Preview: Due August 30 - Canada Q2/June GDP - A second straight quarter of moderate growth

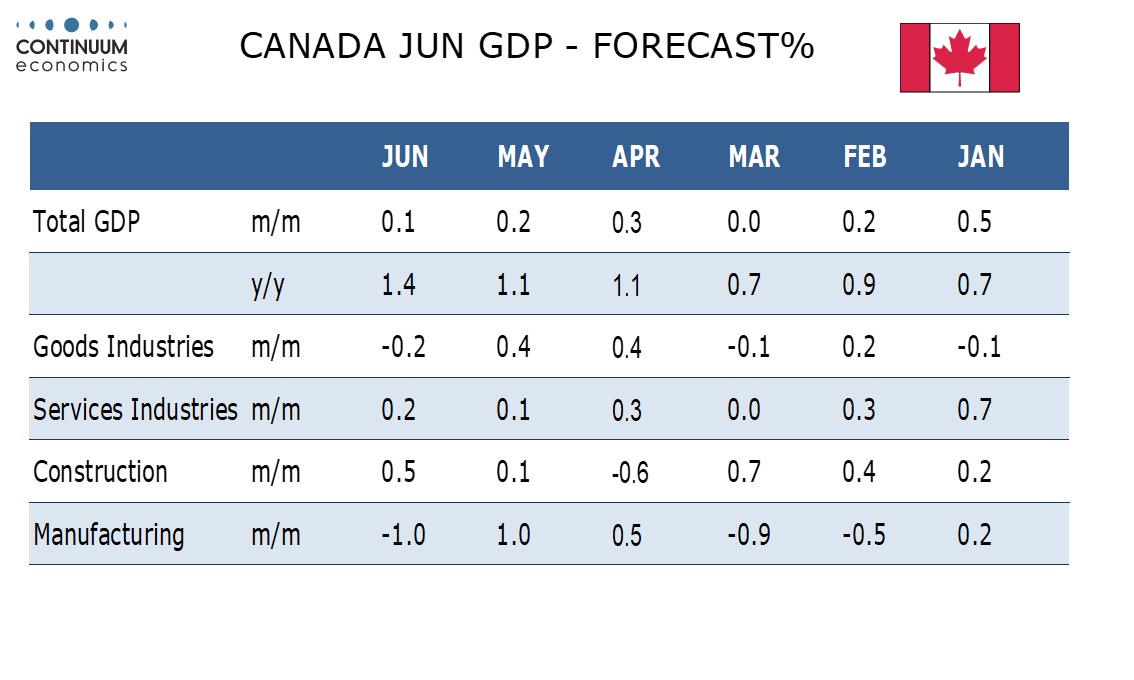

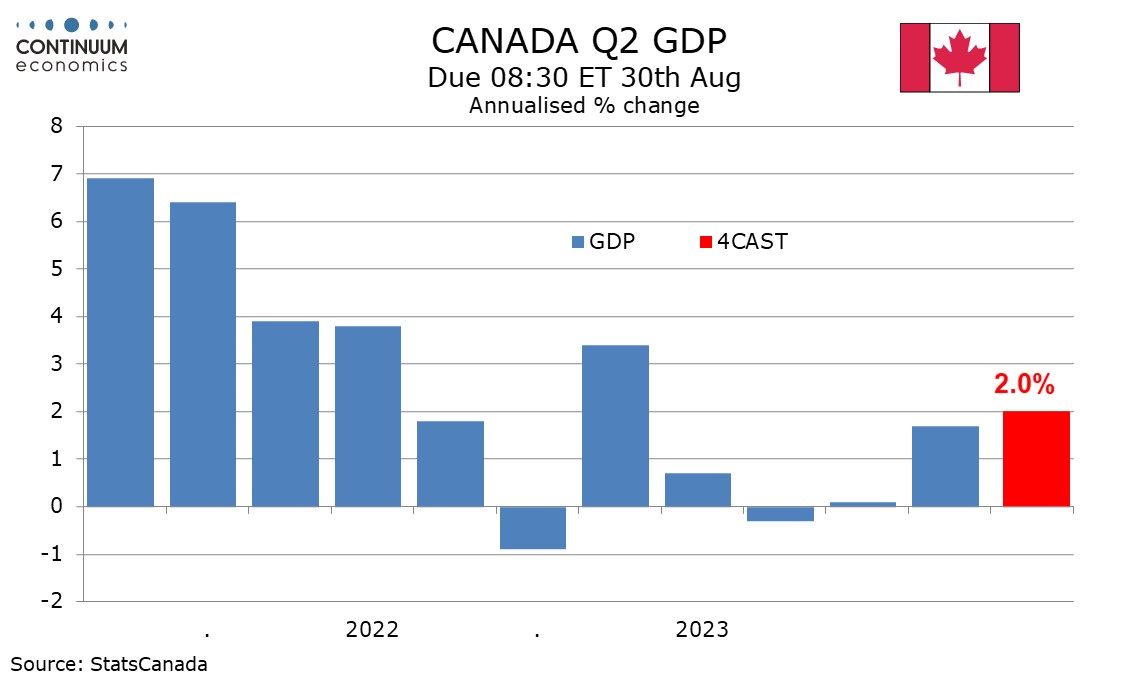

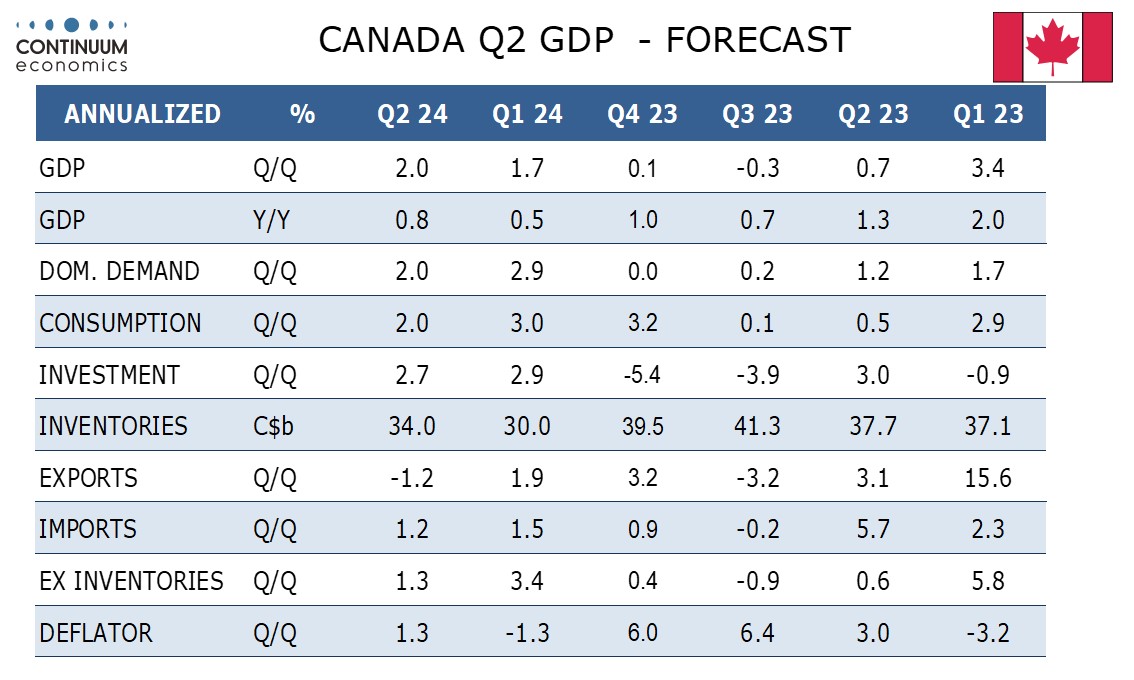

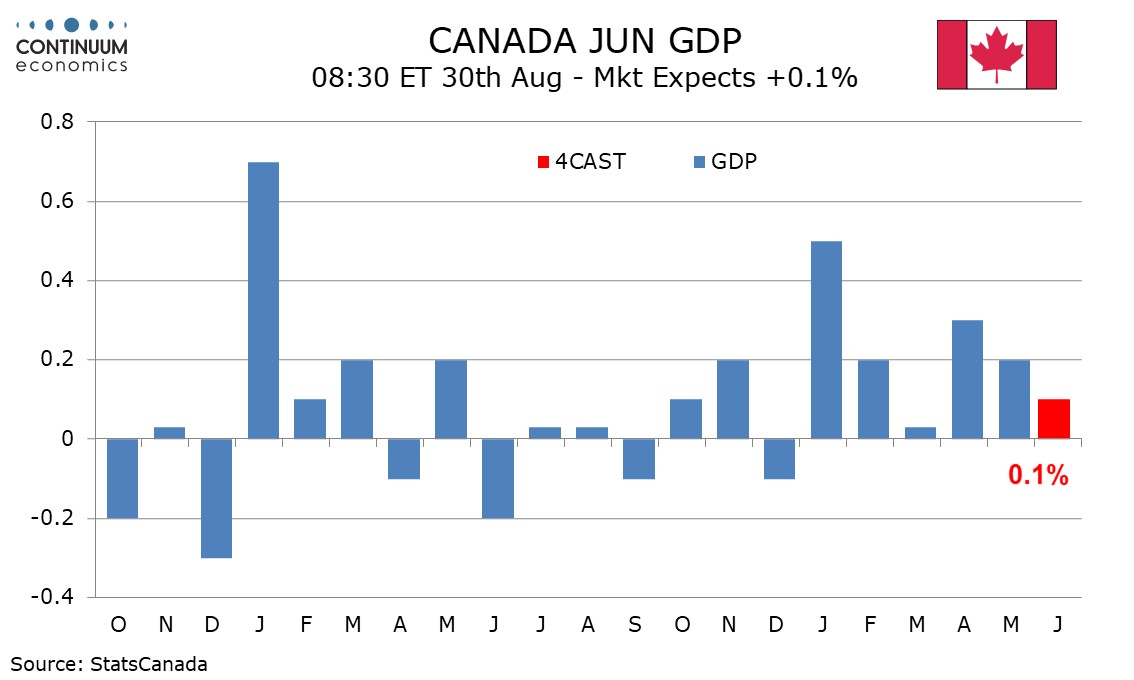

We expect Q2 Canadian GDP to rise by 2.0% annualized, a little above a 1.5% estimate made with the Bank of Canada’s July Monetary Policy Report and s second straight quarter of moderate growth after a near flat second half of 2023. We expect a 0.1% increase in June GDP, in line with a preliminary estimate made with May’s GDP report.

We expect domestic demand to also rise by 2.0% annualized, slightly slower than Q1’s 2.9% despite GDP seen marginally accelerating from 1.7% in Q1. We consumer spending also rising by 2.0%, with the gain in investment set to be slightly stronger but government to rise by slightly less.

We expect a negative contribution of 0.7% from net exports, with Q2 data showing exports slightly down in real terms but imports slightly higher. We expect the negative from net exports to be offset by a matching positive from inventories, correcting a larger negative contribution in Q1.

We expect a modest 0.3% rise in the GDP deflator (1.3% annualized) to reverse a matching decline in Q1.

A 0.1% rise in June GDP would be a slowing from 0.2% in May and 0.3% in April. The preliminary June estimate saw gains in construction, real estate/rental/leasing and finance/insurance but declines in manufacturing and wholesale.