This week's five highlights

U.S. November Employment To Rebound from October's hurricanes and strike

U.S. Initial Claims up but still low, narrowing in Trade Deficit may be temporary

U.S. November ADP Employment Mostly strong despite weak manufacturing

USD/JPY Chops Around

A Political Crisis But Not (Yet) a Fiscal One for France

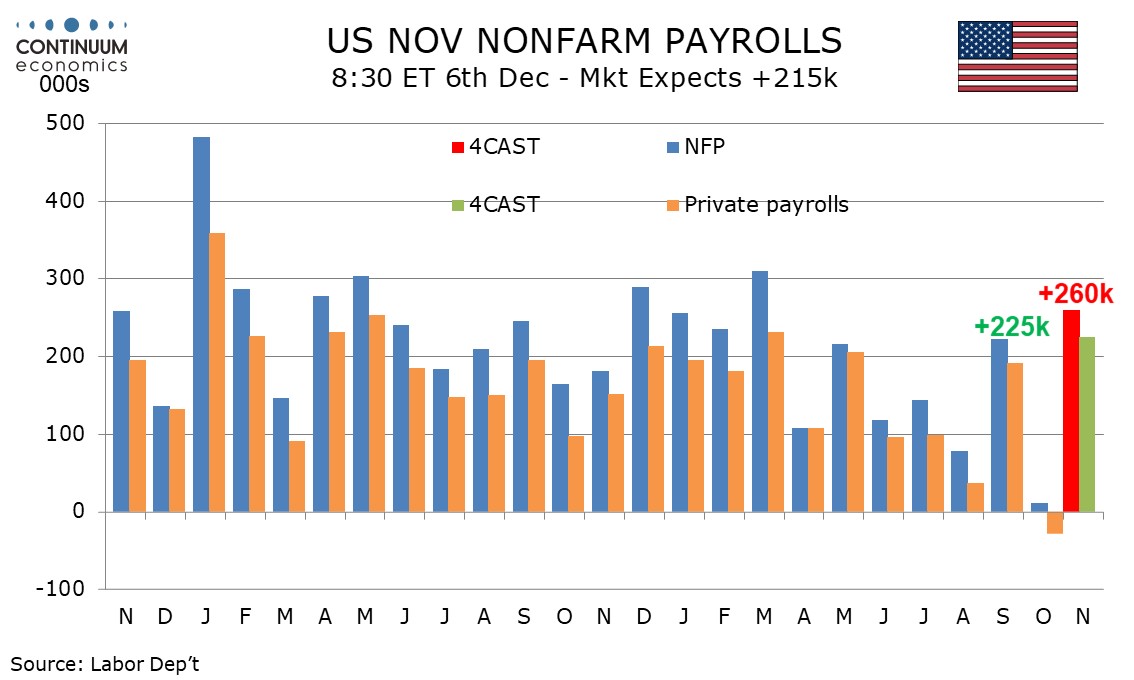

We expect an above trend 260k increase in November’s non-farm payroll, with 225k in the private sector. This will follow weak October outcomes of up 12k overall and down 28k in the private sector, depressed by two hurricanes and a strike at Boeing. We however expect unemployment to be unchanged at 4.1% for a third straight month and a slightly lower 0.3% increase in average hourly earnings. The two month non-farm payroll averages would then stand at 136k overall and 98.5k in the private sector. In September the 3-month averages were slightly stronger than this, at 148k and 109k respectively. We expect manufacturing to increase by 40k after a 46k October decline that was largely due to a now settled strike at Boeing.

How much October’s payroll was influenced by Hurricanes Helene and Milton is hard to say, but initial claims saw a significant spike after Hurricane Helene in early October and Hurricane Milton arrived in the survey week for October’s non-farm payroll. Initial claims have since fallen to see their lowest level since April but continued claims have not seen a similar dip. While the unemployment rate was unchanged at 4.1% in October both the labor force and employment saw significant dips, suggesting some impact from the hurricanes. We expect both series to bounce in November, though employment to rise by more. Before rounding we expect an unemployment rate of 4.11%, down from 4.145% in October but above September’s 4.052%.

