U.S. August Job Openings slightly higher but September Consumer Confidence slips on labor market concerns

August job openings in the JOLTS report were slightly higher than expected with a rise off 19k to 7.227m but still present a picture of a fairly flat labor market. September consumer confidence at 94.2 from 97.8 was slightly weaker than expected, and showed perceptions of the labor market deteriorating.

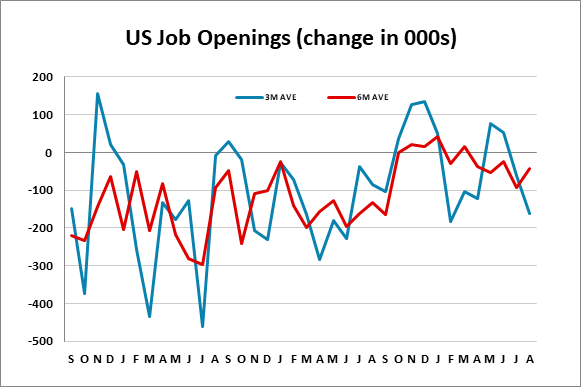

The marginal rise in job openings follows two straight declines, which followed two straight increases. The three month average is weaker at -162k as a rise three month ago drops out but the six month average of -42k is only modestly negative and probably better illustrates trend.

Elsewhere in the detail hirings fell by 114k and separations fell by 110k, with most of that due to a 75k fall in quits. The level of hirings and separations is almost identical, the firmer 15k above the latter, which is consistent with the minimal growth in non-farm payrolls seen in August.

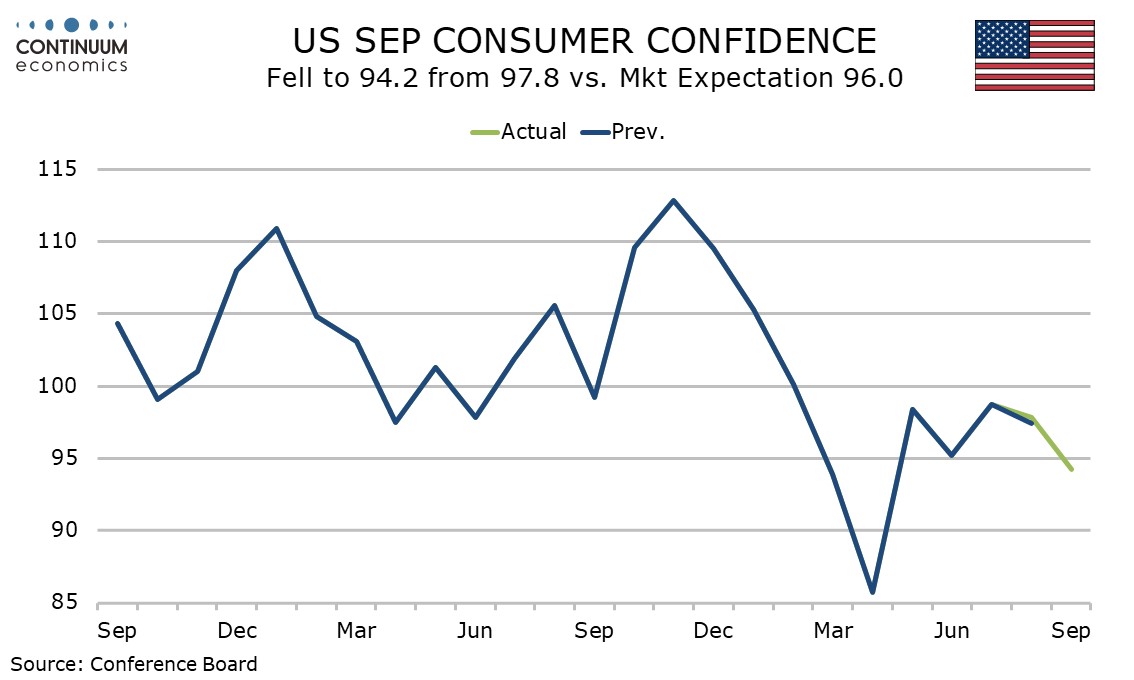

The Conference Board’s Consumer Confidence Index at 94.2 is at its lowest since April when equities plunged in response to the tariff announcement. Equities have since recovered, so the slowing in confidence appears related to the real economy, particularly the labor market.

