This week's five highlights

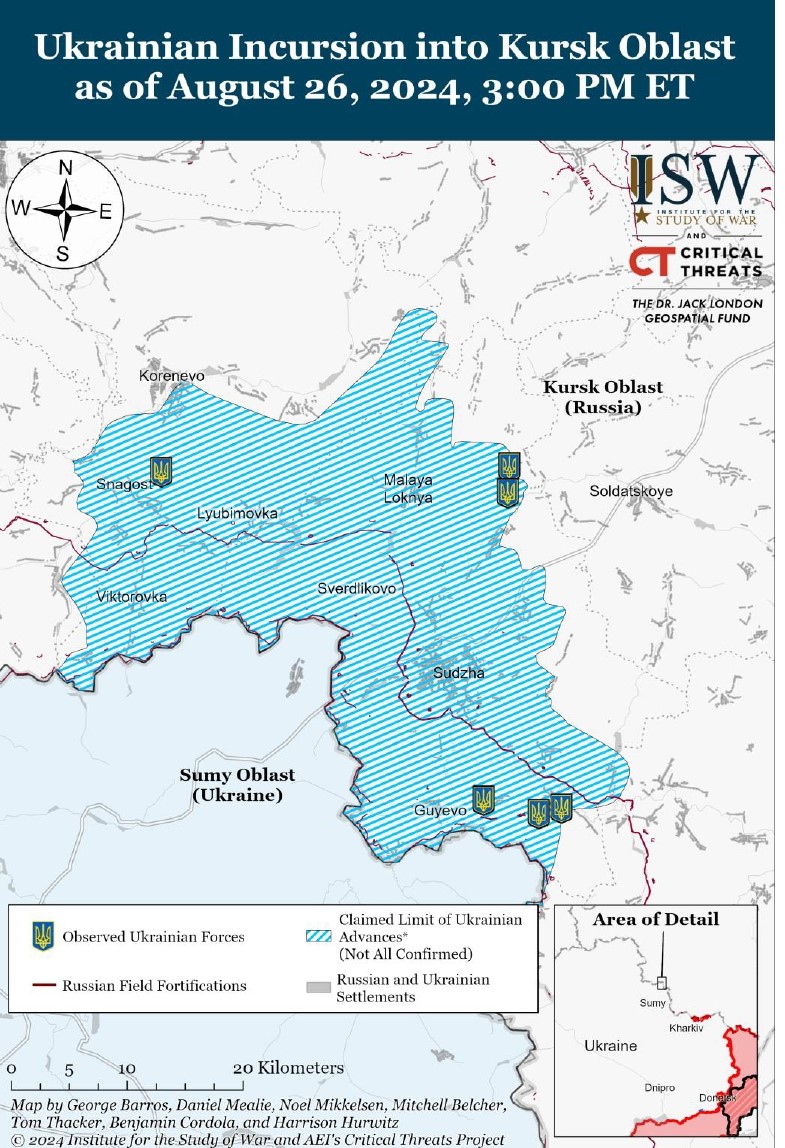

Surprising Ukraine Incursion in Russia Continues

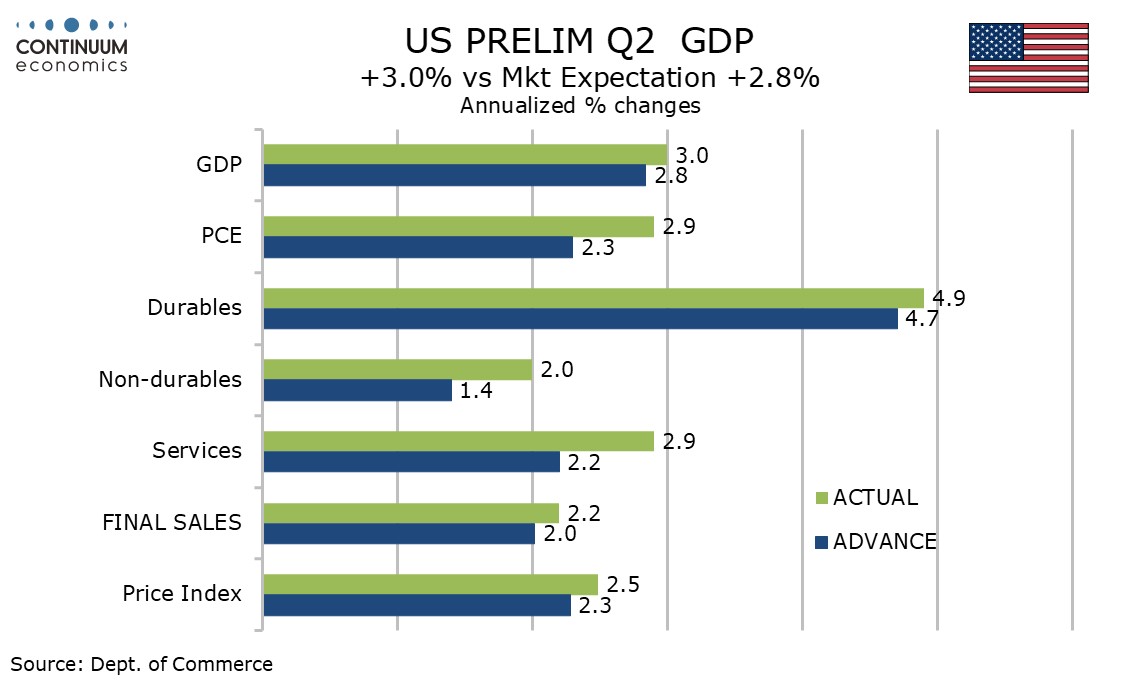

U.S. Q2 GDP revised even higher