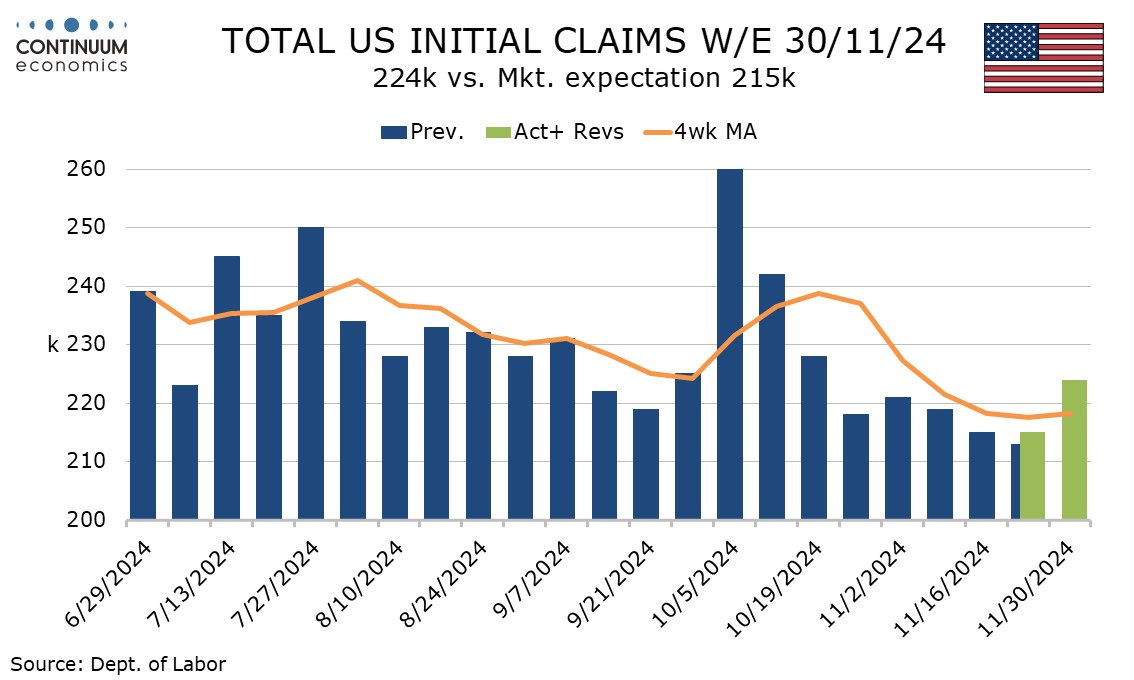

Initial claims at 225k are a little higher than expected after two weeks at 215k (last week was revised up from 213k which was the lowest since April). The level is still low and it is possible that seasonal adjustments for the Thanksgiving holiday influenced the latest weekly data. The survey week for November’s non-farm payroll came two weeks ago and the dip in claims in early November after hurricane-induced gains in early October suggest a rebound in payrolls from October’s weak outcome.

Continued claims ae lower than expected with a 25k fall to 1.871m. Recently continued claims had been continuing to trend higher despite initial claims falling, but this latest data suggests continued claims are slipping too, a sign of jobs being created in addition to layoffs being low. October’s trade deficit of $73.8bn is a little lower than expected, and down from $83.8bn in September, which was revised lower from $84.4bn, the revision led by an upward revision to September’s services surplus.

