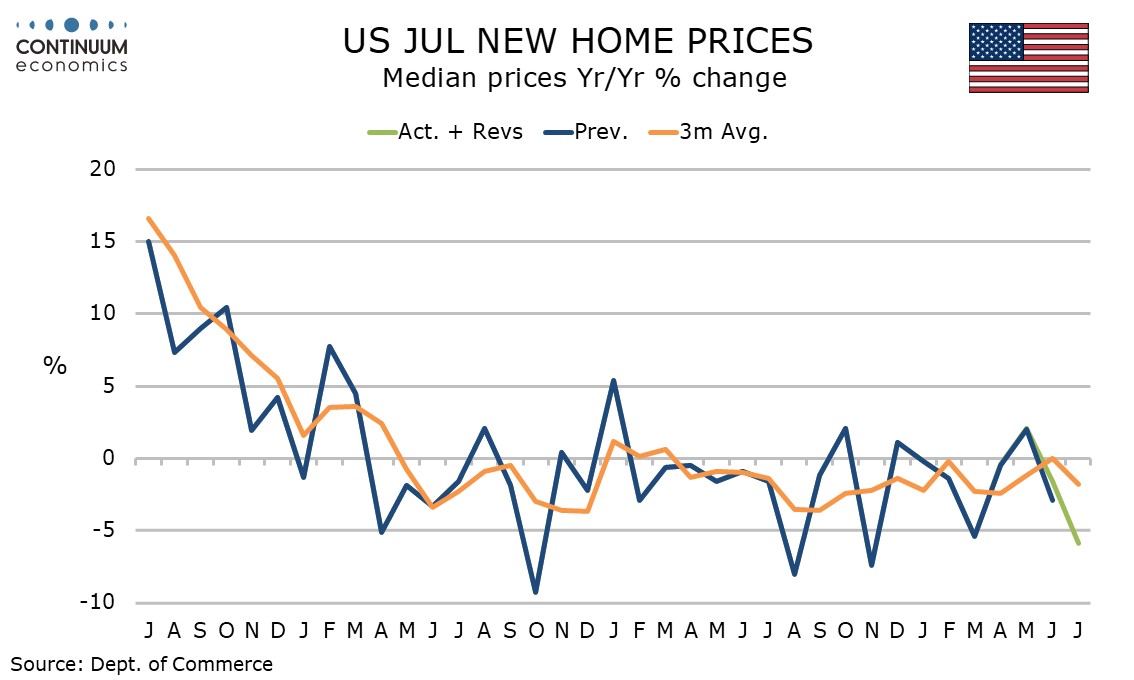

Prices looks soft, the median down 0.8% on the month for a yr/yr decline of 5.9% and the average down 3.6% on the month for a yr/yr decline of 5.0%.