Preview: Due October 15 - Canada September CPI - To fall below 2% overall, but with pause in BoC core rates

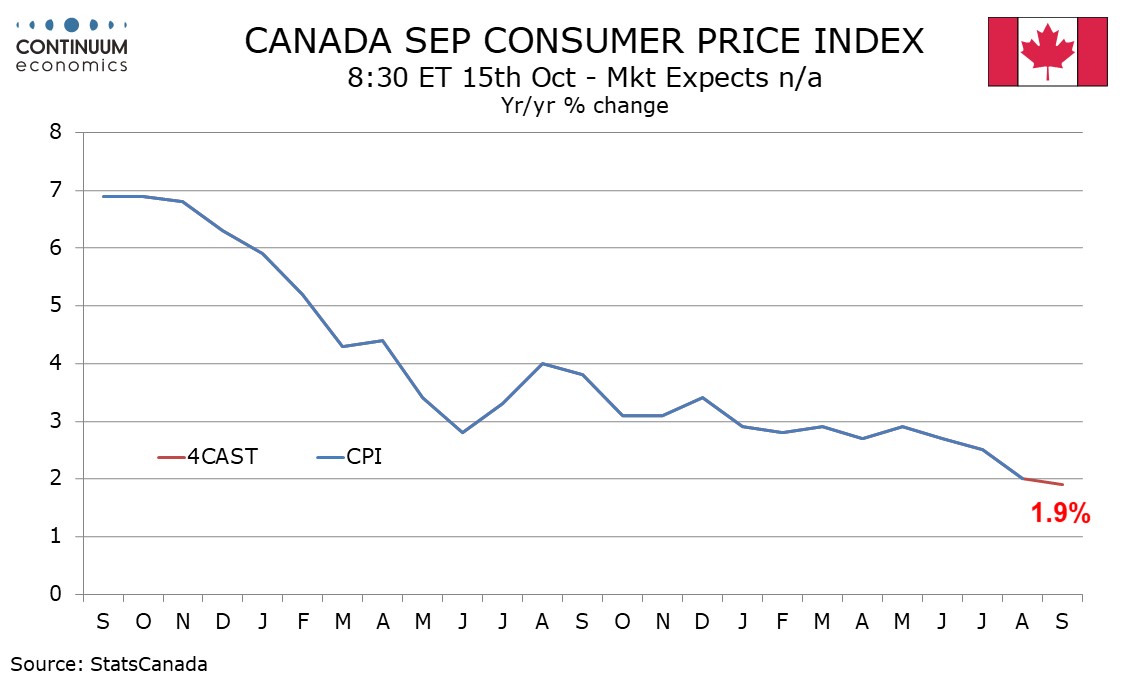

We expect September Canadian CPI to slip to 1.9% yr/yr from 2.0% on weaker gasoline prices, reaching its slowest since February 2021. However we expect the downtrend in the Bank of Canada’s core rates to see a temporary pause as weak data a year ago drops out.

