This week's five highlights

Tariff man Strikes Auto

USD/JPY Rose on its Mark

Norges Bank's Policy Easing Delayed but Far From Abandoned

UK Inflation Slips Even as Services Fail to Soften

Bank of Canada March Minutes Debate over the 25bps easing

The 25% tariffs on cars underlines that tariffs are not just about getting better trade deals, but in Trump’s view raising (tax) revenue and trying to shift production back to the U.S. Combined with other tariffs being implemented, plus policy uncertainty, we see a moderate overall hit from tariffs on U.S. GDP and a boost to inflation.

President Donald Trump 25% car tariff shows that he is interested in raising tax revenue from tariffs and shifting production back to the U.S., with better trade deals not featuring in the list of objectives. Trump noted that his is against exemptions, which will disappoint Japan that thought it had a chance due to its good relationship with the U.S. Japan, EU and S Korea GDP will be hurt by the move by a small amount, as it will likely led to less sales into the U.S. Car parts are also covered from May.

The 25% tariffs on cars from April 3 does have a caveat for Mexico and Canada if covered under the USMCA, with the tariff then only applying to non U.S. content – see White House factsheet. This caveat still means a hit to Mexican and Canada cars and undermines the competitiveness of exporting some cars to the U.S.

As a big auto exporter, Japan is one of the countries that will be significantly affected by the latest U.S. tariff. The BoJ was tilted to more tightening in the coming quarters as inflationary pressure mounts but the auto tariffs will be negatively affecting Japanese economic growth, which may push BoJ's tightening further. After the initial risk off haven bids, we are seeing the JPY softens as the possibility of an imminent hike from BoJ dims in market participants' eyes.

On the chart, the pair bounced at the 150.00 level see pressure returning to resistance at the 151.00/30 highs. Daily studies still tracking higher and suggest scope for break here to extend gains from the 146.54, 11 March YTD low, to further retrace losses from the January high. Higher will see room for extension to the 152.00 congestion. Meanwhile, support is raised to the 150.00 level which should underpin and sustain bullish gains from the 146.54 low. Bbreak will open up room for retest of the support at 148.55 and the 148.00 congestion.

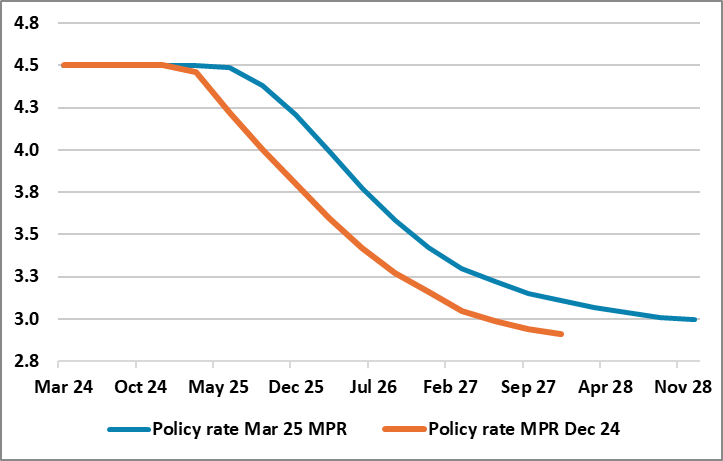

Figure: Policy Easing Deferred

As was perhaps just the more likely case, the Norges Bank did not deliver on the rate cut it had been flagging very clearly until recently. Instead, it kept the policy rate at 4.5% on the back of inflation having been markedly higher than expected and where wage growth in 2024 turned out higher than projected. But in a clearly far from hawkish signal, policy easing is still seen starting this year and where the outlook still sees similar easing cycle to that previously envisaged but merely some 4-6 months later. Indeed, gripped possibly by weaker real economy data and the risk of global trade tensions, the Norges Bank has revised down its GDP outlook to a degree that a much larger output gap emerges. Thus helps bring inflation (now very much overshooting) back towards target but only 2-3 years hence according to the Norges Bank. We think that the circa 4% rate projected by year end is too high against these justifiable risks and that a rate well under 4% is more likely.

Clearly, inflation has moved further above target, but has been boosted by a series of one-offs and also by the CPI basket re-weighting. The question was whether the (hawkish) Norges Bank judged price pressures appear to be more persistent than it previously assumed – this does not seem to be the case. Indeed, amidst a significant reassessment, does not really seem to have altered the Boards (admittedly hawkish)’ mindset. It thinks that the output gap has narrowed, and output is now close to potential. But this is set to change as GDP growth is pared back to just over 1% in the next three years, this accentuating an ever-clearer output gap.

As for that outlook, the Norges Bank also worries about business costs, but has noted previously two-sided risks around it, encompassing the risk of an increase in international trade barriers but with less overt concern about the weak currency once again. The worry is that higher tariffs will likely dampen global growth, but the implications for price prospects in Norway are uncertain. We still see some 100 bp of rate cuts in 2025 – ie likely to be more than 50 bp greater than the Norges Bank is advertising and at least the same amount of cuts in 2026!