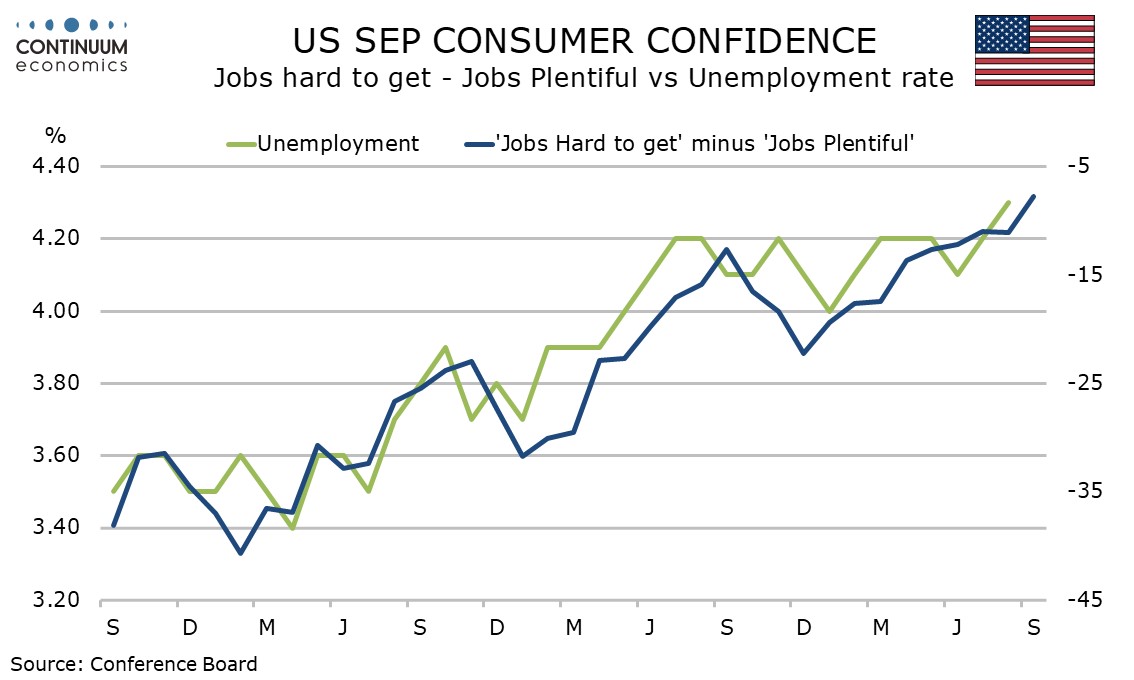

The differential between those seeing jobs as plentiful to those seeing them as hard to get fell to 7.8%, its lowest since February 2021, from 11.1%, hinting at rising unemployment.

