U.S. October Consumer Confidence remains broadly stable if subdued

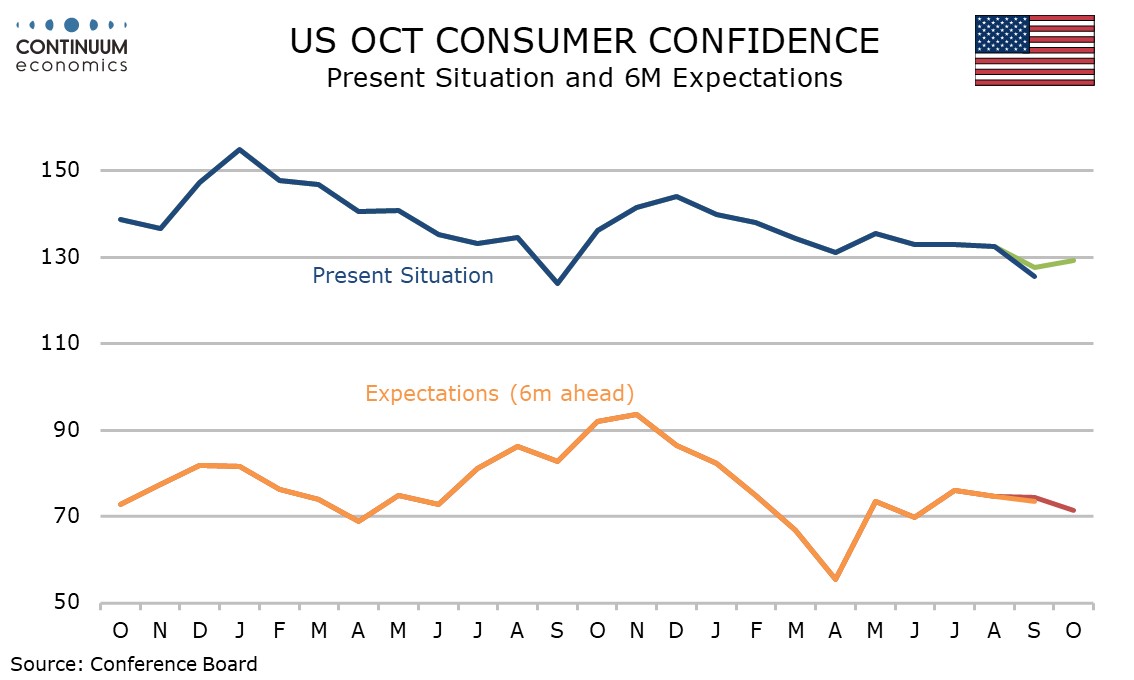

The Conference Board’s Consumer Confidence Index at 94.6 in October is slightly stronger than expected and down from 95.6 in September only because September was revised up from 94.2. Labor market conditions are slightly improved and inflation expectations slightly higher.

The picture remains fairly stable, if quite subdued.

