U.S. May Housing Starts and Permits, Weekly Initial Claims - Trends weakening

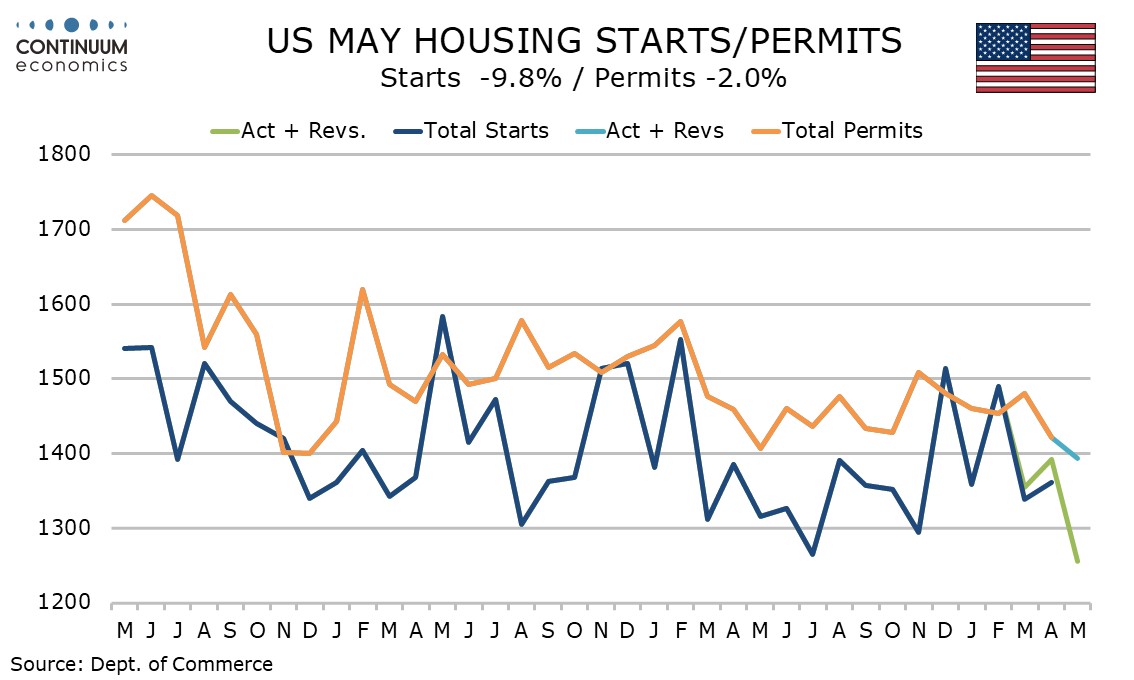

May housing starts with a 9.8% decline to 1256k are well below expectations and the weakest since June 2020 through a 2.0% fall in permits, also below consensus, suggests a fairly moderate weakening in trend. Initial claims at 245k from 250k and continued claims at .945m from 1.951m are slightly lower but trend has moved higher in recent weeks.