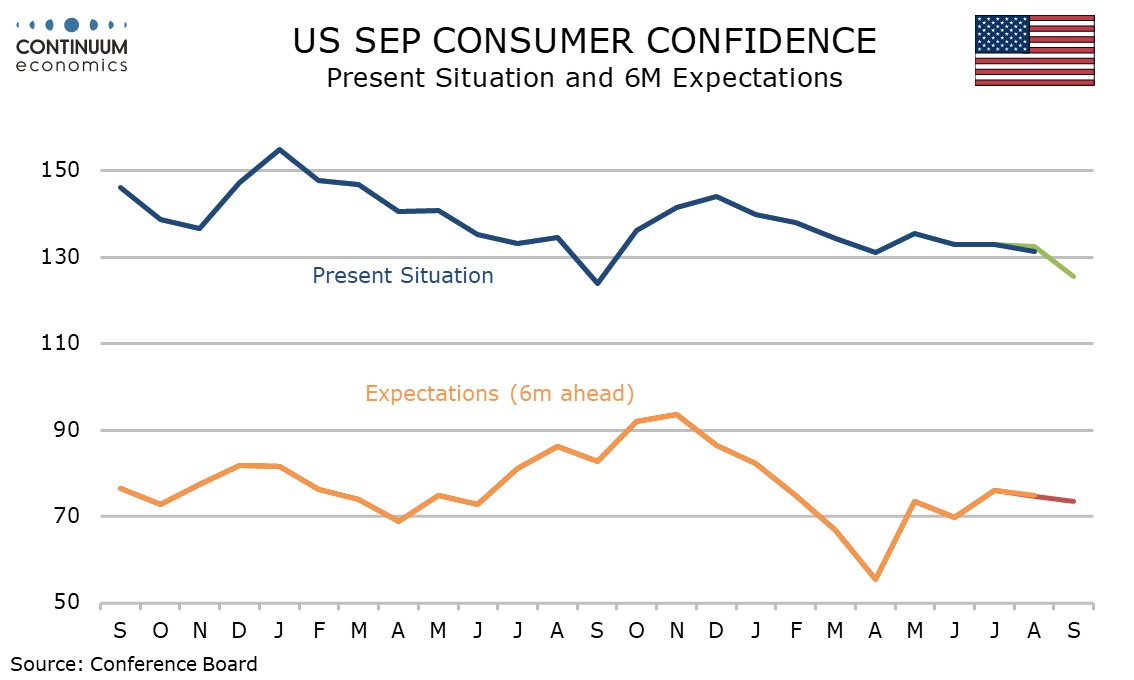

The fall in confidence was led by the present situation, which at 125.4 from 132.2 is the lowest since September 2024. Six month expectations fell only marginally to 73.4 from 73.7 and remain well above April’s 55.4, and even ahead of June’s 69.9.

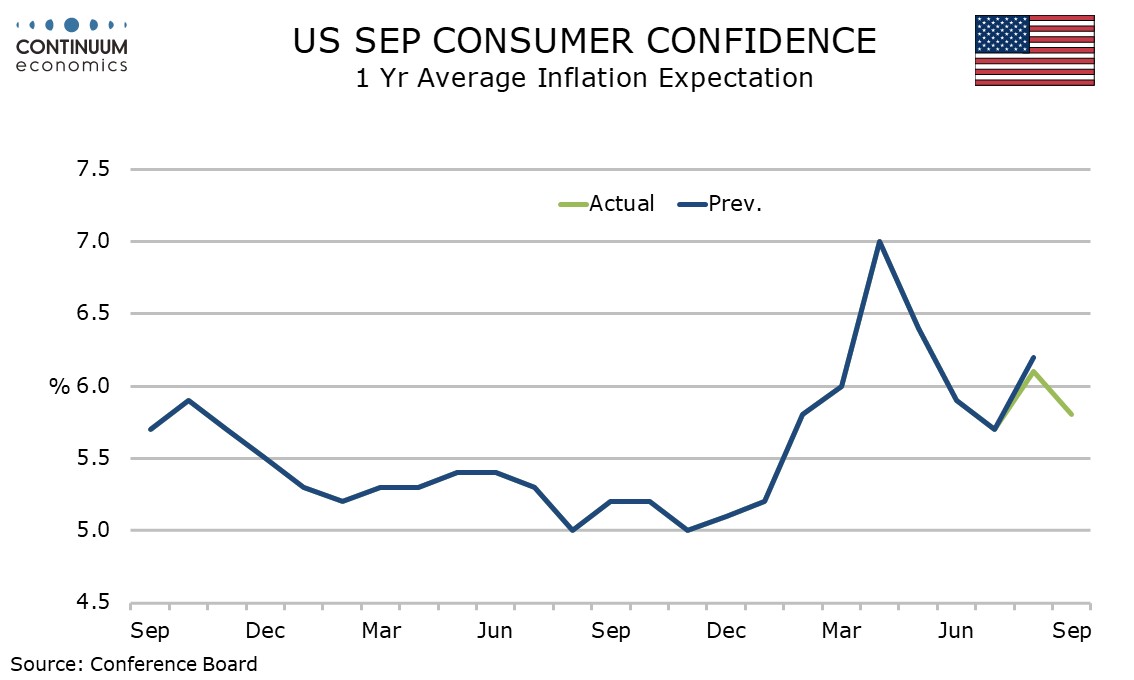

Inflation expectations are softer, the average at 5.8% from 6.1%, still above July’s 5.7%, and the median at 4.7% from 5.0%, this returning to July’s pace. That inflation expectations fell further emphasizes the significance of the labor market in the confidence drop.