U.S. May Preliminary Michigan CSI - Is the fall a sign that prices are now accelerating?

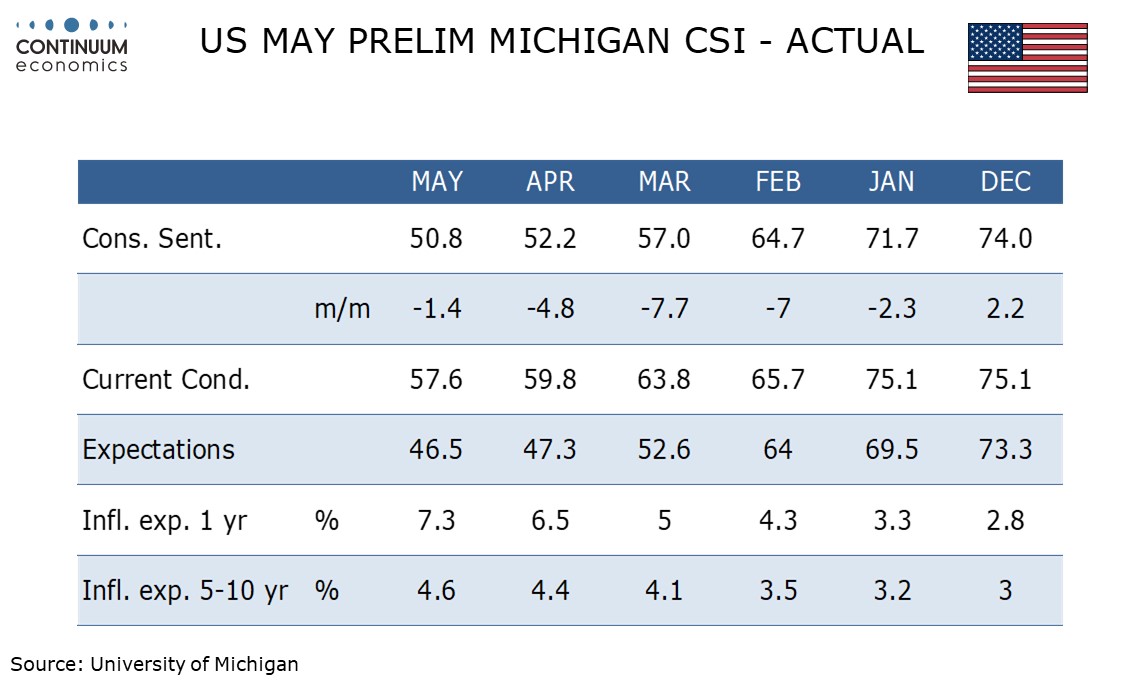

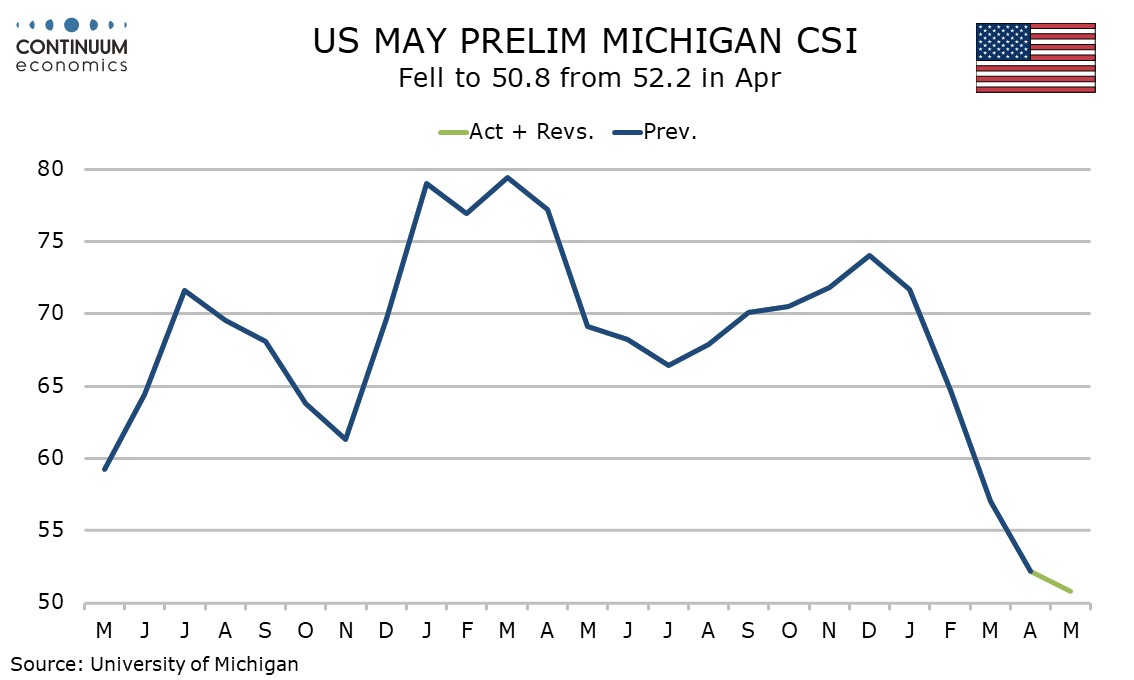

May’s Preliminary Michigan CSI of 50.8 is, despite the equity recovery, surprisingly weaker than April’s final of 52.2, though the 50.8 reading matches exactly the preliminary May outcome, though most responses were received before the US-China