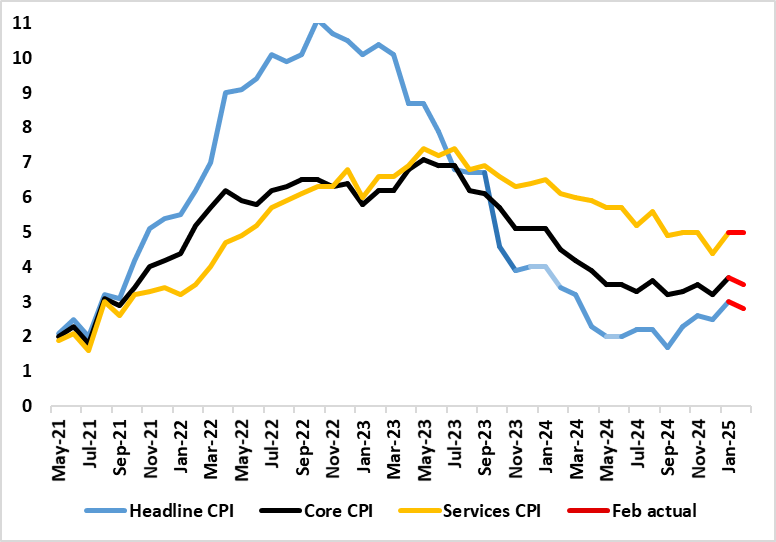

Figure: February Inflation Slips Back But Not Broadly?

Not surprisingly, February’s CPI data provided mixed signals. They may have undershot expectations, but actually tallied with our and BoE thinking, at least in terms of a 0.2 ppt drop for both the headline to 2.8% and for the core to 3.5%. This came in spite of higher alcohol duties and no drop in services, the latter pulled higher by mobile phone costs, with good inflation actually softening instead, based around clothing inflation turning negative for the first time since the midst of the pandemic in 2021 – possibly a fresh sign of consumer weakness? Also notable was the first clear drop in rent inflation in the current cycle – also possibly a sign of the economy weakness. But with price pressures falling in just three of the 12 CPI components, the data hardly will soften worries bout price resilience among some MPC members, especially core inflation has basically moved sideways in the last 6-9 months.

January’s CPI numbers showed a marked bounce back up, and with the 0.5 ppt rise taking it to a 10-month high of 3.0%, this being above consensus and BoE thinking. Notably services jumped from 4.4% to 5.0%, actually below expectations, having been driven higher by a swing in airfares and the rise in school fees, bit with further upward pressure evident in rents too. We think some of this services pressure was noise but it continues into February with airfares failing to fall back as expected.

The January CPI data added to worries about a fresh spike in price pressures having emerged, albeit with it unclear the extent to which pandemic-induced changes in seasonal price patterns have acted to make the CPI backdrop much more volatile. Certainly the data were not helped by an increase in the weighting of (currently high) services and a lower setting for (currently soft goods). Notably, these CPI data come after more apparently perturbing wage data, although we think that there are actually signs that companies are reacting to labor costs pressures by curbing jobs as a means of trying to raise prices. This explains our still optimistic outlook regarding prices. In this regard tentative evidence about softer clothing prices and a drop in rental inflation could be seen as signs current economic weakness taking a toll on price pressures and company pricing power

