Preview: Due March 24 - U.S. March S&P PMIs - Manufacturing correct lower, Services to correct higher

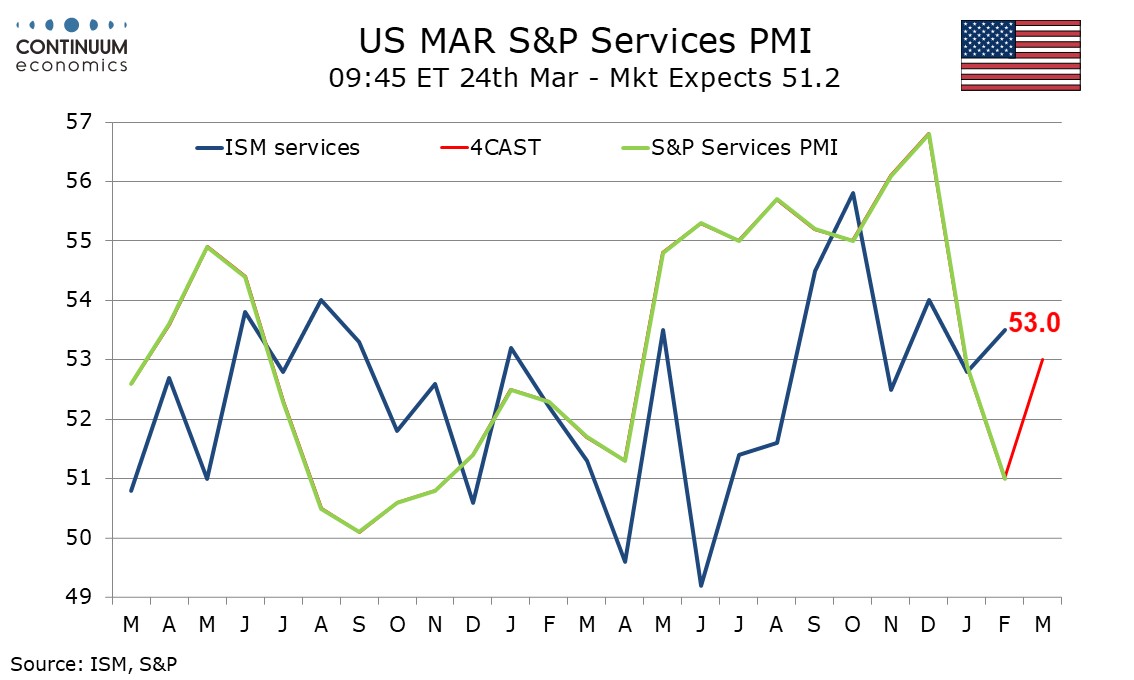

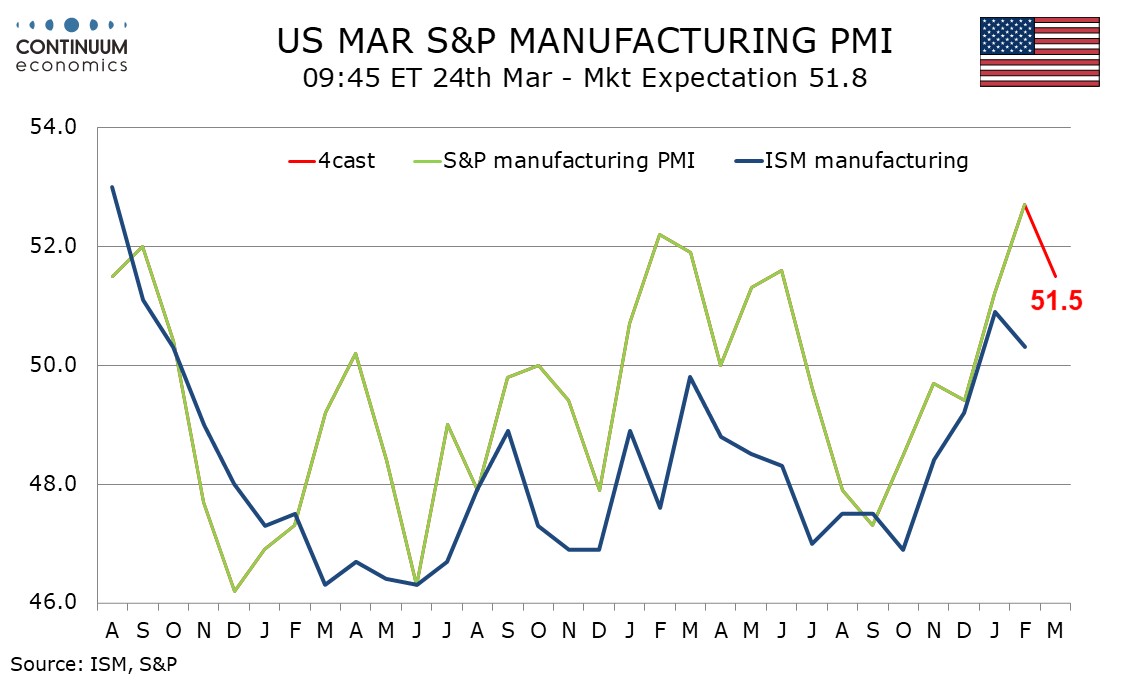

We expect March’s S and P PMIs to show manufacturing slipping to 51.5 from February’s 52.7, which was the highest since June 2022, but services picking up to 53.0 from 51.0 in February, which was the weakest since November 2023.

The S and P manufacturing index moved above the neutral 50 in January for the first time since June 2024, a move that was backed by the ISM manufacturing index. The S and P index continued to improve in February, but the ISM manufacturing index slipped back while remaining above neutral, and trade tensions are a downside risk. An upturn in the S and P manufacturing index in early 2024 peaked in February. Early 2025 may prove similar.

The S and P service index saw a significant move below the positive preceding trend in January, which was backed by the ISM services index, but further slowing in the S and P index in February was not backed by the ISM’s. Bad weather may have been an issue in January and February and despite storms in the South, should be less of a concern in March. The S and P Services data also appears sensitive to interest rates and recent declines in bond yields may be supportive.