trade de-escalation. This could be a sign that after a subdued April for inflation, prices are starting to respond to tariffs in May.

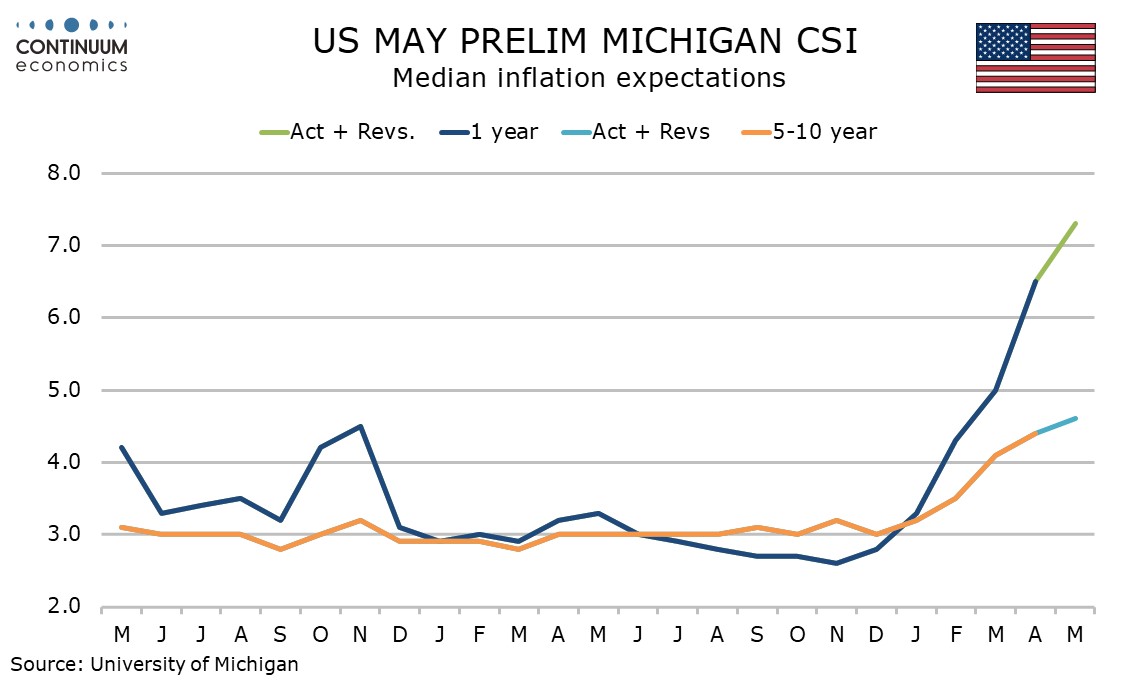

Inflation expectations have resumed their acceleration, the 1-year view at 7.3% from 6.5% and the 5-10 year view at 4.6% from 4.4%. The 5-10 year view is at a level not seen since 1991 and the 1-year view was last this high in 1981.