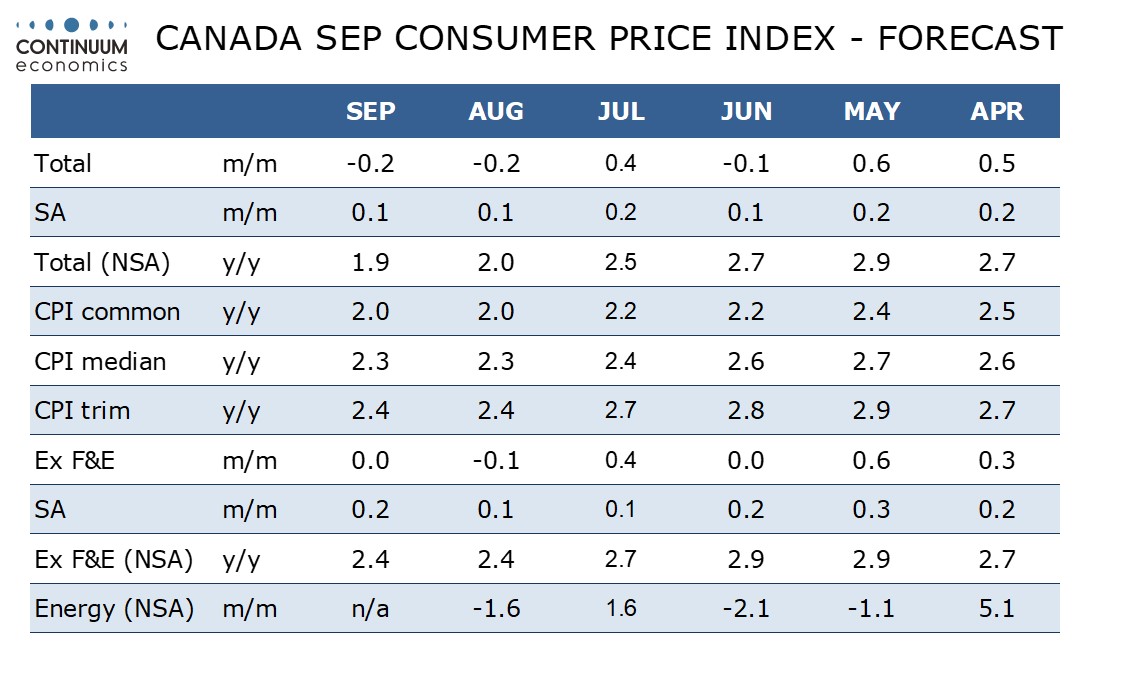

Seasonally adjusted we expect a second straight 0.1% increase on the month overall with a 0.2% increase ex food and energy, the latter slightly stronger than 0.1% gains seen in July and August but still acceptably subdued. Before seasonal adjustment we expect CPI to fall by 0.2% overall with an unchanged outcome ex food and energy.

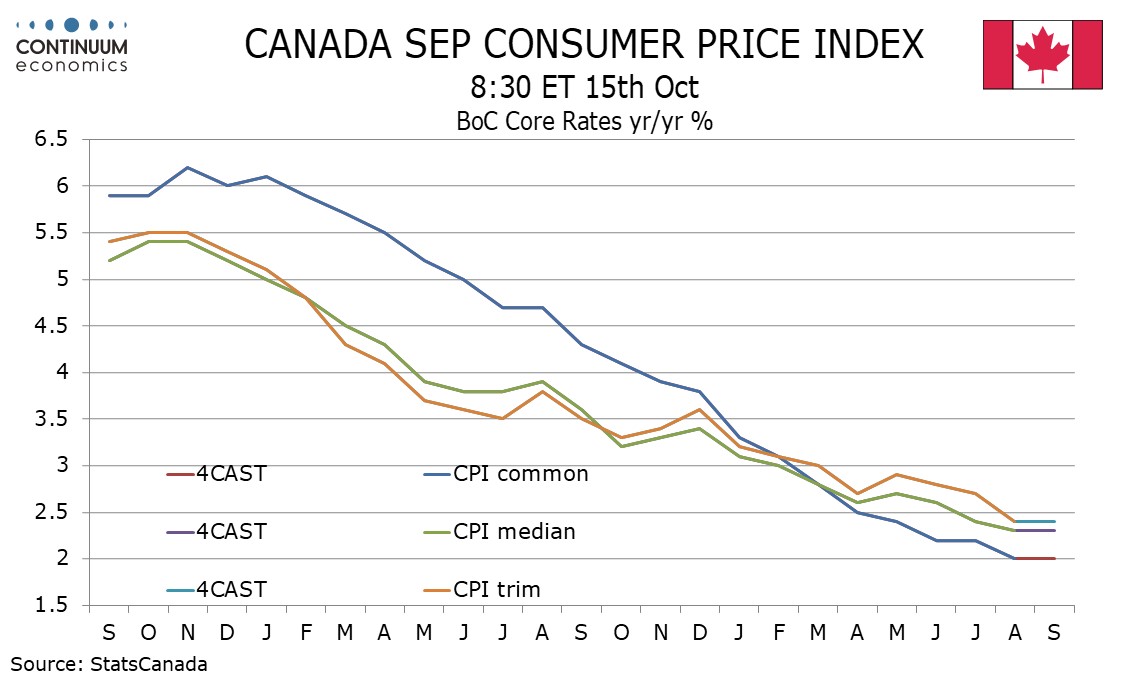

We expect the ex food and energy yr/yr pace to be unchanged from August at 2.4%. The ex food and energy rate is not one of the BoC’s three core rates, though we expect each of these to be unchanged from August too, at 2.0% for CPI-Common, 2.3% for CPI-Median and 2.4% for CPI-Trim.

This will be the first time since May in which there will be no downward progress on average in the core rates. May 2023 saw a particularly steep dip in the core rates, limiting the scope for progress in May 2024. September 2023 also showed a steep dip in the core rates, which we expect will prevent further progress in September 2024.