JPY flows: New JPY lows as market continues to trade election expectations

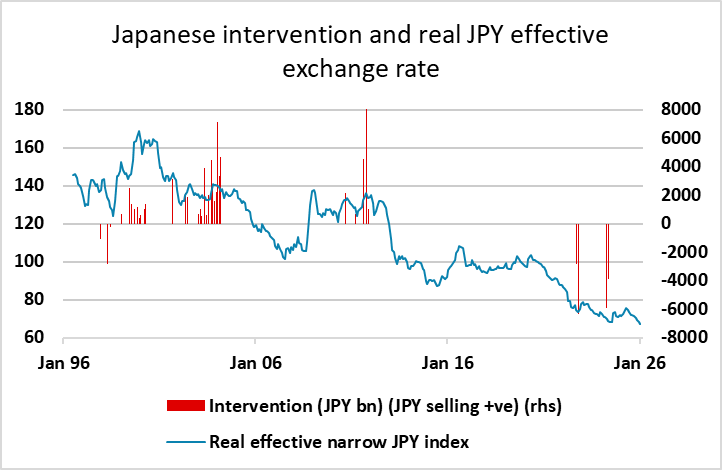

The JPY has hit a new all time low against the EUR and new one year low against the USD as markets price in more fiscal easing. The rationale for the JPY decline is weak, but the momentum is strong. Intervention looks necessary to halt the decline.

JPY weakness was once against the theme overnight, as increased expectations of a general election being called in February, and the possibility of easier fiscal policy thereafter, triggered renewed selling both of JGBs and the JPY. USD/JPY hit new one year highs and EUR/JPY hit new all time highs. The real JPY trade-weighted index is at all time lows. The rationale for JPY weakness nevertheless remains extremely flimsy, as it is hard to see why the threat of easier Japanese fiscal policy is JPY negative. Normally, higher fiscal deficits mean tighter monetary policy and higher yields and are currency positive. The exception comes if there is a loss of confidence in the sustainability of fiscal policy, as was the case in the UK when both gilts and GBP sold off on the October 2022 Truss/Kwarteng budget, which was seen as irresponsible.

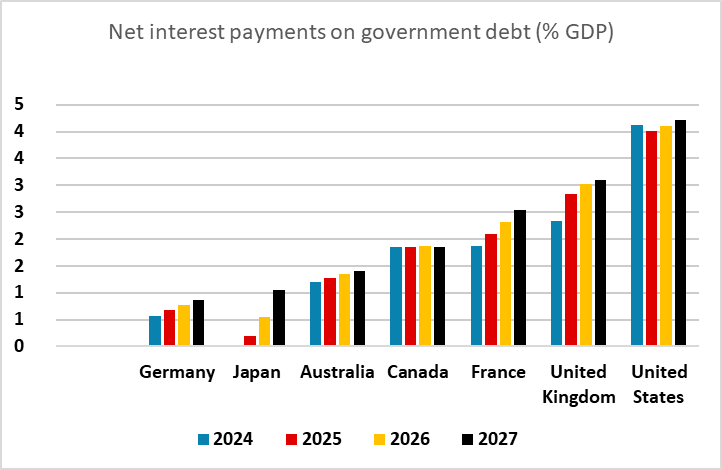

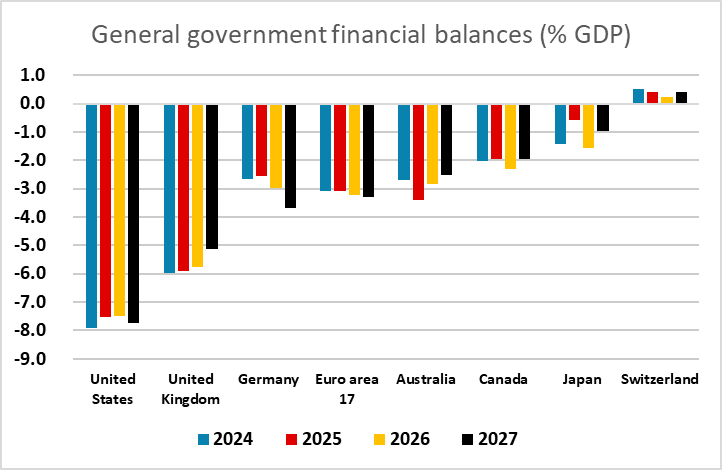

However, it is hard to apply this to Japan, as the Japanese fiscal deficit is very modest by international standards, and while gross government debt is high, it is almost all domestically owned and the interest payments on the debt are tiny by comparison to most of the rest of the developed world. Nevertheless, we are seeing rising JGB yields in concert with a falling JPY. One other argument from the JPY bears is that the Takaichi government will also be seeking easier monetary policy, but it is hard to maintain this view after the BoJ rate hike in December and the hawkish tone of recent BoJ comments.

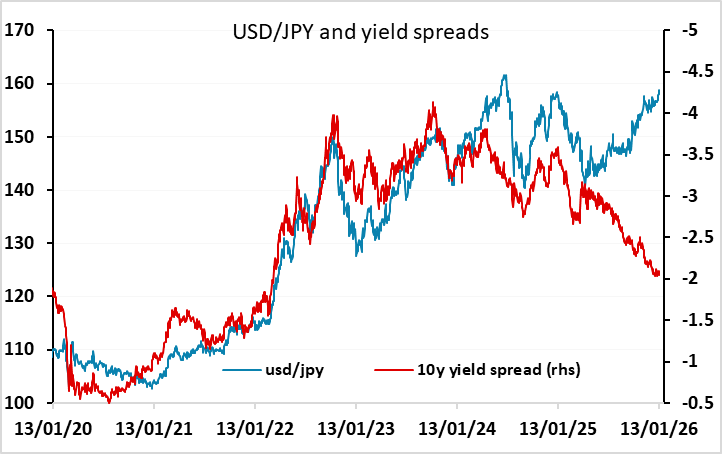

So the rationale for JPY weakness looks flawed, but the trend of JPY weakness is nevertheless undeniable. It is notable that while the JPY is now weakening in response to higher JGB yields and narrowing yield spreads, it was weakening through the previous 5 years in response to higher yields elsewhere and widening yield spreads. In such situations, where the currency is weakening in all scenarios and without real fundamental justification, the main driver is simply momentum, and a forced break in the trend is needed to halt the decline. This is most likely to be achieved in current circumstances by intervention. More verbal protests from Japanese cabinet secretary Katayama overnight about the one-sided JPY decline had no impact, as the market is unconvinced that the current government is prepared to use physical FX intervention, as the previous interventions in 2022 and 2024 were under the previous administration. But without it the JPY can be expected to continue to spiral to new lows, however illogical the decline may be.