A worryingly plausible explanation for the renewed acceleration in inflation expectations (final April data saw a pause compared with the preliminary) is that consumers are now seeing price gains. If so, the surprisingly subdued inflation data for April may only be a temporary relief.

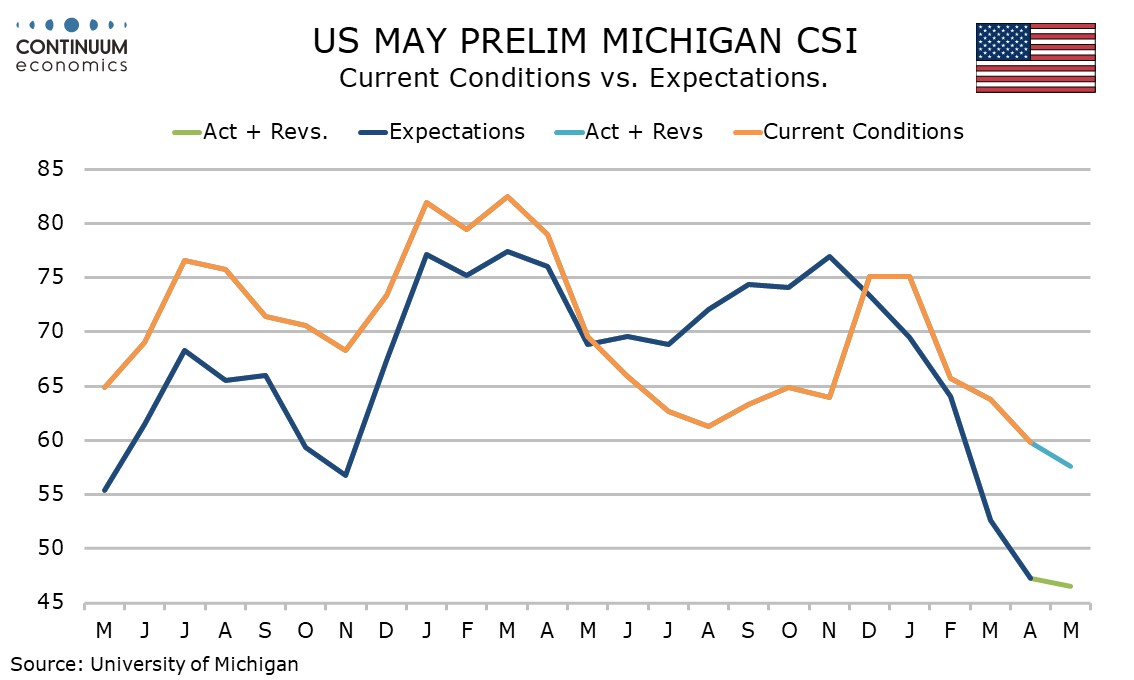

May’s fall in the composite was led by current conditions, down 2.2 points to 57.6, with expectations showing only a modest 0.8 point fall to 46.5. Current conditions however are still up from April’s preliminary reading of 56.5 while expectations are down from April’s final of 47.2.

It is surprising that the bounce in equities, which was well under way before tariffs on China were cut, has had so little impact on expectations. If prices are rising, that would help explain consumer pessimism. One notable feature of the detail is that May’s fall was led by Republicans, down to 84.2 from 90.2. Democrats, already very pessimistic, fell to 33.9 from 34.4 but independents increased to 48.2 from 46.2. That suggests May’s weakness was not exaggerated by political bias. Republicans may be noticing higher prices that they did not expect.