German Inflation Back at Target

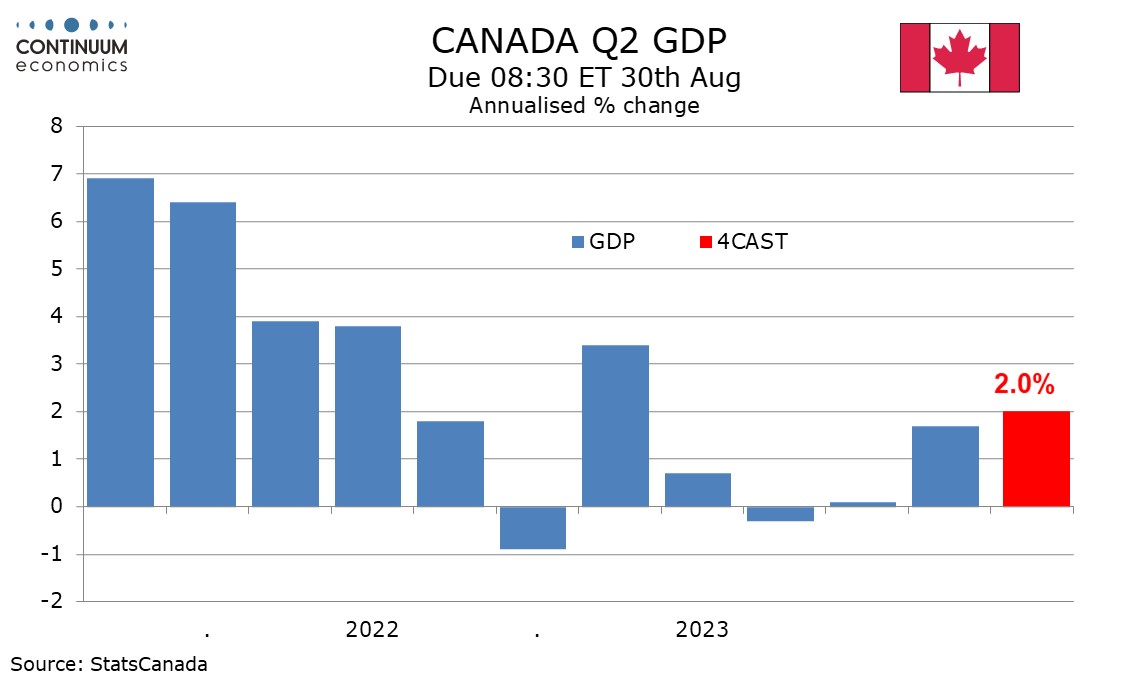

Moderate growth for Canada Q2/June GDP

China Consumer Volatility

Source: Institute for the Study of War (ISW)