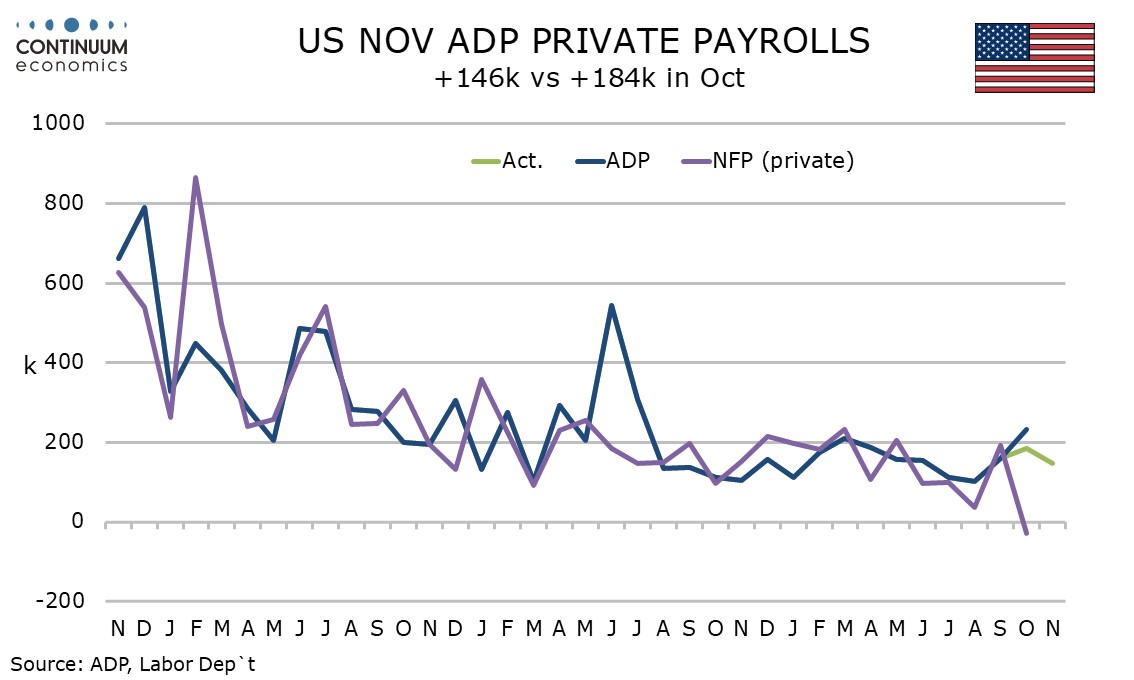

ADP’s November estimate for private sector employment growth of 146k is in line with expectations and a modest slowing from October’s 184k (revised down from 233k). Trend still looks solid and it appears that October’s weak non-farm payroll which saw a 28k decline in the private sector reflects temporary factors from hurricanes and a strike at Boeing, and a bounce back above trend is likely. ADP data tends to be less sensitive to weather than the non-farm payroll. November ADP data shows a 26k decline in manufacturing suggesting that an October decline in ADP manufacturing data was not caused by the Boeing strike. ADP’s manufacturing data is surprisingly weak.

Construction with a 30k increase looks solid, as do services, led by a 50k rise in education and health. ADP sees financial services and leisure/hospitality as soft, but both managed gains, of 5k and 15k respectively. One surprising area of strength in the ADP data was an acceleration in wages. Yr/yr growth for job stayers of 4.8% from 4.6% saw the first rise in 25 months while gains for job changers bounced to 7.2% from 6.2% in October. While there may be a few areas of weakness, the labor market looks firm overall.

