USD flows: USD dips after stronger claims

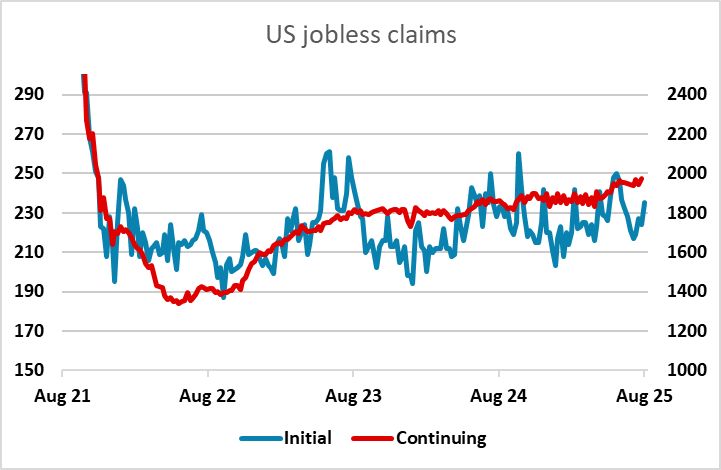

Higher initial and continuing claims trigger modest USD decline

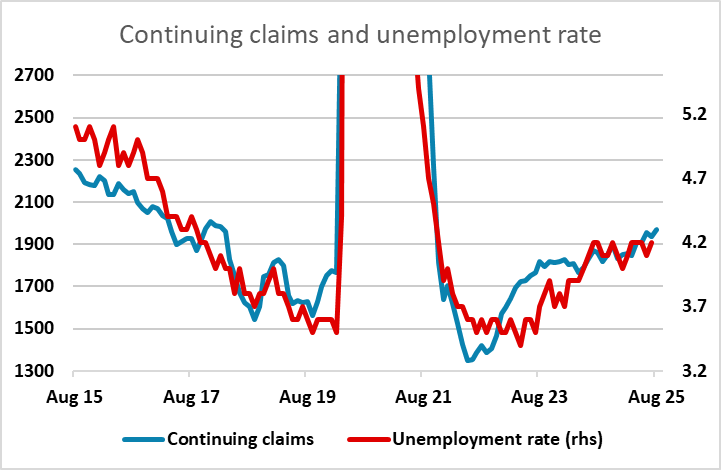

Somewhat higher initial claims data saw an initial USD dip, but there has been little followthrough, with EUR/USD now little changed from before the data release and USD/JPY only slightly lower. The numbers weren’t dramatically higher than expected, but initial claims were the highest since June and continuing claims hit another new post-pandemic high. While initial claims are still within the recent range, the steady rise in continuing claims does suggest that there is upward pressure on unemployment which may start to show up in the employment report (today is the survey week data). If so, the pressure for Fed easing will increase. If this comes into conflict with inflation data, as it might if tariffs start to feed through, the equity market consequences could be severe, so we do see today’s numbers as a reason to see more downside risks for USD/JPY and EUR/JPY.