Ukraine’s surprise cross-border offensive inside Russia's western Kursk region continues with pace as Ukrainians recently advanced near Sudzha. In response, Russian military deploys forces from lower priority sectors of the frontline in Ukraine to the frontline in Kursk Oblast. We foresee it is still unlikely that Russia will allow Ukrainian forces to go too far, but deploying more men and material to Kursk region will take time and will be slower than expected. As we envisaged, Russia already started stronger missiles and drone attacks into Ukraine territory, as it conducted one of the largest combined series of drone and missile strikes against Ukrainian critical infrastructure to date on August 26 while the use of any tactical nuclear weapons remains unlikely for now. It will likely be hard for Ukraine to sustain the operation whilst Russia continues to bring more artillery and aviation, and it is uncertain whether the operation will be a game changer. The incursion is expected to increase Ukraine’s bargaining position at any negotiations in the future and will likely work as a hedge should Trump is reelected as U.S. president, splits western support and leading to a probable Russia-friendly peace deal, likely in 2025.

Q2 has seen a marginal upward revision to 3.0% from an already strong 2.8% with the revision due to consumer spending, now at 2.9% from 2.3% and maintaining a picture of surprising resilience. Core PCE prices were revised slightly lower to 2.8% from 2.9%. While Q2 GDP is strong a wider advance July goods trade deficit of $102.7bn from $96.6bn is negative for Q3. Initial claims at 231k are slightly down from 233k and do not suggest any further weakening in the labor market.

The upward revision to consumer spending was broad based and unexpected, goods to 3.0% from 2.5% and services to 2.9% from 2.2%. This puts consumer spending well ahead of real disposable income, which was unrevised at 1.0% and that raises questions over how long consumer resilience can persist. Gross domestic income at 1.3% in Q2 (this the first estimate) matched the gain in Q1 and significantly underperformed GDP in Q2. Excluding the revision to consumer spending, GDP revisions were modestly negative, with business investment at 4.6% from 5.2%, housing at -2.0% from -1.4%, and government at 2.7% from 3.1%. Exports were revised down to 1.6% from 2.0% and imports revised up to 7.0% from 6.9%. Inventories also saw a small downward revision.

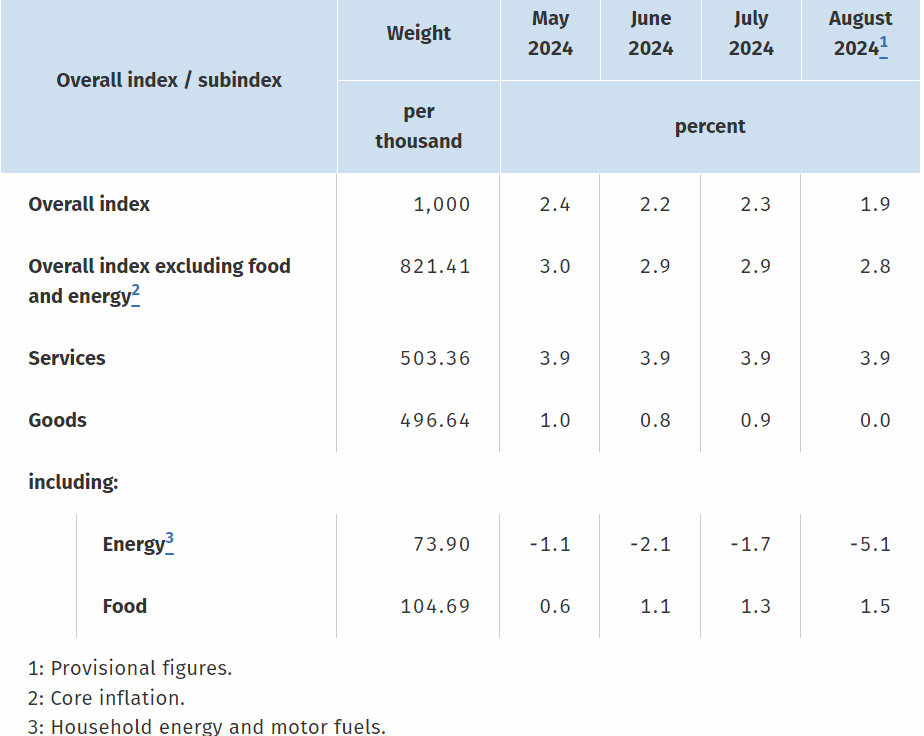

Figure: Inflation at Target?