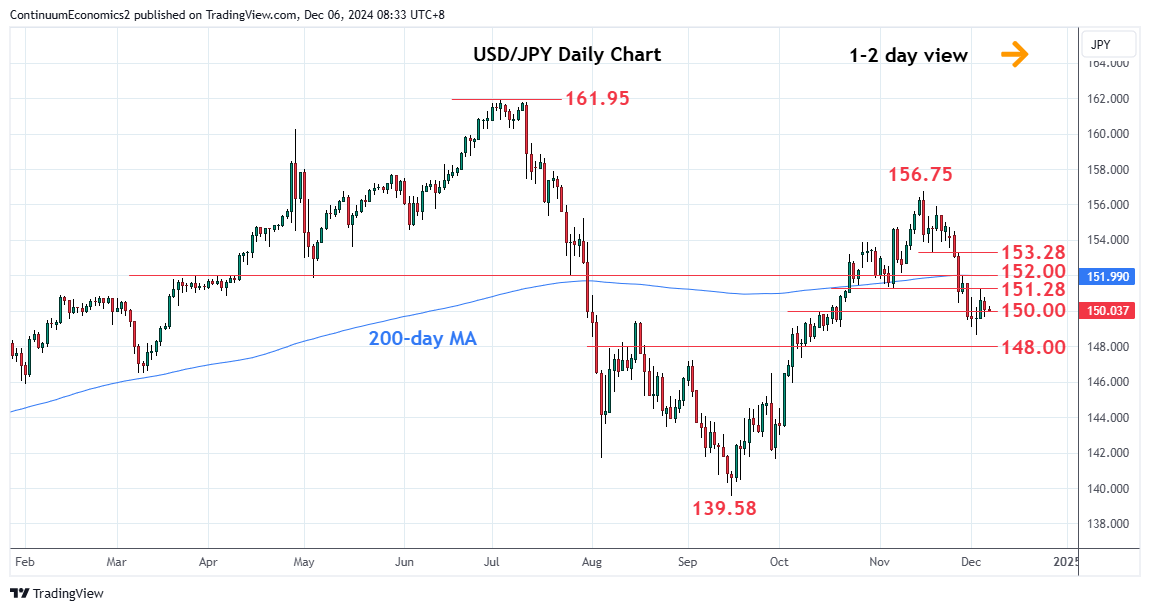

USD/JPY has been chopping around this week after market participant begin to price in the possiblity of a hike in December from the BoJ but was unsure about it. The BoJ has been sending mixed signal, from Ueda's supportive remark on wage push inflation to doves saying unsure about sustainability of wage growth. Combined with the fact that the BoJ has been surprising the market for the past two years and little forward guiding, market participants are being cautious in taking a step too big.

On the chart, the pair is extending consolidation around the 150.00 level following bounce from the 148.64 low. Positive daily studies suggest scope for retest of the 151.28 and where break will open up stronger corrective bounce to the 152.00 level. Gains beyond this, if seen, will turn focus to the strong resistance at 153.28. However, corrective bounce expected to give way to renewed selling pressure later and below the 150.00 level will expose the 148.64 low to retest. Lower will open up room to support at the 148.15/00, 50% Fibonacci retracement and congestion area.

With a parliamentary no-confidence vote having toppled the Barnier administration convincingly, France has no government. This far from unexpected development is a political crisis and one that even without the fiscal cuts that the failed Budget envisaged is likely to mean that the country also faces an increasing economic predicament. But with President Macron able to use so-called ‘special powers’ to fund the government for the time being, France does not (yet) face a fiscal crisis.

Meanwhile Macron is likely to try and nominate a new prime minister but also could resort to a technocratic administration led by a non-political figure. But the irony is that the left and right parties that combined to unseat PM Barnier on the basis of a budget they suggested was too fiscally restrictive may still mean that the electorate will still face a tighter fiscal stance. Indeed, special powers which will probably involve rolling over the 2024 budget will increase effective tax-takes due to a lack of indexing while holding government spending constant in nominal terms implies clear real-term cuts.

Admittedly, it is unclear what this may mean for the budget deficit, but with it likely that debt servicing costs will have to rise, a fiscal hole in the coming year is unlikely to be much different to the 6% of GDP gap seen for this year and thus far above the 5% goal of the Barnier Budget plan.

Regardless, prolonged political deadlock is likely to continue being the order of the day as Macron is likely to resist pressure to step down and call an early presidential election before the end of his term in 2027. Indeed, forming any stable and even minority administration is going to remain complicated further as the three main parliamentary factions are all being driven by the looming 2027 presidential election, most notably far-right Le Pen and far-left leader Jean-Luc Mélenchon. The president is due to address the nation on Thursday night to explain the way forward. But whatever he suggests, it is likely that France may remain in a political impasse until at least next July when new parliamentary elections can then take place. But with the electorate very much sectioned into three factions, a stable government even then is unlikely; after all, three into two does not go! All of which suggest a fiscal crisis or crunch, which may be avoidable for the time being, could occur in H2 next year.