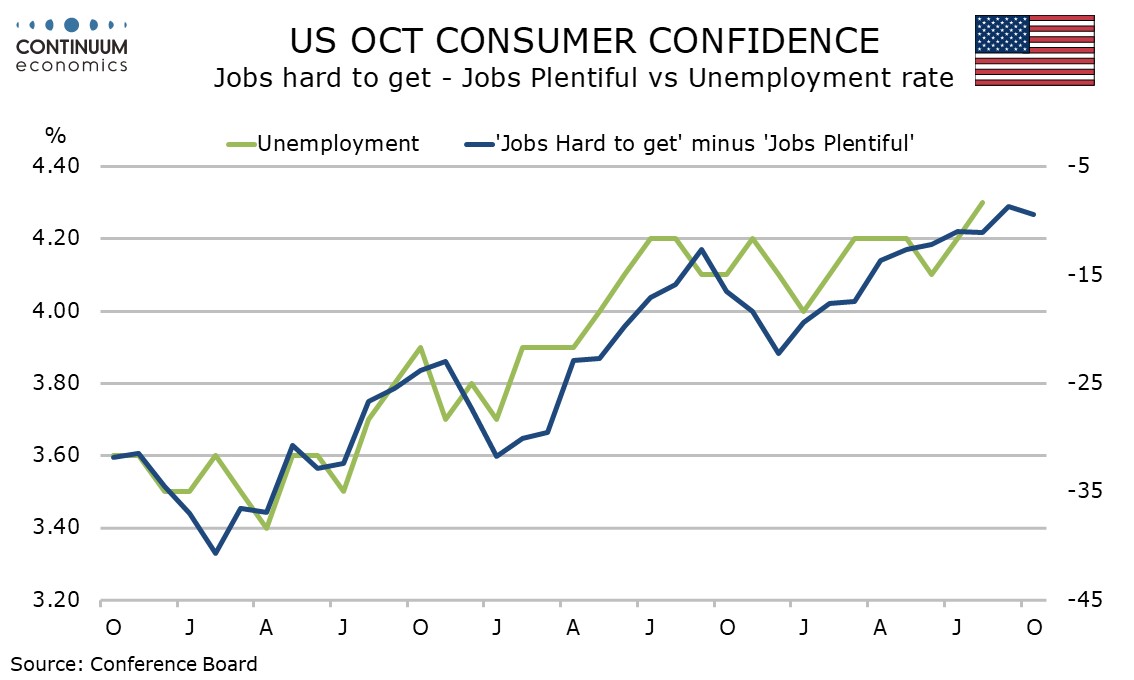

The differential between those seeing jobs as plentiful to those seeing them as hard to get increased to 9.4 from 8.7, though remains above August’s 11.1. This suggests that when we receive October’s non-farm payroll it might one marginally less weak than September’s, which ADP data hints will be negative. Today ADP released a weekly report that hints at marginal employment gains in October.

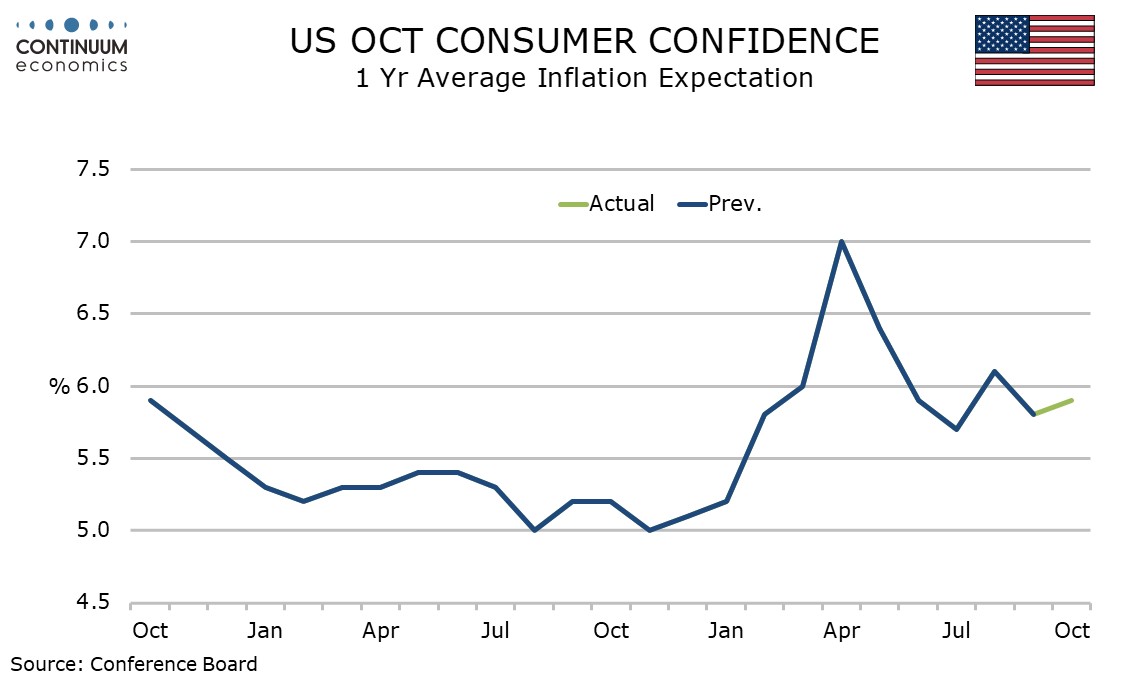

1-year Inflation expectations show the median at 4.8% from 4.7% and the average at 5.9% from 5.8%, the average above the median due to some extreme pessimists who may be politically biased. Both remain below the respective August outcomes of 5.0% and 6.1%.

The breakdown of the composite showed a rise in the present situation, to 129.3 from 127.5, but a fall in expectations to 71.5 from 74.4. Employment may be supporting the former while inflation may be hurting the latter. The ongoing government shutdown may be impacting future expectations more than the current situation.