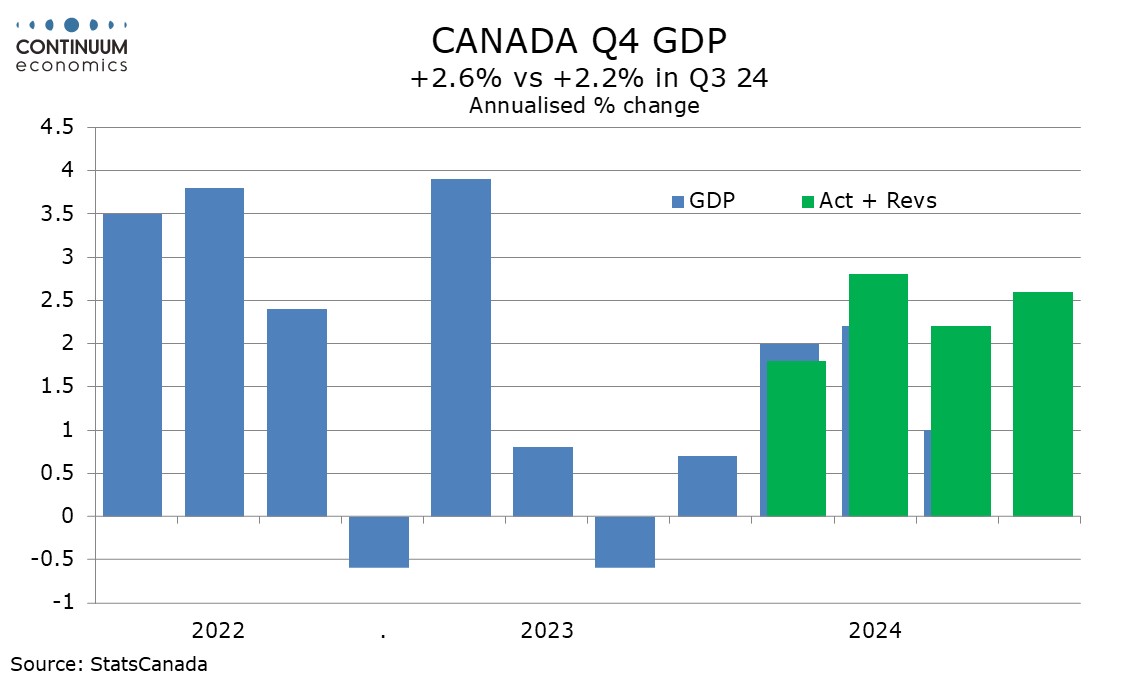

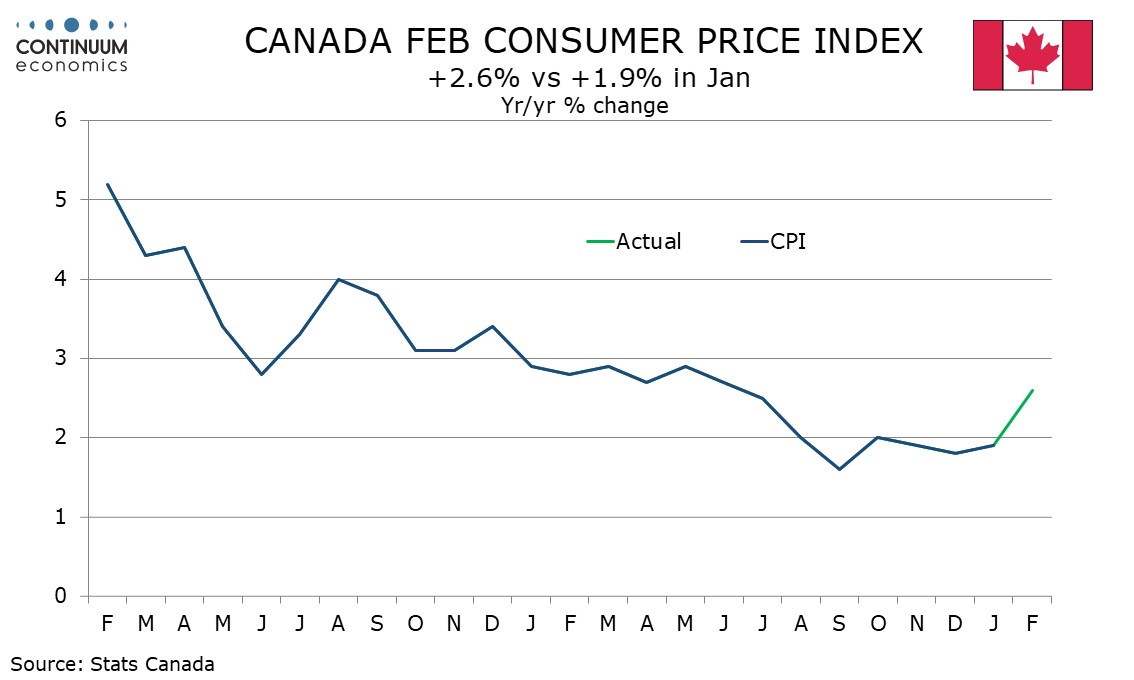

The Bank of Canada has released minutes from its March 12 meeting, and these show some debate about the meeting’s decision to ease by 25bps to 2.75% and agreement to proceed carefully with further changes to policy. A lot can happen before the BoC next meets on April 16, but these minutes suggest rates are more likely to be kept on hold at that meeting. The minutes note a stronger than expected 2.6% annualized increase in Q4 Canadian GDP, with significant upward back revisions, and members were encouraged by labor market developments. A stronger than expected 1.9% increase in January CPI was also noted, though members noted that shelter was the only component above its historical average. Members agreed that the new data had shifted the balance, with less risk of lower inflation outcomes, and agreed that in the absence of tariff-related uncertainty, the rate would have been left at 3.0%. Since the meeting February CPI also came in stronger than expected, accelerating to 2.6%.

The risks associated with the tariff threat were considered in detail, with surveys suggesting a consequent reduction in hiring and increased pessimism from both consumers and businesses. There was a difference opinion into the implications of this, with some cautious about reading too much into survey evidence but others stressing the consistency and size of the survey deteriorations. Some argued for holding rates at 3.0% until there was greater clarity, while others felt that the outlook had changed sufficiently to justify the further easing that was delivered. There was agreement that forward guidance would not be appropriate.