Source: German Federal Stats Office,

Germany’s disinflation process has not been smooth due to swings in base effects and this was again clearly the case in the August data. After July saw the headline HICP rate rise an unexpected 0.1 ppt to 2.6%, unwinding a third of fall seen in June, it plummeted this month to a 41-month low of 2.0%, ie consistent with the ECB target and well below expectations. Indeed, the CPI counterpart actually fell a notch below 2%, albeit with the core rate on this basis down just 0.1 ppt. Details show stable services and with more negative energy and slightly higher food inflation causing the higher headline outcome.

This German data mirrors weaker than expected Spanish figures today and hints that the EZ HICP flash due tomorrow could also hit the 2% target, a full year earlier than ECB projections suggest. Perhaps the last mile for inflation is not the hardest, after all, for middle distance runners the last mile is often the quickest!

We expect Q2 Canadian GDP to rise by 2.0% annualized, a little above a 1.5% estimate made with the Bank of Canada’s July Monetary Policy Report and s second straight quarter of moderate growth after a near flat second half of 2023. We expect a 0.1% increase in June GDP, in line with a preliminary estimate made with May’s GDP report. We expect domestic demand to also rise by 2.0% annualized, slightly slower than Q1’s 2.9% despite GDP seen marginally accelerating from 1.7% in Q1. We consumer spending also rising by 2.0%, with the gain in investment set to be slightly stronger but government to rise by slightly less. We expect a negative contribution of 0.7% from net exports, with Q2 data showing exports slightly down in real terms but imports slightly higher. We expect the negative from net exports to be offset by a matching positive from inventories, correcting a larger negative contribution in Q1.

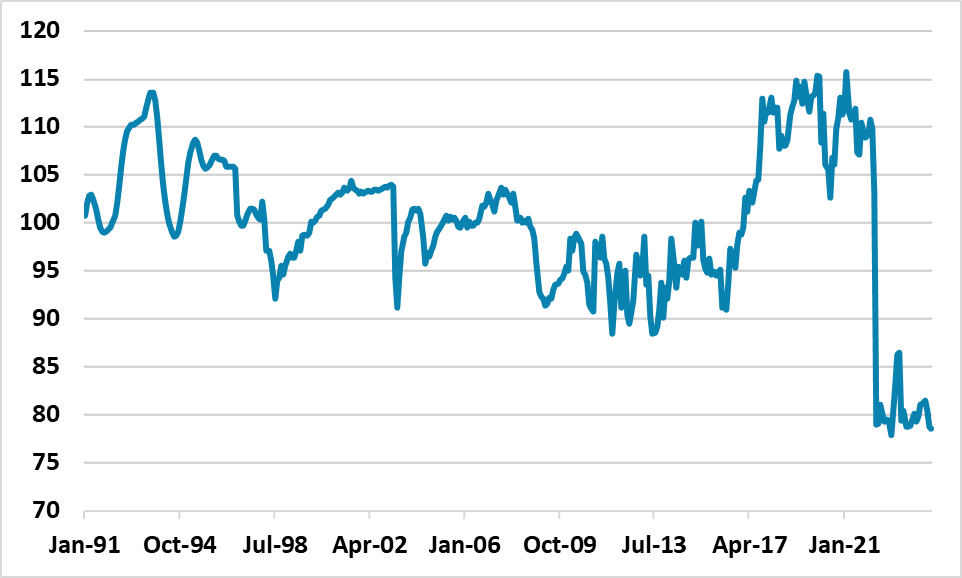

Figure: NBS China Consumer Confidence (1991 = 100)

Source Datastream/Continuum Economics

China consumption patterns are divergent; slowing and becoming more volatile at a sub sector level. Less certainty over new employment and wage growth, plus wealth worries over housing are some of the causes. We forecast GDP to slow in H2 and be 4.0% in 2025.

China’s consumption is vital to growth when production is transitioning from old economy dependency on residential investment, steel, cement and other industries. The problem is that China consumer are in a volatile mood. The breakdown of the retail sales numbers suggest that post COVID pent up demand is still providing a boost helped by restaurant services and tourism. However, furniture and household appliance sales are weak, auto sales soft and the luxury industry not seeing the same buying demand from China’s consumers. PDD a major e commerce provider has just reported weak revenue and profits (here), despite targeting budget focused consumers. Finally, consumer confidence is weak (Figure 1). One issue is income for China consumers, where consumers views have deteriorated. This is a combination of private sector companies slowing hiring; some construction related wages stalling or falling plus unevenness in rural to urban migration (that traditionally boosts income and consumption for a sub sector).