JPY flows: USD/JPY gains continue

USD/JPY continues higher with longer term trend traders potentially being squeezed

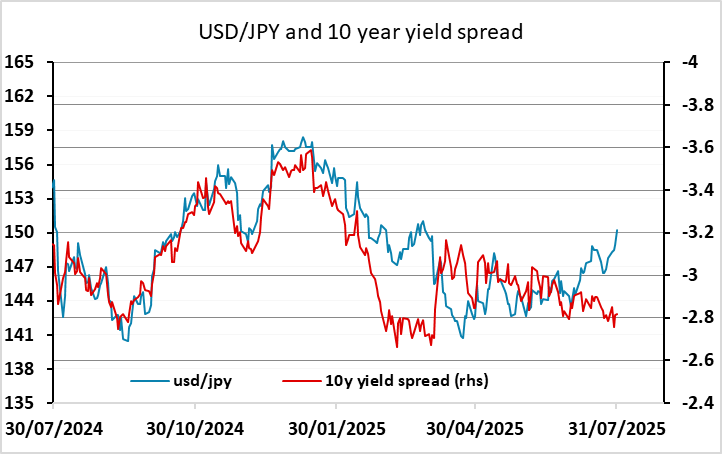

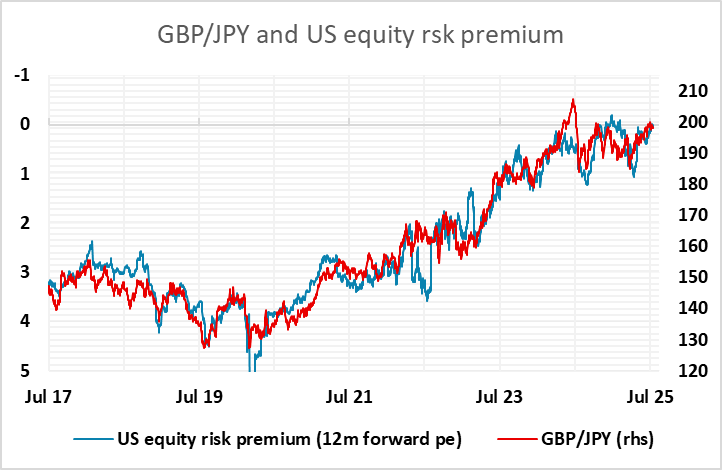

USD strength against the JPY has continued to extend after the US data, which is generally on the firm side, with another drop in initial claims and marginally higher than expected PCE price index for June and employment cost index for Q2. Even so, US yields have edged a little lower in early US trade, so the basis for USD/JPY strength looks a little suspect, given that USD gains elsewhere, particularly against the EUR and CHF, are much more modest. But the JPY downside momentum has been fuelled by a less hawkish tone from Ueda this morning, and by another new high in S&P 500 futures reached overnight. The S&P has benefited from strength in Meta and Microsoft earnings, so strength looks unlikely to be reversed near term.

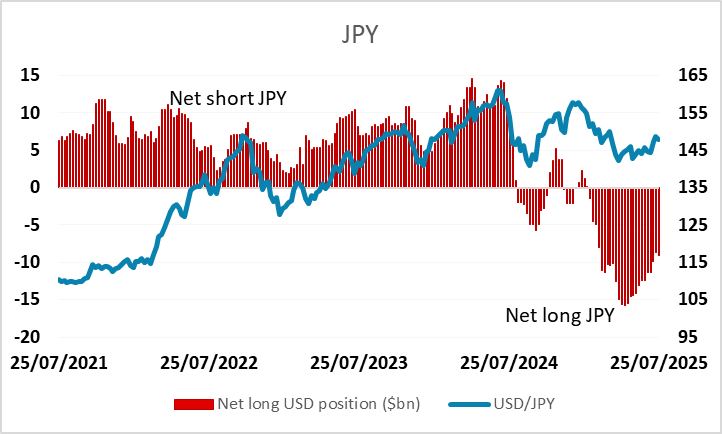

Technically, the break above the 200 day moving average at 149.53 may trigger more gains, potentially towards the retracement area at 151.80. Longer term trend traders may still be long JPY, judging by the CFTC data, and may only now be being squeezed out. We still favour longer term JPY gains, but a JPY turn still looks likely to require a move lower in equities.

CFTC speculative positioning data