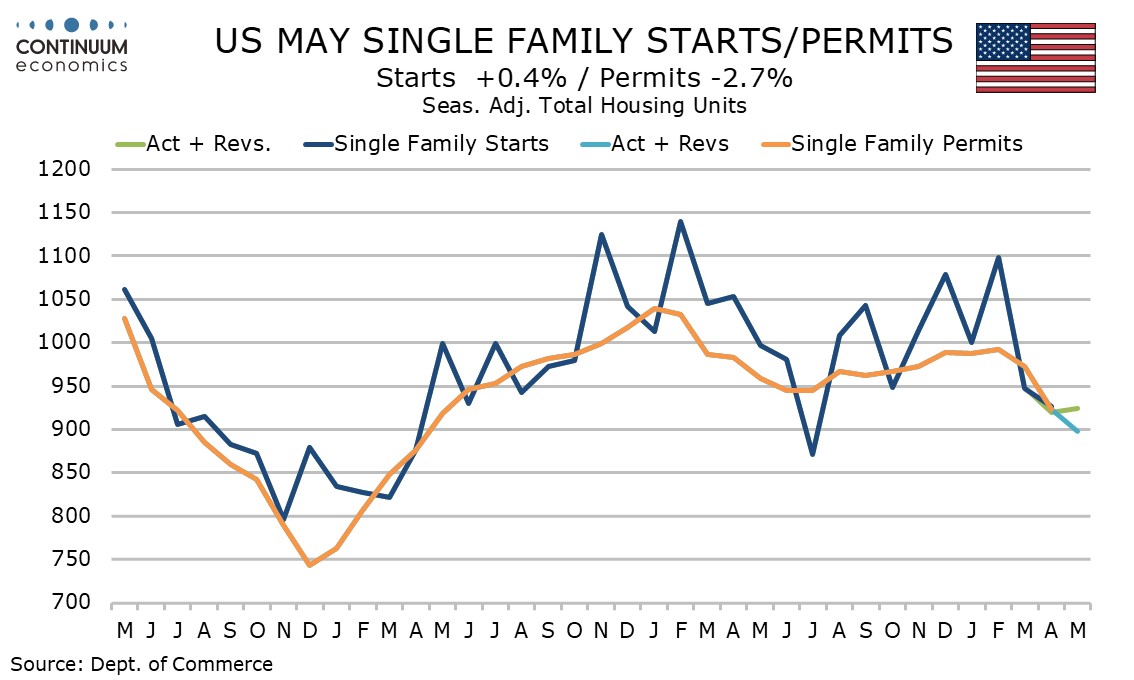

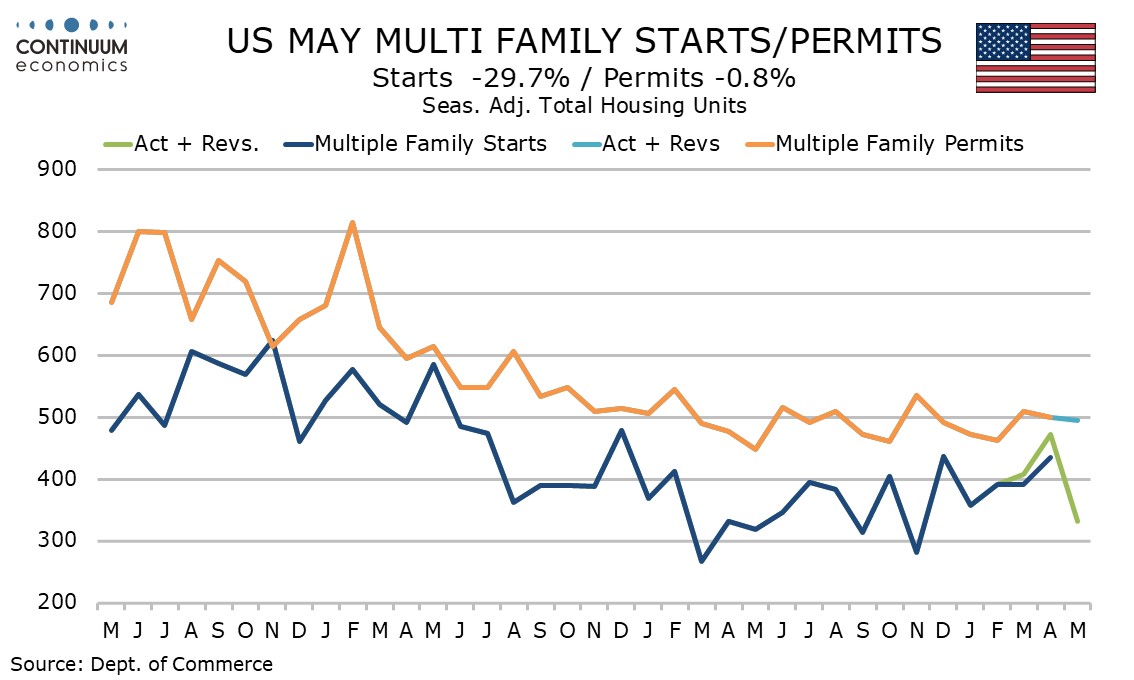

The housing starts plunge was exaggerated by a 29.7% fall in multiples that followed a 16.0% increase in April. Single starts actually increased by 0.4% though this follows a 3.0% decline in April.

Permits showed a 2.7% fall in singles to follow a 5.0% drop in April which suggests a weakening of trend, being a third straight decline. Multiple permits fell by 0.8% after a 2.0% decline in April.

Housing sector data has for the most part been quite soft, particularly May and June data from the NAHB homebuilders’ survey. A strong rise in April new home sales contrasts tis picture and will be difficult to sustain.

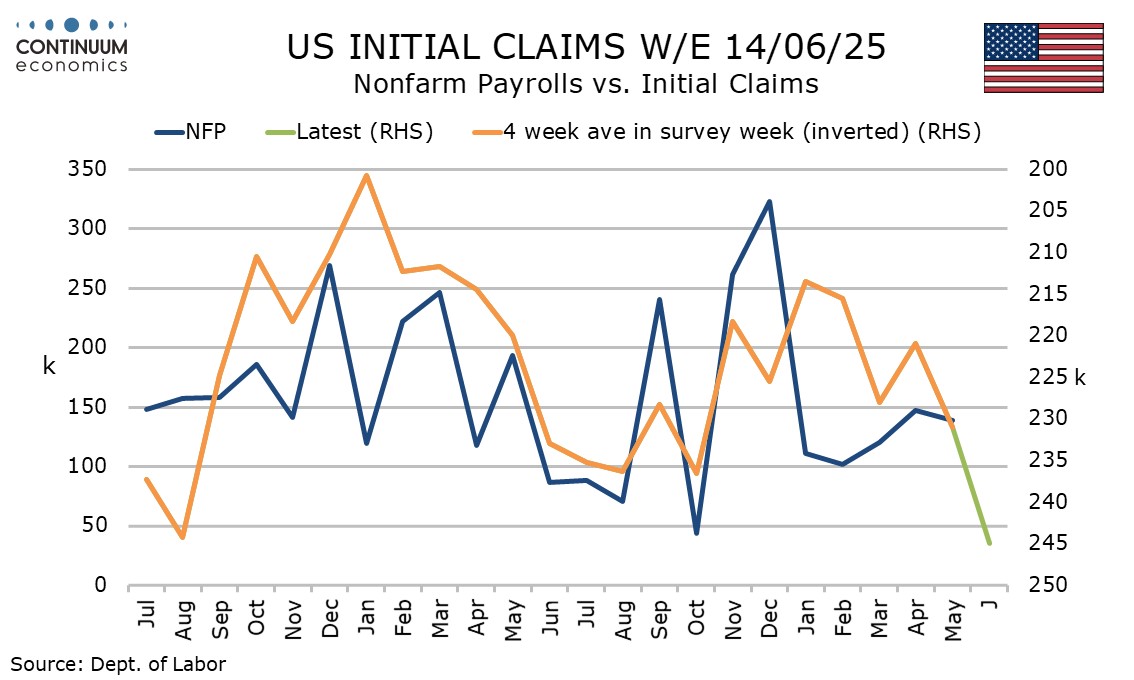

The latest initial claims data covers the survey week for June’s non-farm payroll. The 4-week average of 245.5k compares to 231k in May’s survey week and is the highest since August 2023. Continued claims cover the week before initial claims. Its 4-week average of 1.926m is the highest since December 2021.